In the modern business landscape, the importance of efficient financial management cannot be overstated. Basic accounting software serves as a vital tool for businesses of all sizes, providing a streamlined approach to managing financial transactions, tracking expenses, and generating reports. These software solutions are designed to simplify the accounting process, making it accessible even for those without extensive financial training.

By automating routine tasks, basic accounting software allows business owners and managers to focus on strategic decision-making rather than getting bogged down in manual bookkeeping. The evolution of technology has led to a proliferation of accounting software options, ranging from simple applications suitable for small businesses to more complex systems designed for larger enterprises. Basic accounting software typically includes features such as invoicing, expense tracking, and financial reporting, which are essential for maintaining accurate financial records.

As businesses increasingly recognize the value of real-time financial data, the adoption of these tools has become a necessity rather than a luxury. This article delves into the myriad benefits of basic accounting software, how to choose the right solution for your business, and best practices for setting it up and utilizing its features effectively.

Key Takeaways

- Basic accounting software simplifies financial management for businesses of all sizes.

- It offers benefits like improved accuracy, time savings, and better financial insights.

- Selecting the right software depends on business needs, budget, and ease of use.

- Proper setup and regular use help efficiently manage invoices, expenses, income, and cash flow.

- Integration with other business tools enhances overall operational efficiency and reporting capabilities.

Benefits of Using Basic Accounting Software

One of the primary advantages of using basic accounting software is the significant time savings it offers. Manual bookkeeping can be a labor-intensive process, often requiring hours of data entry and reconciliation. Basic accounting software automates many of these tasks, allowing users to input data quickly and efficiently.

For instance, features like bank reconciliation can automatically match transactions from bank statements with those recorded in the software, drastically reducing the time spent on this essential task. This efficiency not only frees up valuable time but also minimizes the risk of human error that can occur with manual entries. Another key benefit is the enhanced accuracy and reliability of financial data.

Basic accounting software typically includes built-in checks and balances that help ensure data integrity. For example, when generating invoices or recording expenses, the software can flag inconsistencies or errors, prompting users to correct them before finalizing any documents. This level of oversight is particularly beneficial for small businesses that may not have dedicated accounting staff.

By maintaining accurate records, businesses can make informed decisions based on reliable financial information, ultimately leading to better financial health and growth.

