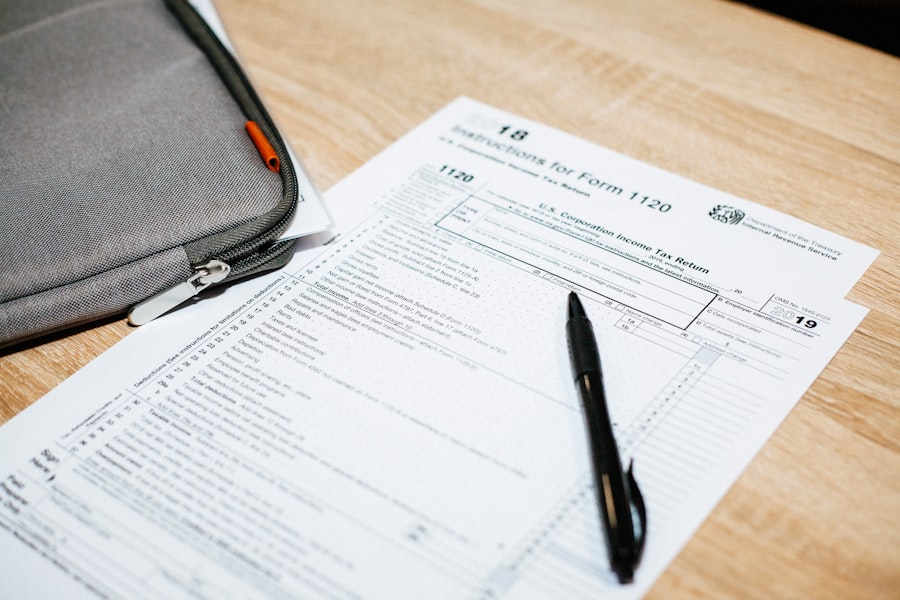

A personal tax accountant plays a pivotal role in managing an individual’s financial obligations to the government, particularly concerning income tax. Their primary responsibility is to ensure that clients comply with tax laws while maximizing their financial benefits. This involves preparing and filing tax returns, advising on tax strategies, and helping clients navigate the complexities of tax regulations.

Personal tax accountants are well-versed in the ever-evolving tax codes and can provide insights that are crucial for effective financial planning. They serve as a bridge between the taxpayer and the IRS, ensuring that all necessary documentation is submitted accurately and on time. Moreover, personal tax accountants often take on a consultative role, offering advice on various financial matters beyond just tax preparation.

They can assist clients in understanding the implications of their financial decisions, such as investments, retirement planning, and estate management. By analyzing a client’s financial situation, they can recommend strategies that not only minimize tax liabilities but also align with long-term financial goals. This holistic approach to financial management underscores the importance of having a knowledgeable professional in one’s corner, especially as tax laws become increasingly intricate.

Key Takeaways

- Personal tax accountants provide expert guidance tailored to individual tax situations.

- Hiring a local personal tax accountant offers convenience and personalized service.

- Choosing the right accountant involves assessing qualifications, experience, and compatibility.

- Personal tax accountants help maximize deductions and credits to reduce tax liability.

- Regular communication and technology use enhance accuracy and efficiency in tax filing.

Benefits of Hiring a Personal Tax Accountant Near Me

One of the most significant advantages of hiring a personal tax accountant nearby is the convenience of face-to-face interactions. Local accountants can provide personalized service that is often more effective than remote consultations. Being able to meet in person allows for a more thorough discussion of financial matters, fostering a relationship built on trust and understanding.

This proximity can also facilitate quicker responses to questions or concerns that may arise during the tax preparation process, ensuring that clients feel supported throughout the year. Additionally, local personal tax accountants possess an intimate knowledge of state-specific tax laws and regulations that may affect their clients. Each state has its own set of rules regarding deductions, credits, and filing requirements, which can significantly impact an individual’s tax situation.

A local accountant is likely to be familiar with these nuances and can provide tailored advice that considers both federal and state obligations. This localized expertise can lead to more effective tax strategies and potentially greater savings for clients.

How to Find the Right Personal Tax Accountant for Your Needs

Finding the right personal tax accountant requires careful consideration of several factors. First and foremost, it is essential to assess the accountant’s qualifications and experience. Look for professionals who hold relevant certifications, such as Certified Public Accountant (CPA) or Enrolled Agent (EA), as these designations indicate a higher level of expertise in tax matters.

Additionally, consider their experience in handling cases similar to yours; for instance, if you are self-employed or have complex investment portfolios, seek out accountants who specialize in those areas. Another critical aspect to consider is the accountant’s approach to client relationships. A good personal tax accountant should prioritize communication and be willing to take the time to understand your unique financial situation.

Reading reviews or seeking recommendations from friends and family can provide valuable insights into an accountant’s reputation and service quality. It may also be beneficial to schedule initial consultations with a few candidates to gauge their compatibility with your needs and expectations before making a final decision.

