Mastering Financial Reporting and Analysis

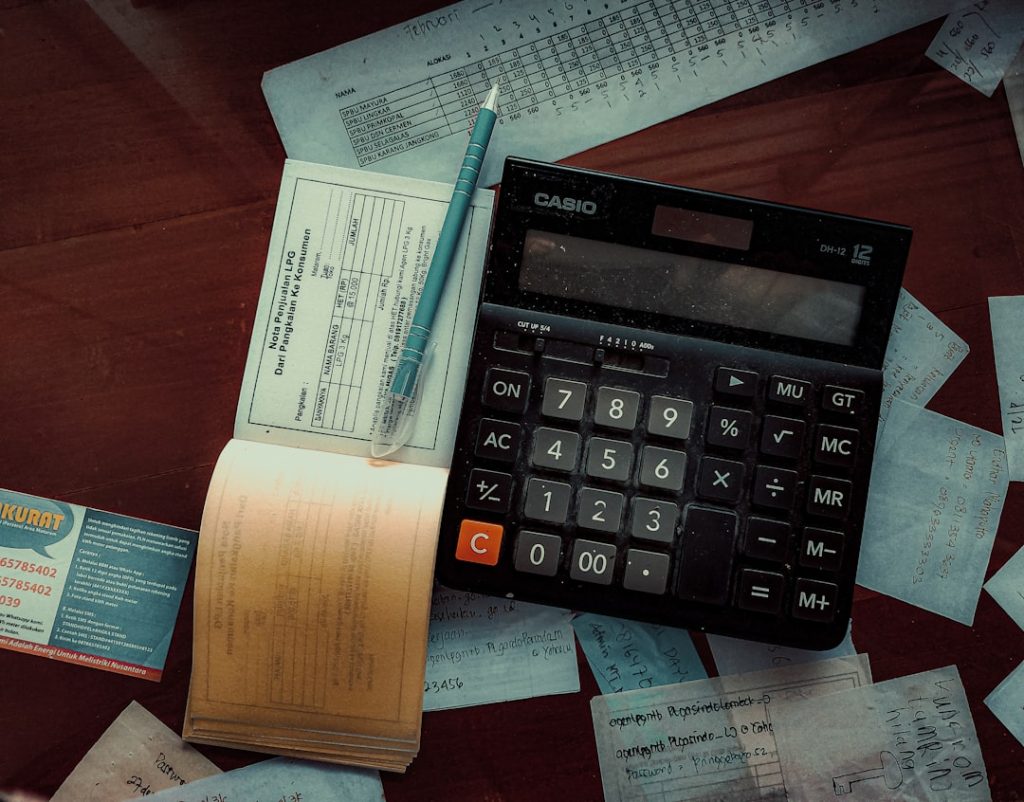

Financial reporting serves as the backbone of corporate transparency and accountability, providing stakeholders with essential information about a company’s financial health. At its core, financial reporting involves the systematic presentation of financial data, which includes income statements, balance sheets, and cash flow statements. These documents are designed to convey a company’s performance over a specific […]

Mastering Financial Reporting and Analysis Read More »