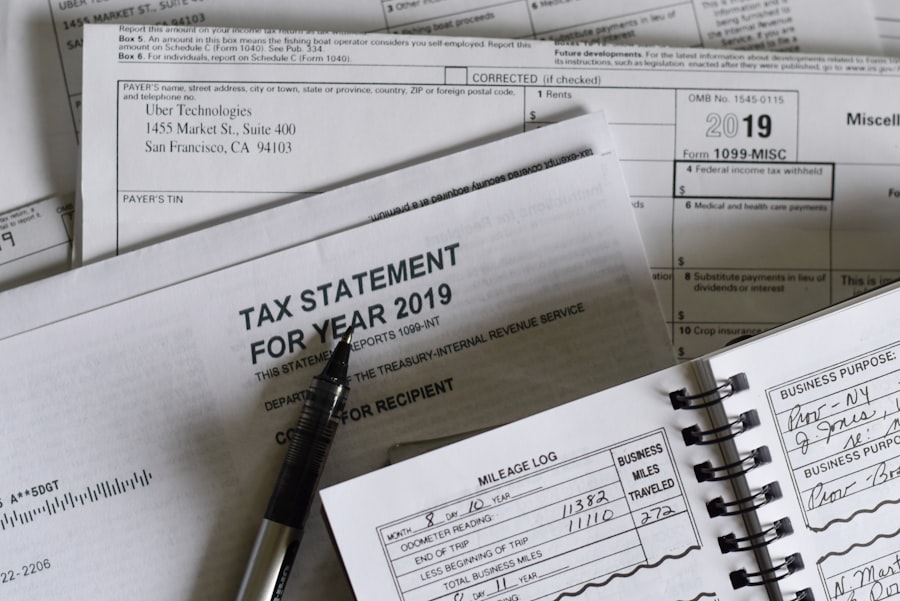

Navigating the complex world of taxes can be a daunting task for many individuals and businesses alike. The intricacies of tax laws, regulations, and deadlines can lead to confusion and anxiety, making tax assistance an invaluable resource. Tax assistance is not merely about filing returns; it encompasses a wide range of services designed to help taxpayers understand their obligations, maximize deductions, and ensure compliance with the law.

The importance of tax assistance becomes particularly evident during tax season when the pressure to file accurately and on time is at its peak. Moreover, tax assistance can play a crucial role in financial planning. By working with a knowledgeable tax professional, individuals can gain insights into how their financial decisions impact their tax liabilities.

This proactive approach can lead to better financial outcomes, such as increased savings or reduced tax burdens. For businesses, effective tax assistance can mean the difference between thriving and merely surviving in a competitive market. Understanding available credits, deductions, and incentives can significantly enhance a company’s bottom line, making tax assistance an essential component of sound financial management.

Key Takeaways

- Tax assistance is crucial for accurate filing and maximizing refunds.

- Various types of tax help include in-person, online, and volunteer services.

- Finding local tax assistance involves researching providers and checking credentials.

- Choose providers with experience, good reviews, and clear communication.

- Expert tax help can prevent errors, save money, and reduce stress.

Types of Tax Assistance Available

Tax assistance comes in various forms, each tailored to meet the diverse needs of taxpayers. One of the most common types is individual tax preparation services, where professionals help individuals prepare and file their personal income tax returns. These services often include identifying eligible deductions and credits, ensuring compliance with tax laws, and providing guidance on tax-related questions.

For those with more complex financial situations, such as self-employed individuals or investors, specialized tax preparation services may be necessary to navigate the intricacies of their unique circumstances. In addition to individual tax preparation, there are also business tax services that cater specifically to companies of all sizes. These services can include corporate tax planning, payroll tax assistance, and sales tax compliance.

Businesses often face a myriad of tax obligations that require expert knowledge to manage effectively. Furthermore, there are nonprofit organizations that provide free or low-cost tax assistance to low-income individuals and families, ensuring that everyone has access to the help they need during tax season. This variety of services highlights the importance of finding the right type of assistance based on one’s specific needs.

How to Find Tax Assistance Near Me

Finding tax assistance in your local area can be a straightforward process if you know where to look. One of the most effective methods is to utilize online resources. Websites such as the IRS’s official site offer tools to locate certified tax preparers and volunteers who provide free assistance through programs like the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE).

These programs are designed to help those who may not be able to afford professional services while ensuring that they receive accurate and reliable assistance. Another valuable resource is local community centers or libraries, which often host workshops or have information on local tax assistance programs. Networking within your community can also yield recommendations for reputable tax professionals.

Asking friends, family, or colleagues for referrals can lead you to trusted providers who have successfully assisted others in similar situations. Additionally, social media platforms and online forums can serve as platforms for gathering insights and reviews about local tax assistance options.