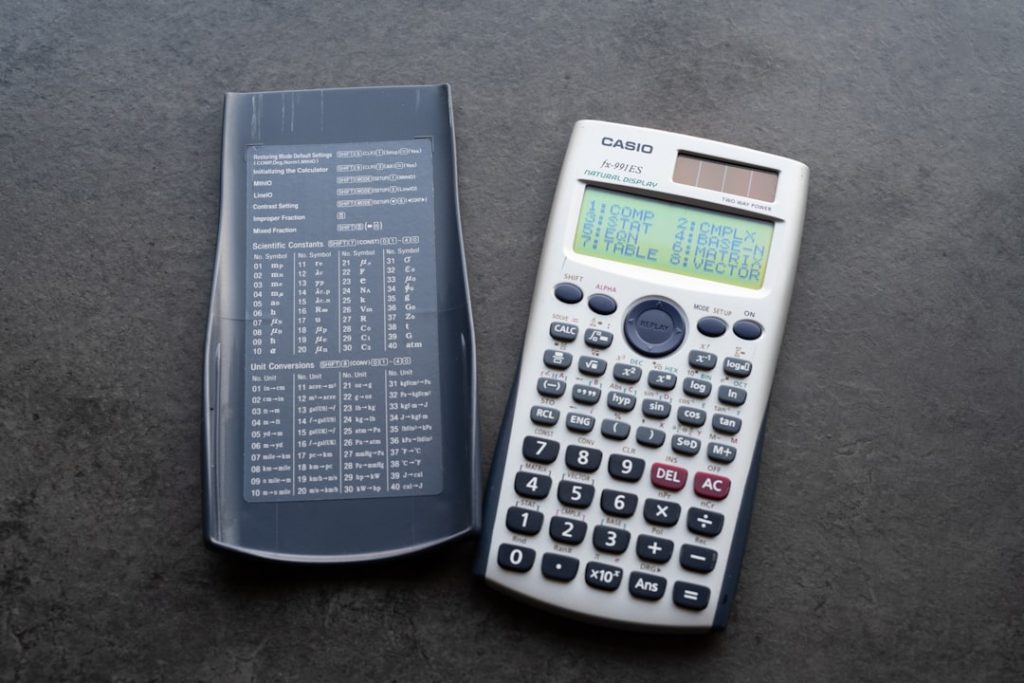

Choosing the Right Basic Accounting Software for Your Business

Selecting the appropriate basic accounting software for your business requires careful consideration of several factors. First and foremost, it is essential to assess your specific needs and requirements. For instance, a freelance graphic designer may require different features compared to a small retail store.

Understanding your business model will help you identify which functionalities are most critical. Look for software that offers customizable invoicing options, expense tracking capabilities, and reporting features that align with your operational goals. Additionally, consider the scalability of the software.

As your business grows, your accounting needs may evolve. Opting for a solution that can accommodate increased transaction volumes or additional users will save you from the hassle of switching systems down the line. Furthermore, user-friendliness is paramount; choose software that is intuitive and easy to navigate, especially if you or your team members lack extensive accounting knowledge.

Reading user reviews and seeking recommendations from other business owners can provide valuable insights into which software solutions are most effective in real-world applications.

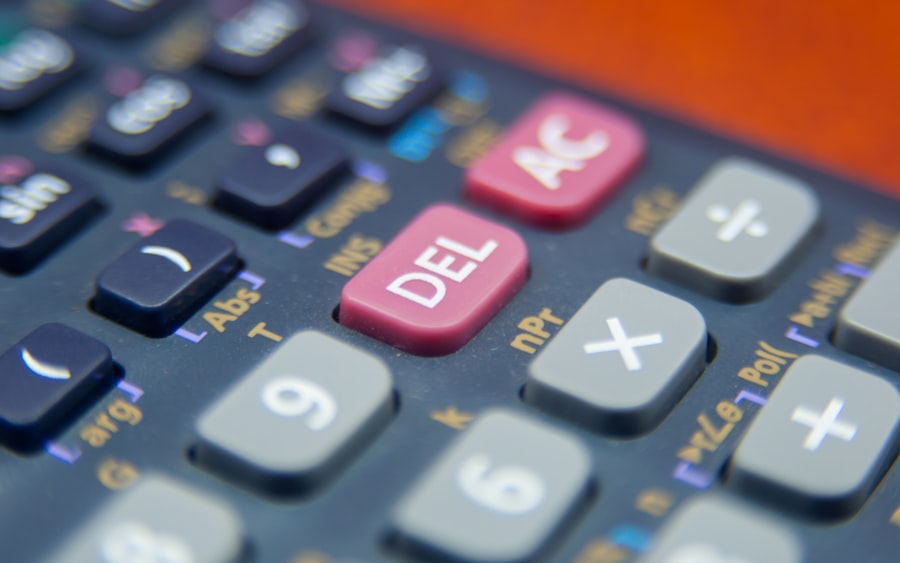

Setting Up Your Basic Accounting Software

Once you have selected the right basic accounting software for your business, the next step is setting it up properly to ensure optimal functionality. The initial setup process typically involves creating an account and entering essential business information such as your company name, address, and tax identification number. Many software solutions offer guided setup wizards that walk users through each step, making it easier to get started.

After entering basic information, it is crucial to configure your chart of accounts. This chart serves as the backbone of your accounting system, categorizing all financial transactions into specific accounts such as assets, liabilities, income, and expenses. A well-organized chart of accounts allows for more accurate tracking and reporting of financial data.

Additionally, integrating bank accounts and payment processors into the software can streamline transaction recording and reconciliation processes. By linking these accounts, you can automate data imports and reduce manual entry errors.