Maximizing Deductions and Credits with a Personal Tax Accountant

One of the primary advantages of working with a personal tax accountant is their ability to identify potential deductions and credits that individuals may overlook. Tax laws are filled with opportunities for savings, but they can be complex and difficult to navigate without professional guidance. A skilled accountant will conduct a thorough review of your financial situation, including income sources, expenses, and investments, to uncover all eligible deductions.

For example, they may identify deductions related to home office expenses for remote workers or educational credits for students. Furthermore, personal tax accountants stay updated on changes in tax legislation that could impact available credits and deductions from year to year. This knowledge allows them to proactively advise clients on strategies to optimize their tax returns.

For instance, if new legislation introduces additional credits for energy-efficient home improvements, an accountant can guide clients on how to take advantage of these incentives effectively. By leveraging their expertise, clients can significantly reduce their taxable income and increase their overall refund.

Avoiding Costly Mistakes with the Help of a Personal Tax Accountant

| Metric | Description | Typical Range | Notes |

|---|---|---|---|

| Average Hourly Rate | Cost charged per hour for personal tax accounting services | 50 – 200 | Varies by location and accountant experience |

| Average Tax Return Preparation Fee | Fee for preparing a standard personal tax return | 100 – 400 | Depends on complexity and state |

| Average Client Rating | Customer satisfaction rating on review platforms | 3.5 – 5.0 | Based on Google, Yelp, and other reviews |

| Typical Turnaround Time | Time taken to complete tax return preparation | 1 – 7 days | Depends on workload and document availability |

| Number of Local Accountants | Count of personal tax accountants within a 10-mile radius | 5 – 50 | Varies by city size and demand |

| Common Services Offered | Typical services provided by personal tax accountants | Tax preparation, tax planning, audit support | Additional services may include bookkeeping and consulting |

Tax preparation is fraught with potential pitfalls that can lead to costly mistakes if not handled correctly. Errors in filing can result in penalties, interest charges, or even audits by the IRS. A personal tax accountant plays a crucial role in mitigating these risks by ensuring that all information is accurate and compliant with current regulations.

They meticulously review all documentation before submission, reducing the likelihood of errors that could trigger unwanted scrutiny from tax authorities. In addition to preventing mistakes during the filing process, personal tax accountants can also help clients avoid common traps that lead to audits. For example, they can advise on proper record-keeping practices and ensure that all claimed deductions are substantiated with appropriate documentation.

This proactive approach not only safeguards against potential penalties but also provides peace of mind for clients who may otherwise feel overwhelmed by the complexities of tax compliance.

Long-Term Tax Planning with a Personal Tax Accountant

Long-term tax planning is an essential component of effective financial management, and personal tax accountants are well-equipped to assist clients in this area. They can help individuals develop strategies that align with their financial goals while minimizing future tax liabilities. This might involve advising on retirement account contributions, investment strategies, or estate planning considerations that take into account potential tax implications.

For instance, a personal tax accountant might recommend specific retirement accounts that offer tax advantages based on an individual’s income level and future goals. They can also analyze investment portfolios to identify opportunities for tax-loss harvesting or suggest adjustments that could lead to more favorable tax outcomes in the long run. By engaging in proactive long-term planning with a personal tax accountant, clients can make informed decisions that enhance their financial well-being over time.

The Importance of Regular Communication with Your Personal Tax Accountant

Establishing regular communication with a personal tax accountant is vital for maintaining an effective working relationship. Frequent discussions allow for ongoing updates regarding changes in financial circumstances or shifts in tax laws that could impact an individual’s situation. This open line of communication ensures that both parties are aligned on goals and strategies throughout the year rather than just during the busy tax season.

Moreover, regular check-ins provide opportunities for accountants to offer timely advice on financial decisions that may arise between filing periods. For example, if a client is considering making a significant purchase or investment, discussing these plans with their accountant beforehand can help assess potential tax implications and guide them toward making informed choices. This proactive approach fosters a collaborative relationship where both the client and accountant work together toward achieving optimal financial outcomes.

Leveraging Technology for Streamlined Tax Filing with a Personal Tax Accountant

In today’s digital age, technology plays an increasingly important role in streamlining the tax filing process. Personal tax accountants often utilize advanced software tools that enhance efficiency and accuracy in preparing returns. These technologies allow for seamless data collection and organization, reducing the time spent on manual entry and minimizing errors associated with traditional methods.

Additionally, many accountants now offer secure online portals where clients can upload documents and access their financial information conveniently. This not only simplifies communication but also ensures that sensitive data is handled securely. By leveraging technology in collaboration with a personal tax accountant, clients can experience a more efficient filing process while benefiting from the expertise of their accountant without the stress typically associated with tax season.