Income is a fundamental concept in personal finance, representing the money that an individual or entity receives in exchange for providing goods, services, or through investments. It encompasses various forms, including wages, salaries, bonuses, rental income, dividends, and interest. However, it is crucial to distinguish between what constitutes income and what does not.

For instance, while a paycheck from employment is a clear example of income, gifts or inheritances are typically not classified as income in the same way, even though they may increase an individual’s financial resources. Moreover, income can be categorized into earned and unearned income. Earned income refers to money received from active participation in work or business activities, such as salaries or freelance payments.

In contrast, unearned income includes revenue generated from investments or assets without active involvement, such as interest from savings accounts or capital gains from selling stocks. Understanding these distinctions is vital for effective financial planning and tax considerations, as different types of income may be subject to varying tax rates and regulations.

Key Takeaways

- Income is the money you earn from various sources, including wages, salaries, and investments, but it does not include gifts or loans.

- Types of income include earned income (wages, salaries), passive income (rental income, dividends), and portfolio income (capital gains, interest).

- Gross income is the total amount you earn before taxes and deductions, while net income is the amount you take home after taxes and deductions.

- Taxes can impact your income through various means, such as income tax, payroll tax, and capital gains tax.

- Budgeting, investing, and planning for the future are essential for managing and maximizing your income and achieving long-term financial goals.

Types of Income: Understanding the Different Sources

Income can be broadly classified into several categories, each with its unique characteristics and implications for financial management. The most common type is earned income, which includes wages, salaries, commissions, and tips. This form of income is typically subject to payroll taxes and is often the primary source of revenue for most individuals.

For example, a full-time employee at a corporation receives a regular paycheck that reflects their hourly wage or annual salary, along with any bonuses or overtime pay they may earn. Another significant category is passive income, which refers to earnings derived from investments or business ventures in which the individual is not actively involved. This can include rental income from real estate properties, dividends from stocks, or royalties from creative works.

Passive income is particularly appealing because it allows individuals to generate revenue without the continuous effort required by earned income. For instance, a person who owns rental properties can earn monthly rent payments while spending minimal time managing the properties if they hire a property management company. Investment income is another critical source of revenue that encompasses earnings from various financial instruments.

This includes interest earned on savings accounts or bonds, capital gains from selling stocks or real estate at a profit, and dividends paid by corporations to their shareholders. Understanding the nuances of investment income is essential for individuals looking to build wealth over time. For example, an investor who purchases shares in a company may receive quarterly dividends while also benefiting from the appreciation of the stock’s value over the years.