Managing Invoices and Expenses with Basic Accounting Software

| Software | Price Range | Key Features | Best For | Platform | User Rating (out of 5) |

|---|---|---|---|---|---|

| QuickBooks Online | 10 – 70 per month | Invoicing, Expense Tracking, Payroll, Tax Filing | Small to Medium Businesses | Web, iOS, Android | 4.5 |

| FreshBooks | 15 – 50 per month | Time Tracking, Invoicing, Expense Management | Freelancers, Small Businesses | Web, iOS, Android | 4.4 |

| Wave Accounting | Free (paid add-ons available) | Invoicing, Accounting, Receipt Scanning | Freelancers, Small Businesses | Web, iOS, Android | 4.3 |

| Zoho Books | 15 – 60 per month | Invoicing, Inventory, Banking, Tax Compliance | Small to Medium Businesses | Web, iOS, Android | 4.2 |

| Xero | 12 – 65 per month | Bank Reconciliation, Invoicing, Payroll | Small to Medium Businesses | Web, iOS, Android | 4.3 |

Effective management of invoices and expenses is a cornerstone of sound financial practices in any business. Basic accounting software simplifies this process by providing tools for creating professional invoices quickly and efficiently. Users can customize invoice templates with their branding elements such as logos and color schemes, ensuring consistency in their communications with clients.

Furthermore, many software solutions allow for recurring invoices, which is particularly useful for businesses that operate on subscription models or have long-term contracts. Expense management is equally important in maintaining a healthy cash flow. Basic accounting software often includes features that enable users to track expenses in real-time by uploading receipts or categorizing expenditures as they occur.

This level of organization not only helps in monitoring spending but also aids in preparing for tax season by ensuring that all deductible expenses are accurately recorded. Some advanced solutions even offer mobile applications that allow users to capture receipts on-the-go, further enhancing convenience and efficiency.

Tracking Income and Cash Flow with Basic Accounting Software

Monitoring income and cash flow is vital for any business’s sustainability and growth. Basic accounting software provides tools that allow users to track income streams effectively by categorizing revenue sources and analyzing trends over time. By generating income reports, business owners can gain insights into which products or services are performing well and which may require adjustments or additional marketing efforts.

Cash flow management is another critical aspect facilitated by basic accounting software. Many solutions offer cash flow forecasting tools that help businesses project future cash inflows and outflows based on historical data and current trends. This forecasting capability enables business owners to make informed decisions regarding expenditures, investments, and potential financing needs.

By having a clear picture of cash flow dynamics, businesses can avoid potential pitfalls such as cash shortages that could hinder operations or growth initiatives.

Generating Financial Reports and Analysis with Basic Accounting Software

The ability to generate comprehensive financial reports is one of the standout features of basic accounting software. These reports provide valuable insights into a business’s financial health and performance over specific periods. Common reports include profit and loss statements, balance sheets, and cash flow statements.

Each report serves a distinct purpose; for example, a profit and loss statement summarizes revenues and expenses to determine net income over a given timeframe. Moreover, many basic accounting software solutions offer customizable reporting options that allow users to tailor reports according to their specific needs. This flexibility enables businesses to analyze key performance indicators (KPIs) relevant to their industry or operational goals.

For instance, a retail business might focus on inventory turnover ratios while a service-based company may prioritize billable hours versus non-billable hours in their analysis. By leveraging these reports effectively, business owners can make data-driven decisions that enhance profitability and operational efficiency.

Integrating Basic Accounting Software with Other Business Tools

To maximize the benefits of basic accounting software, integration with other business tools is essential. Many modern accounting solutions offer compatibility with various applications such as customer relationship management (CRM) systems, e-commerce platforms, payroll services, and project management tools. This integration facilitates seamless data flow between systems, reducing the need for manual data entry and minimizing errors.

For example, integrating an e-commerce platform with accounting software allows sales transactions to be automatically recorded in real-time as they occur online. This not only streamlines bookkeeping but also provides immediate insights into sales performance without requiring additional effort from staff members. Similarly, linking payroll systems ensures that employee compensation is accurately reflected in financial reports without duplicating efforts in data entry.

By creating an interconnected ecosystem of business tools, companies can enhance operational efficiency while maintaining accurate financial records across all departments. In conclusion, basic accounting software plays an indispensable role in modern business management by simplifying financial processes and providing valuable insights into performance metrics. By understanding its benefits, choosing the right solution, setting it up effectively, managing invoices and expenses efficiently, tracking income and cash flow diligently, generating insightful reports, and integrating with other tools seamlessly, businesses can leverage these systems to foster growth and sustainability in an increasingly competitive environment.