Qualities to Look for in a Tax Assistance Provider

When seeking a tax assistance provider, it is essential to consider several key qualities that can significantly impact the quality of service you receive. First and foremost, expertise and qualifications are paramount. Look for professionals who hold relevant certifications, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs).

These credentials indicate a level of proficiency and adherence to ethical standards in the field of taxation. Another critical quality is experience, particularly in dealing with situations similar to your own. A provider who has worked with clients in your specific industry or financial situation will likely have a deeper understanding of the nuances involved.

Additionally, effective communication skills are vital; your tax professional should be able to explain complex concepts in a way that is easy to understand. Finally, consider the provider’s reputation within the community. Online reviews, testimonials, and word-of-mouth recommendations can provide valuable insights into the reliability and effectiveness of a potential tax assistance provider.

Benefits of Seeking Expert Help for Tax Assistance

| Service Provider | Location | Type of Assistance | Hours of Operation | Contact Number | Cost | Appointment Required |

|---|---|---|---|---|---|---|

| IRS Volunteer Income Tax Assistance (VITA) | Downtown Community Center | Free tax preparation for low to moderate income | Mon-Fri 9am – 5pm | 555-123-4567 | Free | Yes |

| H&R Block | 123 Main St, Suite 101 | Professional tax preparation and filing | Mon-Sat 9am – 7pm | 555-234-5678 | Varies by service | No |

| TurboTax Live | Online | Virtual tax assistance with CPA/EA | 24/7 | 1-800-555-7890 | Varies by package | No |

| Local Library Tax Help Desk | City Library, 456 Elm St | Basic tax help and forms | Tue & Thu 10am – 4pm | 555-345-6789 | Free | No |

| TaxAid Nonprofit Organization | 789 Oak Ave | Free tax assistance for seniors and disabled | Wed-Fri 10am – 3pm | 555-456-7890 | Free | Yes |

Engaging with a qualified tax assistance provider offers numerous benefits that can enhance your overall financial well-being. One significant advantage is the potential for maximizing deductions and credits that you may not be aware of on your own. Tax professionals stay updated on the latest changes in tax laws and regulations, ensuring that you take full advantage of available opportunities to reduce your taxable income.

Additionally, expert help can provide peace of mind during what is often a stressful time of year. Knowing that a knowledgeable professional is handling your taxes allows you to focus on other important aspects of your life or business without the constant worry of making mistakes or missing deadlines. Furthermore, in the event of an audit or inquiry from the IRS, having a professional by your side can be invaluable.

They can represent you and navigate the complexities of the audit process, alleviating much of the stress associated with such situations.

Common Mistakes to Avoid When Seeking Tax Assistance

While seeking tax assistance can be beneficial, there are common pitfalls that taxpayers should be aware of to ensure they receive the best possible service. One frequent mistake is failing to do adequate research before selecting a provider. Rushing into a decision without checking qualifications or reviews can lead to subpar service or even potential fraud.

It’s crucial to take the time to vet potential providers thoroughly. Another common error is not being transparent with your tax professional about your financial situation. Providing incomplete or inaccurate information can hinder their ability to assist you effectively.

It’s essential to be forthcoming about all sources of income, deductions, and any previous tax issues you may have encountered. Additionally, some taxpayers overlook the importance of understanding fees associated with tax services. Always inquire about pricing structures upfront to avoid any surprises when it comes time to settle your bill.

Questions to Ask When Seeking Tax Assistance

When interviewing potential tax assistance providers, asking the right questions can help you gauge their suitability for your needs. Start by inquiring about their qualifications and experience in handling cases similar to yours. Questions such as “What certifications do you hold?” or “How long have you been providing tax assistance?” can provide insight into their expertise.

It’s also beneficial to ask about their approach to staying updated on changes in tax laws and regulations. A knowledgeable provider should be proactive in continuing education and aware of recent developments that could impact your taxes. Additionally, inquire about their availability throughout the year; having access to your tax professional outside of tax season can be advantageous for ongoing financial planning or questions that may arise at any time.

Tips for Making the Most of Tax Assistance

To maximize the benefits of tax assistance, it’s essential to come prepared when meeting with your provider. Gather all relevant documents ahead of time, including W-2s, 1099s, receipts for deductions, and any previous tax returns. This preparation will enable your tax professional to work efficiently and accurately on your behalf.

Additionally, maintain open lines of communication throughout the process. Don’t hesitate to ask questions if something is unclear; understanding your taxes is crucial for making informed financial decisions in the future. Finally, consider establishing an ongoing relationship with your tax professional rather than just seeking help during filing season.

This continuity allows for better planning and advice tailored specifically to your evolving financial situation over time. By taking these steps and being proactive in your approach to seeking tax assistance, you can ensure that you receive comprehensive support tailored to your unique needs while navigating the complexities of taxation with confidence.