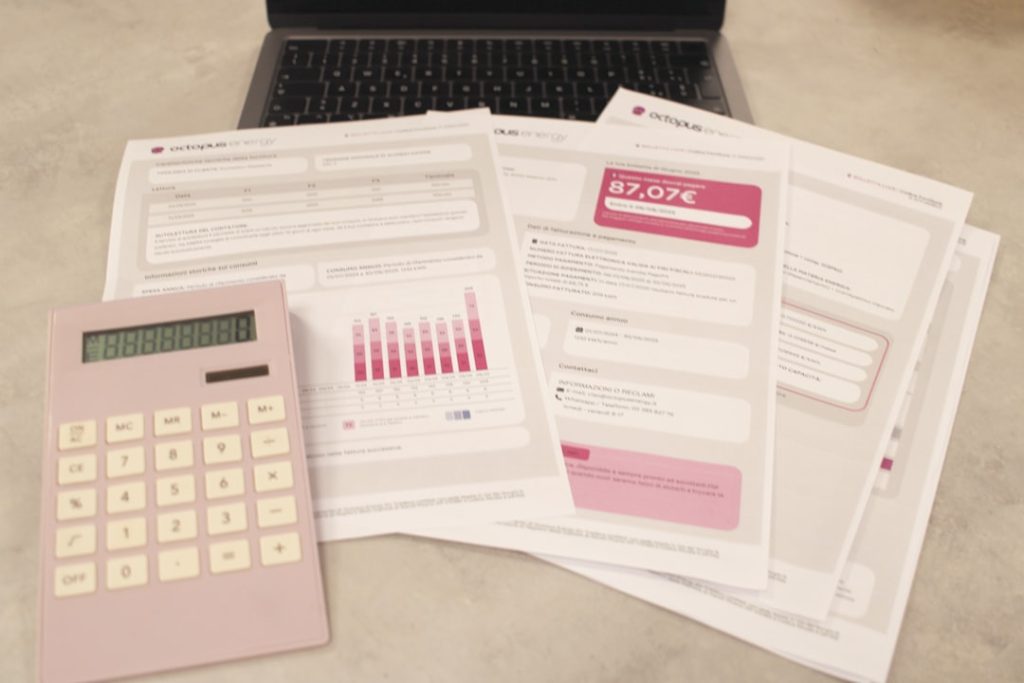

When discussing income, it is essential to differentiate between gross income and net income. Gross income refers to the total earnings before any deductions or taxes are applied. This figure includes all sources of income, such as wages, bonuses, rental income, and investment returns.

For instance, if an individual earns a salary of $60,000 per year and receives an additional $5,000 in rental income, their gross income would be $65,000. Net income, on the other hand, represents the amount of money an individual takes home after all deductions have been made. These deductions can include federal and state taxes, Social Security contributions, health insurance premiums, retirement plan contributions, and other withholdings.

Continuing with the previous example, if the individual’s total deductions amount to $15,000, their net income would be $50,000. Understanding this distinction is crucial for budgeting and financial planning since net income reflects the actual funds available for spending and saving. The implications of gross versus net income extend beyond personal finance; they also play a significant role in business operations.

Companies often report gross revenue but must also account for expenses to determine their net profit. This distinction helps stakeholders assess a company’s financial health and operational efficiency. For individuals managing their finances, recognizing the difference between gross and net income can aid in setting realistic budgets and financial goals.

Understanding Taxes: How They Impact Your Income

Taxes are an inevitable aspect of earning income and can significantly impact an individual’s financial situation. The tax system in many countries operates on a progressive scale, meaning that higher levels of income are taxed at higher rates. This structure aims to distribute the tax burden more equitably among citizens based on their ability to pay.

For example, an individual earning $30,000 may fall into a lower tax bracket than someone earning $100,000, resulting in a lower percentage of their income being paid in taxes. Understanding how taxes affect both gross and net income is essential for effective financial planning. Various deductions and credits can reduce taxable income and ultimately lower the amount owed to tax authorities.

Common deductions include mortgage interest payments, student loan interest, and contributions to retirement accounts like 401(k)s or IRAs. By strategically utilizing these deductions, individuals can maximize their net income and retain more of their earnings. Additionally, tax implications vary depending on the type of income earned.

For instance, capital gains from investments held for more than a year are often taxed at a lower rate than ordinary income such as wages or salaries. This difference incentivizes long-term investing and can influence an individual’s investment strategy. Understanding these nuances allows individuals to make informed decisions about their finances while minimizing their tax liabilities.

Budgeting Your Income: Tips for Managing Your Money

| Income Source | Amount |

|---|---|

| Salary | 3000 |

| Freelance Work | 500 |

| Investment Income | 200 |

| Other | 100 |

Effective budgeting is a cornerstone of sound financial management and involves creating a plan for how to allocate your income across various expenses and savings goals. A well-structured budget helps individuals track their spending habits and identify areas where they can cut costs or increase savings. One popular method for budgeting is the 50/30/20 rule: allocate 50% of your net income to needs (such as housing and groceries), 30% to wants (like entertainment and dining out), and 20% to savings and debt repayment.

