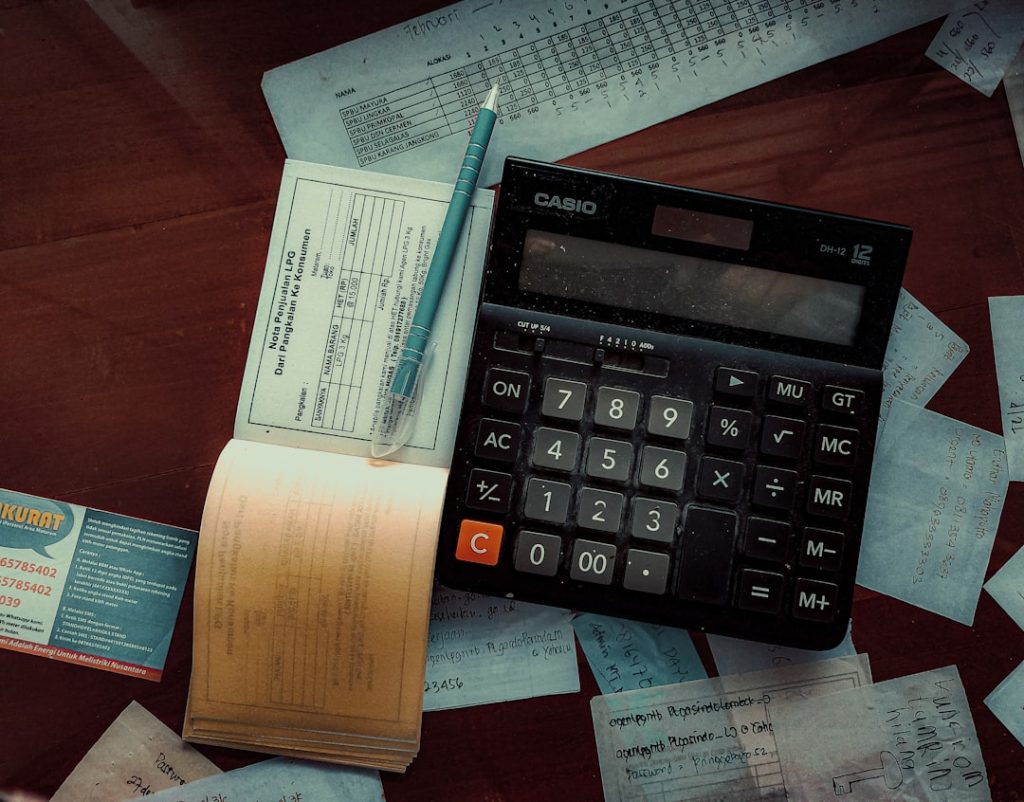

Mastering Bookkeeping and Accounting for Business Success

Bookkeeping and accounting are essential functions that underpin business success rather than mere administrative tasks. Accurate financial records clearly illustrate a company’s financial position, enabling evidence-based decision-making by business owners. Organizations that neglect proper bookkeeping risk losing track of their financial activities, potentially resulting in cash flow difficulties and financial instability. For example, a small […]

Mastering Bookkeeping and Accounting for Business Success Read More »