Cloud accounting represents a transformative shift in the way businesses manage their financial data. Unlike traditional accounting systems that rely on local servers and software installations, cloud accounting leverages the power of the internet to store, manage, and process financial information. This paradigm shift allows businesses of all sizes to access their financial data from anywhere, at any time, using any device with internet connectivity.

The rise of cloud computing has made it possible for organizations to streamline their accounting processes, reduce costs, and enhance collaboration among team members. The concept of cloud accounting is rooted in the broader trend of digital transformation that has swept across various industries. By utilizing cloud-based platforms, businesses can eliminate the need for extensive IT infrastructure and maintenance, which often comes with significant overhead costs.

Furthermore, cloud accounting solutions are typically subscription-based, allowing companies to pay only for what they use. This flexibility is particularly advantageous for small and medium-sized enterprises (SMEs) that may not have the resources to invest in expensive software licenses or dedicated IT staff. As a result, cloud accounting has become an essential tool for modern financial management.

Key Takeaways

- Cloud accounting offers a convenient and secure way to manage financial data and processes online.

- Benefits of cloud accounting include real-time access to financial data, cost savings, and improved collaboration.

- When choosing cloud accounting software, consider factors such as scalability, user-friendliness, and integration with other business tools.

- Setting up and customizing your cloud accounting system involves inputting financial data, creating reports, and customizing settings to fit your business needs.

- Integrating cloud accounting with other business tools such as CRM and project management software can streamline processes and improve efficiency.

Benefits of Cloud Accounting for Financial Management

One of the most significant advantages of cloud accounting is its ability to enhance real-time financial visibility. Traditional accounting methods often involve time-consuming processes that delay access to critical financial data. In contrast, cloud accounting systems provide instant access to up-to-date financial information, enabling business owners and managers to make informed decisions quickly.

This immediacy is crucial in today’s fast-paced business environment, where timely insights can mean the difference between seizing an opportunity or missing out. Additionally, cloud accounting facilitates improved collaboration among team members and stakeholders. With centralized data storage, multiple users can access and work on financial documents simultaneously, regardless of their physical location.

This collaborative approach not only enhances productivity but also reduces the likelihood of errors that can arise from version control issues. For instance, a finance team spread across different geographical locations can seamlessly collaborate on budgeting and forecasting tasks, ensuring that everyone is on the same page and working with the most current data.

Choosing the Right Cloud Accounting Software

Selecting the appropriate cloud accounting software is a critical step that can significantly impact a business’s financial management capabilities. The market is saturated with various options, each offering unique features and functionalities tailored to different business needs. When evaluating potential software solutions, it is essential to consider factors such as scalability, user-friendliness, integration capabilities, and customer support.

A solution that meets the current needs of a business while also allowing for future growth is vital for long-term success. Moreover, businesses should assess the specific features that align with their operational requirements. For example, a retail company may prioritize inventory management and point-of-sale integration, while a service-based business might focus on project tracking and invoicing capabilities.

It is also advisable to take advantage of free trials or demos offered by many cloud accounting providers. This hands-on experience can provide valuable insights into how well the software aligns with a company’s workflows and whether it meets user expectations.

Setting Up and Customizing Your Cloud Accounting System

| Metrics | Value |

|---|---|

| Number of users trained | 50 |

| Customized reports created | 20 |

| Integration with other systems | Yes |

| Time taken for setup | 2 weeks |

Once a business has selected its cloud accounting software, the next step involves setting up and customizing the system to fit its unique needs. This process typically begins with importing existing financial data from previous systems or spreadsheets. Many cloud accounting platforms offer tools to facilitate this migration, ensuring that historical data is preserved and accessible in the new system.

Proper data migration is crucial as it lays the foundation for accurate reporting and analysis moving forward. Customization is another vital aspect of setting up a cloud accounting system. Businesses should take advantage of the software’s features to tailor it to their specific workflows and processes.

This may include configuring user roles and permissions to ensure that team members have appropriate access levels based on their responsibilities. Additionally, businesses can customize reports and dashboards to highlight key performance indicators (KPIs) relevant to their operations. By aligning the system with organizational goals, companies can enhance their financial management capabilities and drive better decision-making.

Integrating Cloud Accounting with Other Business Tools

To maximize the benefits of cloud accounting, businesses should consider integrating their accounting software with other essential business tools. Integration allows for seamless data flow between different systems, reducing manual data entry and minimizing errors. For instance, connecting cloud accounting software with customer relationship management (CRM) systems can streamline invoicing processes by automatically generating invoices based on sales data captured in the CRM.