To create an effective budget, individuals should start by listing all sources of income and estimating monthly expenses. This process often involves reviewing bank statements and receipts to gain insight into spending patterns. Once expenses are categorized into fixed (e.g., rent or mortgage) and variable (e.g., groceries or entertainment) costs, individuals can identify areas where adjustments can be made.

For example, if someone finds they are spending excessively on dining out each month, they might choose to cook at home more often to save money. Another critical aspect of budgeting is setting realistic financial goals. Whether it’s saving for a vacation, building an emergency fund, or paying off debt, having specific objectives can motivate individuals to stick to their budget.

Regularly reviewing and adjusting the budget as circumstances change—such as receiving a raise or incurring unexpected expenses—ensures that it remains relevant and effective over time.

Investing Your Income: Making Your Money Work for You

Investing is a powerful way to grow wealth over time by putting your money to work in various financial instruments such as stocks, bonds, mutual funds, or real estate. Unlike saving—where money typically earns minimal interest—investing has the potential for higher returns but also comes with increased risk. Understanding different investment vehicles is crucial for making informed decisions that align with one’s financial goals and risk tolerance.

One common investment strategy is dollar-cost averaging, which involves consistently investing a fixed amount of money at regular intervals regardless of market conditions. This approach helps mitigate the impact of market volatility by spreading out purchases over time. For instance, an investor who contributes $500 monthly to a retirement account will buy more shares when prices are low and fewer shares when prices are high, ultimately averaging out the cost per share over time.

Real estate investing is another avenue that many individuals explore as a means of generating passive income and building equity. Purchasing rental properties can provide consistent cash flow through rent payments while also allowing for potential appreciation in property value over time. However, successful real estate investing requires thorough research into market conditions and property management practices to ensure profitability.

Planning for the Future: Retirement and Long-Term Financial Goals

Planning for retirement is a critical component of financial management that requires careful consideration of future needs and lifestyle choices. Individuals must assess how much money they will need during retirement based on factors such as expected living expenses, healthcare costs, and desired lifestyle activities like travel or hobbies. A common rule of thumb suggests that retirees will need approximately 70-80% of their pre-retirement income to maintain their standard of living.

To achieve these long-term financial goals, individuals should take advantage of retirement accounts such as 401(k)s or IRAs that offer tax advantages for saving toward retirement. Many employers provide matching contributions to 401(k) plans up to a certain percentage of an employee’s salary—essentially free money that can significantly boost retirement savings over time. Additionally, understanding the power of compound interest can motivate individuals to start saving early; even small contributions can grow substantially over decades due to interest accumulating on both the initial investment and previously earned interest.

Long-term financial planning should also consider potential risks such as inflation or unexpected medical expenses that could impact retirement savings. Diversifying investments across various asset classes can help mitigate these risks while ensuring that funds remain accessible when needed most.

Maximizing Your Income: Strategies for Increasing Your Earning Potential

Increasing one’s earning potential is a goal for many individuals seeking financial stability and growth. There are several strategies that can be employed to enhance income levels over time. One effective approach is investing in education and skills development through formal education or professional certifications that align with career aspirations.

For instance, obtaining an advanced degree in a specialized field can open doors to higher-paying job opportunities. Networking plays a crucial role in career advancement as well; building relationships within one’s industry can lead to job referrals or mentorship opportunities that facilitate professional growth. Attending industry conferences or joining professional organizations can provide valuable connections that may lead to promotions or new job offers.

Additionally, exploring side hustles or freelance opportunities can supplement primary income streams while allowing individuals to pursue passions outside their main job. Whether it’s offering consulting services based on expertise or starting an online business selling handmade products, diversifying sources of income can provide financial security while fostering personal fulfillment. In conclusion, understanding the intricacies of income—from its definition to its various types—equips individuals with the knowledge necessary for effective financial management.

By recognizing the differences between gross and net income, navigating tax implications wisely, budgeting effectively, investing strategically, planning for retirement thoughtfully, and maximizing earning potential through education and networking opportunities, individuals can take control of their financial futures with confidence.