Financial performance analysis is a systematic evaluation process that examines an organization’s financial data to determine its economic health and operational effectiveness. This analytical method utilizes information from financial statements, including income statements, balance sheets, and cash flow statements, to measure key performance indicators such as profitability, liquidity, solvency, and operational efficiency. The analysis serves multiple stakeholder groups who require accurate financial information for decision-making purposes.

Investors use financial performance metrics to evaluate potential returns and assess investment risks before committing capital. Creditors and lenders examine these indicators to determine creditworthiness and establish lending terms. Internal management teams utilize the analysis to identify operational inefficiencies, allocate resources effectively, and develop strategic plans aligned with organizational objectives.

Key financial ratios and metrics derived from this analysis include return on assets, debt-to-equity ratios, current ratios, and profit margins. These quantitative measures provide objective benchmarks for comparing performance across time periods and against industry standards. The analysis also enables organizations to identify trends, forecast future performance, and implement corrective measures when financial indicators suggest declining performance or emerging risks.

Key Takeaways

- Financial performance analysis helps assess a company’s overall health and operational success.

- Accounting reports provide essential data for evaluating financial status and trends.

- Key ratios like profitability, liquidity, and solvency metrics are critical for comprehensive analysis.

- Cash flow statements reveal the company’s ability to generate and manage cash effectively.

- Informed business decisions rely on accurate interpretation of accounting reports and financial metrics.

Understanding Accounting Reports

Accounting reports are the backbone of financial performance analysis, providing a structured representation of a company’s financial activities over a specific period. The primary accounting reports include the income statement, balance sheet, and cash flow statement. Each of these reports offers unique insights into different aspects of a company’s financial health.

The income statement details revenues and expenses, ultimately revealing the net profit or loss for the period. This report is crucial for understanding how effectively a company generates profit from its operations. The balance sheet, on the other hand, provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

It illustrates what the company owns and owes, thereby offering insights into its financial stability and capital structure. The cash flow statement complements these reports by detailing the inflows and outflows of cash within the organization. It highlights how cash is generated and utilized in operating, investing, and financing activities.

Together, these reports form a comprehensive picture of a company’s financial performance and are essential for stakeholders seeking to understand its economic position.

Key Financial Ratios and Metrics

Financial ratios and metrics are indispensable tools in financial performance analysis, allowing for the comparison of various aspects of a company’s financial health. Ratios such as the current ratio, quick ratio, return on equity (ROE), and debt-to-equity ratio provide valuable insights into liquidity, profitability, and leverage. The current ratio, calculated by dividing current assets by current liabilities, measures a company’s ability to meet short-term obligations.

A ratio above one indicates that the company has more current assets than liabilities, suggesting a healthy liquidity position. Return on equity (ROE) is another critical metric that assesses how effectively a company generates profit from shareholders’ equity. A higher ROE indicates that the company is using its equity efficiently to produce earnings.

Conversely, the debt-to-equity ratio evaluates a company’s financial leverage by comparing total liabilities to shareholders’ equity. A high ratio may indicate greater risk due to reliance on debt financing, while a lower ratio suggests a more conservative approach to capital structure. These ratios not only facilitate internal assessments but also enable comparisons with industry benchmarks and competitors.

Evaluating Profitability

Profitability is a key indicator of a company’s financial performance and sustainability. It reflects the ability of an organization to generate earnings relative to its revenue, assets, or equity. Various metrics are employed to evaluate profitability, including gross profit margin, operating profit margin, and net profit margin.

The gross profit margin measures the percentage of revenue that exceeds the cost of goods sold (COGS), providing insights into production efficiency and pricing strategies. A higher gross profit margin indicates effective cost management and pricing power. Operating profit margin takes this analysis further by considering operating expenses in addition to COGS.

This metric reveals how well a company controls its operating costs while generating revenue from core business activities. Net profit margin, which accounts for all expenses including taxes and interest, provides the most comprehensive view of profitability. A consistent increase in net profit margin over time can signal effective management practices and strong market positioning.

By evaluating these profitability metrics, stakeholders can identify trends and make informed decisions regarding resource allocation and strategic initiatives.

