Vehicle write-offs represent tax deductions available to individuals and businesses for vehicles used in business operations. A vehicle write-off allows taxpayers to deduct vehicle-related expenses from their taxable income when the vehicle serves business purposes. This deduction reduces overall tax liability and provides financial benefits for taxpayers who regularly use vehicles for work activities.

The deduction principle stems from tax law provisions that permit the deduction of ordinary and necessary business expenses incurred while generating income. Claiming vehicle write-offs requires compliance with specific tax authority regulations, including those established by the Internal Revenue Service (IRS) in the United States. Eligibility for vehicle write-offs typically requires that the vehicle be used primarily for business purposes rather than personal use.

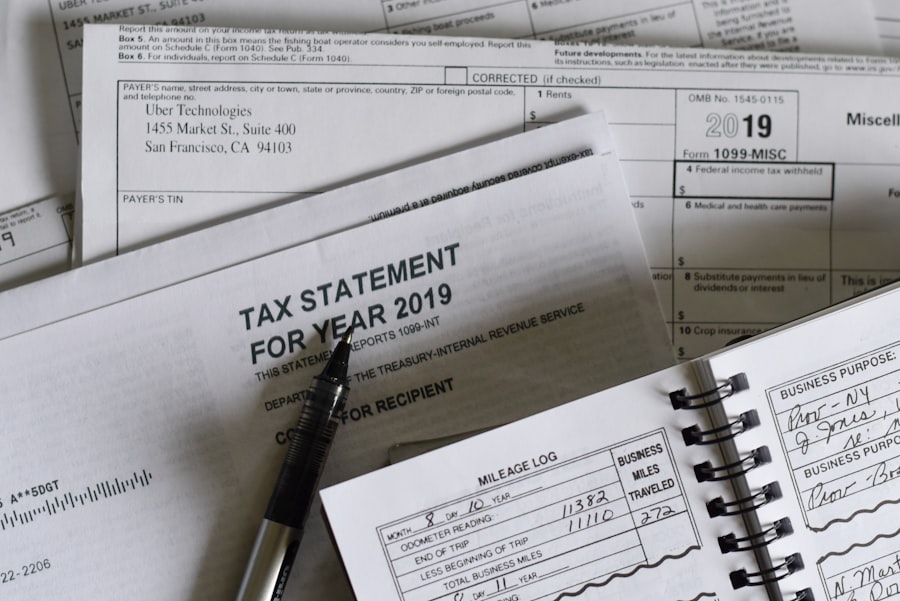

Taxpayers must maintain detailed documentation of vehicle usage, including mileage logs, fuel receipts, maintenance records, and other vehicle-related expenses. Tax authorities require clear separation between personal and business vehicle use, as only expenses directly attributable to business activities qualify for deduction.

Key Takeaways

- Vehicle write-offs allow businesses to deduct the cost of eligible vehicles used for work purposes.

- Proper documentation and record-keeping are essential to substantiate vehicle write-off claims.

- There are specific limits and restrictions on the types and values of vehicles that can be written off.

- Accurate calculation and timely claiming of write-offs maximize tax benefits and compliance.

- Consulting tax professionals helps navigate complexities and reduce risks of audits related to vehicle write-offs.

Types of Vehicles Eligible for Write-Offs

Not all vehicles are eligible for write-offs, and understanding which types qualify is essential for maximizing tax benefits. Generally, vehicles that are used primarily for business purposes can be written off. This includes cars, trucks, vans, and SUVs that are utilized in the course of conducting business activities.

For instance, a delivery van used by a courier service or a pickup truck employed by a contractor can both be eligible for write-offs due to their direct connection to business operations. Moreover, specific vehicles may qualify for additional deductions based on their weight and purpose. For example, heavy vehicles, typically those weighing over 6,000 pounds, may qualify for Section 179 expensing, allowing businesses to deduct the full purchase price in the year the vehicle is placed in service.

This provision is particularly beneficial for businesses that require larger vehicles for their operations, such as construction companies or logistics firms. However, it is essential to note that personal vehicles used occasionally for business purposes may not qualify for the same level of deductions as those used predominantly for business.

Documentation and Record-Keeping Requirements

Accurate documentation and meticulous record-keeping are paramount when it comes to claiming vehicle write-offs. Tax authorities require taxpayers to maintain detailed records that substantiate their claims for deductions. This includes keeping a log of business mileage, which should detail the date of travel, destination, purpose of the trip, and the number of miles driven.

A well-maintained mileage log not only supports the deduction claim but also provides clarity in case of an audit. In addition to mileage logs, taxpayers should retain receipts for all vehicle-related expenses incurred during the year. This encompasses fuel purchases, maintenance and repair costs, insurance premiums, and any other expenses directly related to the vehicle’s operation.

For businesses that utilize multiple vehicles or have employees using company cars, implementing a systematic approach to record-keeping can streamline the process and ensure compliance with tax regulations. Utilizing accounting software or mobile applications designed for expense tracking can further enhance accuracy and efficiency in maintaining these records.

