Navigating the complexities of tax filing can be a daunting task for many individuals and businesses alike. The first step in this journey is to gain a clear understanding of your specific tax filing needs. This involves assessing your financial situation, including income sources, deductions, and credits that may apply to you.

For instance, if you are a freelancer, your tax obligations will differ significantly from those of a salaried employee. Freelancers often have to account for self-employment taxes, estimated quarterly payments, and various business-related deductions that can significantly impact their overall tax liability. Moreover, understanding your tax filing needs also requires familiarity with the deadlines and forms relevant to your situation.

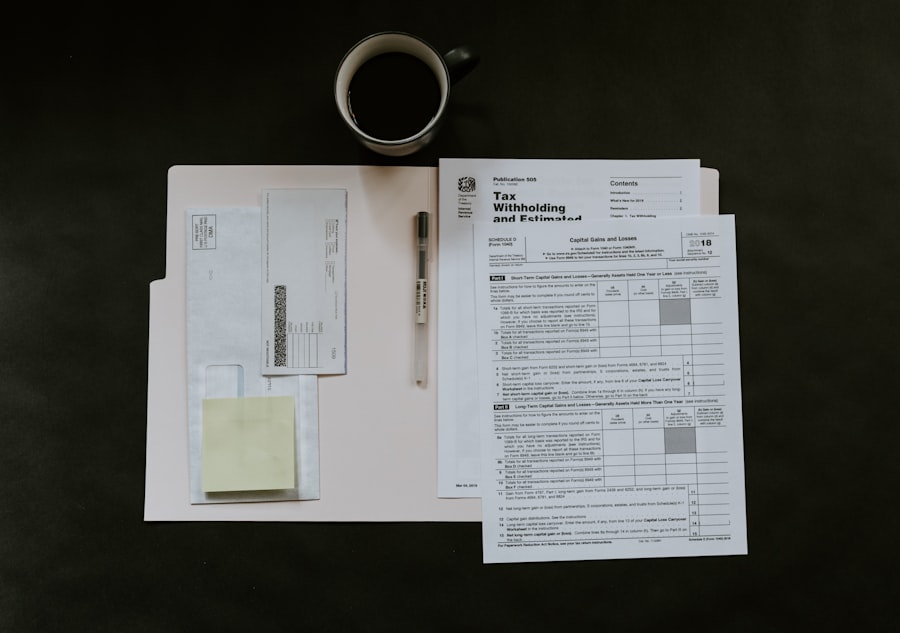

The IRS provides a variety of forms, each tailored to different types of income and deductions. For example, individuals who earn income from investments may need to file additional forms such as Schedule D for capital gains and losses. Additionally, if you have dependents or qualify for certain credits like the Earned Income Tax Credit (EITC), it is crucial to understand how these factors influence your filing requirements.

By taking the time to evaluate your unique circumstances, you can better prepare for the tax filing process and avoid potential pitfalls.

Key Takeaways

- Identify your specific tax filing requirements before seeking assistance.

- Explore local organizations and services that offer tax filing support.

- Use online tools and resources to simplify the tax filing process.

- Consider hiring professional tax experts for complex tax situations.

- Leverage community programs to access affordable or free tax help.

Researching Local Tax Filing Assistance Options

Once you have a grasp of your tax filing needs, the next step is to explore local tax filing assistance options available in your area. Many communities offer resources designed to help residents navigate the tax filing process. Local libraries, community centers, and non-profit organizations often host workshops or provide one-on-one assistance during tax season.

These resources can be particularly beneficial for individuals who may not have the means to hire a professional tax preparer but still require guidance in completing their returns accurately. In addition to community resources, local accounting firms and tax preparation services can also be valuable options. Many of these businesses offer free consultations or discounted rates for first-time clients.

It is essential to research the reputation of these services by reading reviews or seeking recommendations from friends and family. Some firms may specialize in specific areas, such as small business taxes or personal finance, so identifying a provider that aligns with your needs can enhance your overall experience. By thoroughly investigating local options, you can find the right support to help you navigate the complexities of tax filing.

Utilizing Online Resources for Tax Filing Help

In today’s digital age, online resources have become an invaluable tool for individuals seeking assistance with their tax filings. Numerous websites offer comprehensive guides, tutorials, and even interactive tools designed to simplify the tax preparation process. The IRS website itself is a treasure trove of information, providing access to forms, instructions, and frequently asked questions that can clarify many aspects of tax filing.

Additionally, many reputable financial websites offer articles and videos that break down complex topics into digestible segments. Online tax preparation software has also gained popularity in recent years, providing users with step-by-step guidance through the filing process. These platforms often include features such as automatic calculations, error checks, and e-filing options that streamline the submission process.

Some software programs even offer free versions for simple tax situations, making them accessible to a broader audience. However, it is crucial to choose a reputable provider and ensure that the software is up-to-date with the latest tax laws and regulations. By leveraging these online resources, taxpayers can empower themselves with knowledge and tools that facilitate a smoother filing experience.