Furthermore, integrating cloud accounting with e-commerce platforms can enhance inventory management and sales tracking. For example, when a sale occurs on an e-commerce site, the transaction details can be automatically recorded in the accounting system, ensuring that financial records are always up-to-date. This level of integration not only saves time but also provides a comprehensive view of a business’s financial health by consolidating data from various sources into one cohesive platform.

Managing and Monitoring Your Finances in the Cloud

Effective financial management in the cloud requires ongoing monitoring and analysis of financial data. Cloud accounting systems typically offer robust reporting features that allow businesses to generate various financial statements and reports with ease. These reports can provide insights into cash flow, profitability, and expense trends, enabling business owners to make informed decisions based on real-time data.

Additionally, many cloud accounting platforms include budgeting and forecasting tools that help businesses plan for future financial scenarios. By analyzing historical data and current trends, companies can create realistic budgets that align with their strategic goals. Regularly reviewing these budgets against actual performance allows businesses to identify variances early on and make necessary adjustments to stay on track financially.

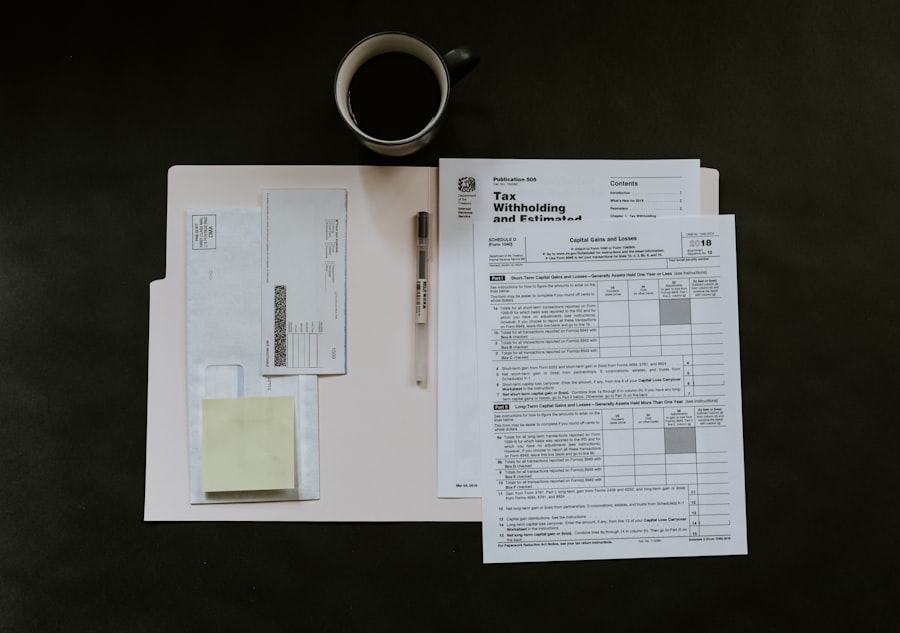

Ensuring Security and Data Protection in Cloud Accounting

As businesses increasingly rely on cloud accounting systems to manage sensitive financial information, ensuring security and data protection becomes paramount. Cloud service providers typically implement robust security measures such as encryption, firewalls, and multi-factor authentication to safeguard data from unauthorized access. However, businesses must also take proactive steps to protect their information.

One critical aspect of data protection is regular backups. While most cloud providers offer automatic backups as part of their service, businesses should verify that these backups are occurring as expected and understand how to restore data if needed. Additionally, educating employees about cybersecurity best practices is essential in preventing data breaches caused by human error.

Training staff on recognizing phishing attempts and using strong passwords can significantly reduce vulnerabilities within an organization.

Tips for Maximizing the Efficiency of Cloud Accounting

To fully leverage the advantages of cloud accounting, businesses should adopt best practices that enhance efficiency and effectiveness. One such practice is regular reconciliation of accounts to ensure that financial records are accurate and up-to-date. By routinely comparing bank statements with internal records, businesses can identify discrepancies early on and address them promptly.

Another tip is to automate repetitive tasks wherever possible. Many cloud accounting platforms offer automation features for invoicing, expense tracking, and payroll processing. By automating these processes, businesses can save time and reduce the risk of errors associated with manual entry.

Additionally, setting up alerts for important financial events—such as low cash balances or upcoming payment deadlines—can help businesses stay proactive in managing their finances. In conclusion, embracing cloud accounting offers numerous benefits that can significantly enhance financial management practices within organizations. From real-time visibility into financial data to improved collaboration among team members, cloud accounting systems provide a modern solution for managing finances effectively.

By carefully selecting software, customizing systems to fit unique needs, integrating with other business tools, ensuring security measures are in place, and adopting best practices for efficiency, businesses can navigate the complexities of financial management in today’s digital landscape with confidence.