Limits and Restrictions on Vehicle Write-Offs

While vehicle write-offs can provide substantial tax benefits, there are limits and restrictions that taxpayers must navigate. One significant limitation is the percentage of business use required to qualify for deductions. If a vehicle is used for both personal and business purposes, only the portion attributable to business use can be deducted.

For instance, if a taxpayer uses their vehicle 70% of the time for business and 30% for personal use, they can only write off 70% of the vehicle-related expenses. Additionally, there are caps on the amount that can be deducted in a given year. For example, under Section 179, there are annual limits on how much can be expensed in relation to vehicle purchases.

Furthermore, luxury auto limits apply to passenger vehicles with a gross vehicle weight rating (GVWR) below 6,000 pounds. These limits can significantly impact the overall tax benefits available to taxpayers who own high-value vehicles or those who frequently purchase new cars for their business.

Calculating and Claiming Vehicle Write-Offs

| Metric | Description | Value / Limit | Notes |

|---|---|---|---|

| Vehicle Weight Requirement | Gross Vehicle Weight Rating (GVWR) to qualify | Over 6,000 lbs | Applies to SUVs, trucks, and certain vans |

| Section 179 Deduction Limit | Maximum immediate deduction for qualifying vehicles | Up to 1,080,000 | Applies to total equipment purchases, not just vehicles |

| Bonus Depreciation | Additional first-year depreciation allowed | 100% (phasing down in future years) | Can be combined with Section 179 |

| Depreciation Period | Standard depreciation schedule for vehicles | 5 years | Applies if Section 179 is not fully utilized |

| Business Use Requirement | Minimum percentage of business use to qualify | More than 50% | Personal use portion is not deductible |

| Luxury Auto Limits | Limits on depreciation for passenger vehicles under 6,000 lbs | Not applicable for vehicles over 6,000 lbs | Heavier vehicles avoid these limits |

Calculating vehicle write-offs involves determining both direct expenses related to the vehicle and the proportion of business use. Taxpayers have two primary methods for calculating deductions: the standard mileage rate method and the actual expense method. The standard mileage rate method allows taxpayers to multiply the number of business miles driven by a predetermined rate set by tax authorities each year.

This method simplifies calculations but may not always yield the maximum deduction. On the other hand, the actual expense method requires taxpayers to calculate all costs associated with operating the vehicle, including fuel, maintenance, insurance, depreciation, and lease payments if applicable. Taxpayers must then allocate these expenses based on the percentage of business use.

For example, if total vehicle expenses amount to $10,000 and business use is determined to be 80%, then $8,000 would be eligible for deduction. It is crucial to choose the method that maximizes deductions while ensuring compliance with tax regulations.

Strategies for Maximizing Tax Benefits

To maximize tax benefits associated with vehicle write-offs, taxpayers should consider several strategies that can enhance their overall deductions. One effective approach is to maintain meticulous records throughout the year rather than waiting until tax season. By consistently logging mileage and retaining receipts as expenses are incurred, taxpayers can ensure they capture all eligible deductions without missing any opportunities.

Another strategy involves evaluating whether to purchase or lease a vehicle based on individual circumstances and tax implications. Leasing may provide lower monthly payments and allow businesses to claim lease payments as deductions while avoiding depreciation limitations associated with ownership. Additionally, businesses should consider timing their purchases strategically; acquiring a new vehicle at year-end may allow them to take advantage of Section 179 expensing before year-end deadlines.

Potential Risks and Audits

While claiming vehicle write-offs can yield significant tax savings, it also carries potential risks that taxpayers must be aware of. One primary concern is the possibility of an audit by tax authorities. Audits can arise from discrepancies in reported income or expenses or from claims that appear excessive or inconsistent with industry norms.

To mitigate this risk, maintaining thorough documentation and adhering strictly to tax regulations is essential. Taxpayers should also be cautious about misclassifying personal use as business use when calculating deductions. Such misclassification can lead to penalties and interest if discovered during an audit.

It is advisable to consult with tax professionals who can provide guidance on proper classification and ensure compliance with all relevant regulations.

Seeking Professional Advice for Vehicle Write-Offs

Given the complexities surrounding vehicle write-offs and tax regulations, seeking professional advice can be invaluable for taxpayers looking to optimize their deductions. Tax professionals possess expertise in navigating intricate tax laws and can provide tailored guidance based on individual circumstances. They can assist in determining eligibility for various deductions and help establish effective record-keeping practices.

Moreover, professionals can offer insights into recent changes in tax legislation that may impact vehicle write-offs or introduce new opportunities for maximizing deductions. Engaging with a qualified accountant or tax advisor not only helps ensure compliance but also empowers taxpayers to make informed decisions regarding their vehicle-related expenses and overall tax strategy. By leveraging professional expertise, individuals and businesses can navigate the complexities of vehicle write-offs with confidence and clarity.