Seeking Professional Tax Filing Help

For those with more complex financial situations or who simply prefer to have an expert handle their taxes, seeking professional tax filing help can be an excellent option. Certified Public Accountants (CPAs) and enrolled agents are trained professionals who can provide personalized assistance tailored to your specific needs. They possess in-depth knowledge of tax laws and regulations, which can be particularly beneficial for individuals with multiple income streams, investments, or significant deductions.

When selecting a professional tax preparer, it is essential to consider their qualifications and experience. Look for professionals who hold relevant certifications and have a solid track record in handling cases similar to yours. Many CPAs specialize in particular areas of taxation, such as estate planning or international taxation, so finding someone with expertise in your specific situation can lead to more favorable outcomes.

Additionally, establishing a good rapport with your tax preparer is vital; open communication can help ensure that all relevant information is considered when preparing your return.

Exploring Community Resources for Tax Filing Assistance

| Place Name | Address | Distance (miles) | Services Offered | Hours of Operation | Contact Number | Customer Rating |

|---|---|---|---|---|---|---|

| TaxPro Solutions | 123 Main St, Cityville | 1.2 | Individual & Business Tax Filing, Audit Support | Mon-Fri 9am-6pm, Sat 10am-4pm | (555) 123-4567 | 4.5/5 |

| QuickTax Services | 456 Elm St, Cityville | 2.5 | Individual Tax Filing, E-filing | Mon-Fri 8am-5pm | (555) 234-5678 | 4.2/5 |

| IRS Volunteer Assistance | 789 Oak St, Cityville | 3.0 | Free Tax Help for Low-Income & Seniors | Tue-Sat 10am-3pm | (555) 345-6789 | 4.8/5 |

| Accounting Experts | 321 Pine St, Cityville | 4.1 | Business & Individual Tax Filing, Financial Planning | Mon-Fri 9am-7pm | (555) 456-7890 | 4.6/5 |

| TaxEase Center | 654 Maple St, Cityville | 5.0 | Individual Tax Filing, Tax Consultation | Mon-Sat 9am-6pm | (555) 567-8901 | 4.3/5 |

Community resources play a crucial role in providing accessible tax filing assistance to individuals who may otherwise struggle with the process. Organizations such as Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) offer free tax preparation services to eligible individuals, including low-income families and seniors. These programs are staffed by trained volunteers who are knowledgeable about current tax laws and can help clients maximize their refunds while ensuring compliance with regulations.

Local non-profits and community organizations may also host tax clinics or workshops during tax season. These events often provide valuable information on various topics related to tax filing, such as understanding deductions, credits, and changes in tax law from year to year. Participating in these community resources not only helps individuals file their taxes accurately but also fosters a sense of community support during what can be a stressful time of year.

By tapping into these local resources, taxpayers can gain confidence in their ability to navigate the complexities of tax filing.

Understanding the Benefits of Tax Filing Assistance

Utilizing tax filing assistance offers numerous benefits that extend beyond simply ensuring compliance with tax laws. One of the most significant advantages is the potential for maximizing deductions and credits that individuals may not be aware of on their own. Tax professionals are trained to identify opportunities that could lead to substantial savings on your overall tax bill.

For example, they may uncover eligible deductions related to education expenses or medical costs that could significantly reduce taxable income. Additionally, seeking assistance can alleviate the stress associated with preparing taxes independently. The intricacies of tax law can be overwhelming, especially for those unfamiliar with the terminology or processes involved.

By enlisting help from professionals or community resources, taxpayers can focus on other important aspects of their lives while ensuring that their taxes are handled correctly. Furthermore, having an expert review your return can provide peace of mind knowing that it has been prepared accurately and submitted on time.

Comparing Different Tax Filing Help Options

When considering various options for tax filing assistance, it is essential to weigh the pros and cons of each approach based on your unique circumstances. Professional services typically offer personalized attention and expertise but may come at a higher cost compared to community resources or online tools. For individuals with straightforward financial situations, utilizing free community programs or online software may suffice and save money in the process.

Conversely, those with more complex financial situations may benefit from the tailored advice provided by a professional preparer. It is also worth considering factors such as convenience and accessibility when comparing options. For instance, online resources allow taxpayers to work at their own pace from the comfort of their homes, while local services may require appointments or in-person visits.

Ultimately, evaluating these factors will help you determine which option aligns best with your needs and preferences.

Making the Most of Local Tax Filing Help

To maximize the benefits of local tax filing assistance, it is essential to come prepared when seeking help from community resources or professional services. Gather all necessary documentation ahead of time, including W-2s, 1099s, receipts for deductions, and any other relevant financial records. Having this information readily available will streamline the process and allow your preparer to work more efficiently on your behalf.

Additionally, take advantage of any educational opportunities offered by local organizations during tax season. Workshops or informational sessions can provide valuable insights into changes in tax law or strategies for maximizing refunds. Engaging actively with your preparer by asking questions and seeking clarification on any aspects you do not understand will also enhance your overall experience.

By being proactive and informed, you can make the most of local tax filing help and ensure that your taxes are filed accurately and efficiently.