Assessing Liquidity and Solvency

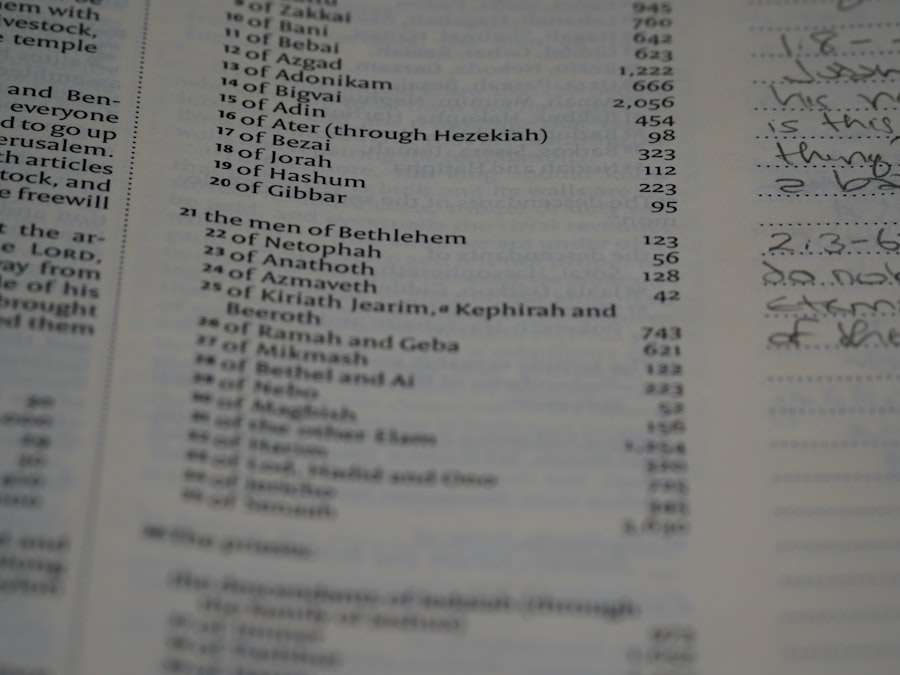

| Report Type | Frequency | Key Metrics | Purpose |

|---|---|---|---|

| Balance Sheet | Monthly/Quarterly/Annually | Assets, Liabilities, Equity | Shows financial position at a point in time |

| Income Statement | Monthly/Quarterly/Annually | Revenue, Expenses, Net Income | Measures profitability over a period |

| Cash Flow Statement | Monthly/Quarterly/Annually | Operating, Investing, Financing Cash Flows | Tracks cash inflows and outflows |

| Accounts Receivable Aging | Monthly | Outstanding Invoices, Days Outstanding | Monitors customer payment status |

| Accounts Payable Aging | Monthly | Outstanding Bills, Days Outstanding | Tracks company’s payment obligations |

| Budget vs Actual | Monthly/Quarterly | Budgeted Amounts, Actual Amounts, Variance | Compares planned vs actual financial performance |

Liquidity and solvency are critical aspects of financial performance that reflect a company’s ability to meet its short-term and long-term obligations. Liquidity refers to the availability of cash or easily convertible assets to cover immediate liabilities. Key metrics for assessing liquidity include the current ratio and quick ratio.

The quick ratio is particularly useful as it excludes inventory from current assets, providing a more stringent measure of liquidity. A company with a quick ratio above one is generally considered capable of meeting its short-term obligations without relying on inventory sales. Solvency, on the other hand, pertains to a company’s ability to meet its long-term obligations and sustain operations over time.

The debt-to-equity ratio is instrumental in evaluating solvency by comparing total liabilities to shareholders’ equity. A lower debt-to-equity ratio indicates that a company relies less on borrowed funds for financing its operations, which can be advantageous during economic downturns when cash flow may be constrained. Additionally, interest coverage ratio—a measure of how easily a company can pay interest on outstanding debt—provides further insights into solvency.

A higher interest coverage ratio suggests that the company generates sufficient earnings to cover interest expenses comfortably.

Analyzing Efficiency and Asset Management

Efficiency in asset management is vital for maximizing returns on investments and ensuring optimal utilization of resources within an organization. Key metrics such as asset turnover ratio and inventory turnover ratio are employed to assess how effectively a company utilizes its assets to generate revenue. The asset turnover ratio measures the efficiency with which a company uses its total assets to produce sales revenue.

A higher asset turnover ratio indicates that the company is effectively leveraging its assets to generate sales. Inventory turnover ratio is another critical metric that evaluates how quickly inventory is sold and replaced over a specific period. A high inventory turnover ratio suggests strong sales performance and effective inventory management practices, while a low ratio may indicate overstocking or weak demand for products.

By analyzing these efficiency metrics, businesses can identify areas for improvement in their operations and make strategic decisions regarding inventory management and asset allocation.

Interpreting Cash Flow Statements

The cash flow statement is an essential tool for understanding the liquidity position of an organization by detailing how cash flows in and out during a specific period. It categorizes cash flows into three main activities: operating, investing, and financing activities. Operating cash flow reflects cash generated from core business operations and is crucial for assessing whether a company can sustain its day-to-day activities without relying on external financing.

Investing cash flow provides insights into how much cash is being spent on capital expenditures or investments in long-term assets such as property or equipment. Positive investing cash flow may indicate that a company is expanding its operations or investing in growth opportunities. Financing cash flow details cash transactions related to borrowing or repaying debt and issuing or repurchasing stock.

Analyzing these components allows stakeholders to understand how effectively a company manages its cash resources and whether it can fund future growth initiatives while maintaining liquidity.

Using Accounting Reports to Make Informed Business Decisions

The ultimate goal of financial performance analysis is to empower stakeholders with the information needed to make informed business decisions. By leveraging insights from accounting reports and financial ratios, management can identify strengths and weaknesses within the organization and develop strategies that align with overall business objectives. For instance, if profitability metrics indicate declining margins, management may choose to reevaluate pricing strategies or explore cost-cutting measures.

Investors can also utilize this information to assess potential investment opportunities or determine whether to divest from underperforming assets. Creditors rely on financial performance analysis to evaluate creditworthiness before extending loans or credit lines. In this way, accounting reports serve as vital tools for decision-making across various stakeholders within an organization.

By fostering a culture of data-driven decision-making based on thorough financial analysis, companies can enhance their strategic planning processes and ultimately drive sustainable growth in an increasingly competitive marketplace.