Navigating the complexities of income tax can be a daunting task for many individuals and families. The intricacies of tax codes, deductions, credits, and filing requirements can lead to confusion and anxiety, particularly for those who may not have a strong background in finance or accounting. The need for income tax help often arises from a variety of circumstances, including changes in personal financial situations, such as marriage, divorce, or the birth of a child.

Additionally, individuals who have recently started a business or experienced significant changes in income may find themselves overwhelmed by the tax implications of their new circumstances. Moreover, the consequences of incorrect tax filings can be severe. Errors can lead to audits, penalties, and even legal repercussions.

For many, the fear of making mistakes can deter them from filing altogether, which can result in further complications with the Internal Revenue Service (IRS). Understanding the need for professional assistance is crucial; it not only alleviates stress but also ensures compliance with tax laws. Seeking help can provide peace of mind and potentially save money through proper deductions and credits that individuals may not be aware of.

Key Takeaways

- Recognize when professional income tax help is necessary to ensure accurate filing.

- Explore various local and government-sponsored tax assistance programs available.

- Consider certified public accountants (CPAs) and nonprofit organizations for expert tax support.

- Utilize online tax assistance tools for convenience and accessibility.

- Assess the costs of different tax help services to find affordable and effective options.

Researching Local Tax Assistance Options

When seeking income tax help, one of the first steps is to research local tax assistance options available in your area. Many communities offer resources that cater to a diverse range of needs, from low-income families to individuals with more complex financial situations. Local libraries, community centers, and even universities often host workshops or provide information on tax preparation services.

These resources can be invaluable for those who prefer face-to-face interactions and personalized guidance. In addition to community resources, local tax assistance programs may include volunteer initiatives such as the Volunteer Income Tax Assistance (VITA) program. VITA offers free tax help to individuals who generally make $60,000 or less, persons with disabilities, and limited English-speaking taxpayers.

Volunteers are trained and certified by the IRS to provide accurate tax preparation services. Researching these local options can lead to discovering hidden gems that provide quality assistance without the burden of high fees.

Utilizing Government-Sponsored Tax Assistance Programs

Government-sponsored tax assistance programs are designed to help taxpayers navigate the complexities of filing their income taxes. One prominent example is the IRS’s Free File program, which allows eligible taxpayers to file their federal taxes online for free using brand-name software. This program is particularly beneficial for those with an adjusted gross income below a certain threshold, making it an accessible option for many low- to moderate-income earners.

Additionally, the IRS offers the Tax Counseling for the Elderly (TCE) program, which provides free tax help to individuals aged 60 and older. TCE volunteers are trained to address issues specific to seniors, such as pensions and retirement-related tax concerns. Utilizing these government-sponsored programs not only helps taxpayers save money but also ensures that they receive accurate and reliable assistance tailored to their unique situations.

Seeking Help from Certified Public Accountants (CPAs)

For individuals with more complex financial situations or those who simply prefer a higher level of expertise, seeking help from Certified Public Accountants (CPAs) can be an excellent option. CPAs are licensed professionals who have passed rigorous examinations and met specific educational requirements. Their expertise extends beyond basic tax preparation; they can provide strategic advice on tax planning, investment decisions, and long-term financial goals.

Engaging a CPA can be particularly beneficial for small business owners or self-employed individuals who face unique tax challenges. CPAs can help navigate deductions related to business expenses, ensure compliance with payroll taxes, and provide guidance on retirement plans for business owners. While hiring a CPA may come with a higher price tag than other options, the potential savings and peace of mind they offer can make it a worthwhile investment.

Exploring Tax Assistance Services Offered by Nonprofit Organizations

| Service | Average Cost | Processing Time | Customer Rating | Location |

|---|---|---|---|---|

| Basic Tax Filing | 100 – 150 | 1-3 days | 4.5/5 | Downtown |

| Itemized Tax Filing | 150 – 250 | 2-5 days | 4.7/5 | Midtown |

| Tax Consultation | 75 – 200 | 1 hour session | 4.8/5 | Uptown |

| Audit Assistance | 200 – 400 | Varies | 4.6/5 | Downtown |

| Business Tax Filing | 300 – 600 | 3-7 days | 4.4/5 | Financial District |

Nonprofit organizations play a vital role in providing tax assistance services to underserved populations. Many nonprofits focus on helping low-income families and individuals access the resources they need to file their taxes accurately and on time. Organizations such as United Way and local community action agencies often offer free or low-cost tax preparation services through trained volunteers.

These nonprofit services not only assist with tax preparation but also aim to educate clients about financial literacy and long-term financial planning. By empowering individuals with knowledge about their finances, these organizations help foster a sense of independence and confidence in managing future tax obligations. Exploring these nonprofit options can lead to discovering comprehensive support systems that extend beyond just tax filing.

Considering Online Tax Assistance Options

In today’s digital age, online tax assistance options have become increasingly popular due to their convenience and accessibility. Numerous platforms offer user-friendly interfaces that guide taxpayers through the filing process step-by-step. Many of these online services provide free basic filing options for simple tax situations while charging fees for more complex scenarios that require additional support.

Some online platforms also offer live chat features or virtual consultations with tax professionals, allowing users to ask questions in real-time as they navigate their returns. This hybrid approach combines the ease of online filing with the reassurance of professional guidance when needed. However, it is essential for users to research these platforms thoroughly, ensuring they choose reputable services that prioritize data security and customer support.

Evaluating the Cost of Income Tax Help Services

When considering income tax help services, evaluating the cost is a critical factor that can influence decision-making. The price of tax preparation services can vary significantly based on several factors, including the complexity of the return, geographic location, and the level of expertise required. For instance, simple returns may cost as little as $50 to $100 when prepared by a professional, while more complicated returns involving multiple income sources or business deductions could range from $200 to $1,000 or more.

It is also important to consider hidden costs that may arise during the process. Some preparers charge additional fees for e-filing or for each additional form required for specific deductions or credits. Therefore, obtaining a clear understanding of all potential costs upfront is essential before committing to any service.

Many taxpayers find it beneficial to compare multiple providers and seek out transparent pricing structures that align with their budgetary constraints.

Making the Most of Local Income Tax Help Resources

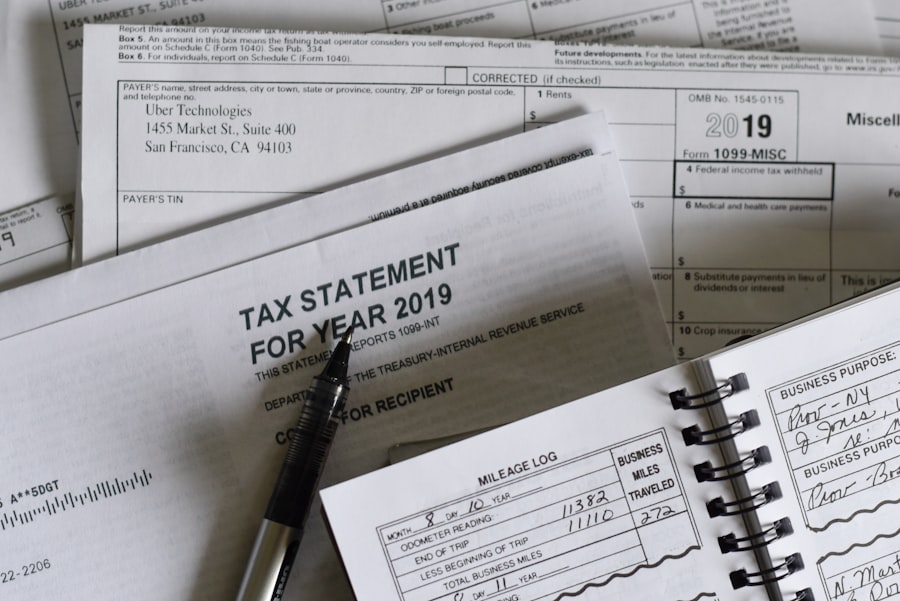

To maximize the benefits of local income tax help resources, taxpayers should approach these services with preparation and organization. Gathering all necessary documentation ahead of time—such as W-2s, 1099s, receipts for deductible expenses, and previous year’s tax returns—can streamline the process significantly. Being organized not only saves time but also ensures that no critical information is overlooked during preparation.

Additionally, engaging actively with tax preparers or volunteers can enhance the experience. Asking questions about deductions or credits that may apply to one’s situation can lead to discovering opportunities for savings that might otherwise go unnoticed. Furthermore, taking advantage of educational workshops or seminars offered by local organizations can provide valuable insights into personal finance management and future tax planning strategies.

By being proactive and informed, taxpayers can make the most out of local income tax help resources available in their communities.