Understanding the current financial situation of a business is the cornerstone of effective financial management. This assessment involves a thorough examination of income statements, balance sheets, and cash flow statements to gain insights into the financial health of the organization. For instance, analyzing the income statement can reveal trends in revenue generation, allowing business owners to identify peak sales periods and areas where sales may be lagging.

Additionally, reviewing the balance sheet provides a snapshot of assets, liabilities, and equity, which is crucial for understanding the company’s solvency and liquidity. Cash flow statements are equally important, as they illustrate how cash is generated and spent over a specific period, highlighting any potential cash shortages that could impact operations. Moreover, it is essential to compare current financial metrics against industry benchmarks.

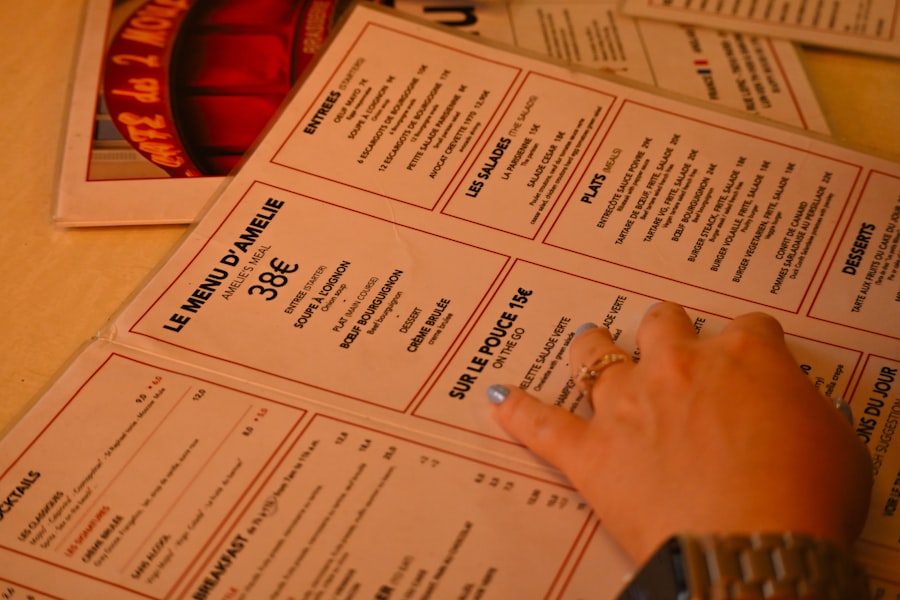

This comparison can help identify whether a business is performing at, above, or below industry standards. For example, if a restaurant’s food cost percentage is significantly higher than the industry average, it may indicate inefficiencies in purchasing or waste management. Similarly, examining labor costs in relation to sales can provide insights into staffing efficiency.

By conducting a comprehensive financial assessment, business owners can pinpoint strengths and weaknesses in their financial performance, laying the groundwork for informed decision-making in subsequent steps.

Key Takeaways

- Evaluate your current finances to understand your starting point.

- Set achievable budget goals aligned with your business objectives.

- Focus on improving key areas like marketing, staff training, and technology.

- Allocate funds strategically to marketing, staff development, and equipment upgrades.

- Continuously monitor your budget and make adjustments to stay on track.

Setting Realistic Budget Goals

Once the current financial situation has been assessed, the next step is to set realistic budget goals that align with the overall business strategy. Budget goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, a restaurant might set a goal to increase monthly revenue by 10% over the next quarter by implementing targeted marketing campaigns and enhancing customer service.

This goal is not only quantifiable but also time-sensitive, providing a clear framework for measuring success. In addition to revenue goals, it is crucial to establish budgetary limits for various expense categories. This includes fixed costs such as rent and utilities, as well as variable costs like food supplies and labor.

By setting these limits, businesses can ensure that they do not overspend in any area, which could jeopardize their financial stability. For example, if a café sets a budget for food costs at 30% of total sales, it can monitor its spending closely to avoid exceeding this threshold. This disciplined approach to budgeting fosters accountability and encourages staff to be mindful of expenses.

Identifying Areas for Improvement

Identifying areas for improvement is a critical step in enhancing financial performance. This process often involves conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to gain a comprehensive understanding of internal and external factors affecting the business. For instance, a restaurant may recognize that its strengths lie in its unique menu offerings and loyal customer base but may also identify weaknesses such as high employee turnover or outdated technology that hampers efficiency.

Opportunities for improvement can often be found by analyzing customer feedback and market trends. For example, if customers express a desire for healthier menu options or more sustainable sourcing practices, the restaurant can capitalize on these insights by adjusting its offerings accordingly. Additionally, examining competitors can reveal gaps in the market that the business can exploit.

If a nearby café has recently closed down due to poor management practices, this could present an opportunity for the restaurant to attract new customers by emphasizing superior service and quality.

Allocating Funds for Marketing and Advertising

Effective marketing and advertising are essential for driving sales and attracting new customers. Allocating funds for these activities requires careful consideration of both traditional and digital marketing strategies. For instance, a restaurant might allocate a portion of its budget to social media advertising, targeting specific demographics based on location and interests.

This approach allows for precise targeting and can yield high returns on investment when executed correctly. In addition to digital marketing efforts, businesses should not overlook the value of local advertising and community engagement. Sponsoring local events or collaborating with nearby businesses can enhance visibility and foster goodwill within the community.

For example, a restaurant could partner with a local farmer’s market to promote farm-to-table initiatives while simultaneously increasing foot traffic to its establishment. By diversifying marketing efforts and allocating funds strategically, businesses can create a robust marketing plan that resonates with their target audience.

Investing in Staff Training and Development

| Category | Estimated Cost | Percentage of Total Budget |

|---|---|---|

| Rent | 3000 | 25% |

| Equipment | 5000 | 41.7% |

| Staff Salaries | 2500 | 20.8% |

| Food Supplies | 1000 | 8.3% |

| Marketing | 500 | 4.2% |

Investing in staff training and development is crucial for maintaining high service standards and operational efficiency. A well-trained staff not only enhances customer satisfaction but also contributes to a positive work environment that can reduce turnover rates. For instance, implementing regular training sessions on customer service best practices can empower employees to handle various situations effectively, leading to improved customer experiences.

Moreover, ongoing professional development opportunities can motivate employees to grow within the organization. Offering workshops on culinary skills or management training can help staff feel valued and invested in their roles. For example, a restaurant might provide culinary classes led by renowned chefs or enroll managers in leadership programs to enhance their skills.

Such investments not only improve employee morale but also translate into better service quality and operational performance.

Upgrading Equipment and Technology

Upgrading equipment and technology is another vital aspect of improving operational efficiency and enhancing customer experience. Outdated equipment can lead to increased downtime and higher maintenance costs, ultimately affecting profitability. For instance, a restaurant with an old oven may experience inconsistent cooking results, leading to customer dissatisfaction and potential loss of repeat business.

Investing in modern technology can streamline operations significantly. Point-of-sale (POS) systems equipped with inventory management features can help track sales trends and manage stock levels more effectively. Additionally, implementing online ordering systems can cater to the growing demand for convenience among customers.

A restaurant that adopts such technology not only improves operational efficiency but also enhances customer satisfaction by providing seamless service options.

Redesigning Menu and Food Offerings

Redesigning the menu and food offerings is an essential strategy for attracting new customers and retaining existing ones. A well-curated menu should reflect current food trends while also catering to the preferences of the target audience. For example, incorporating plant-based options into the menu can appeal to health-conscious consumers and those following vegetarian or vegan diets.

Furthermore, seasonal menu changes can create excitement among customers and encourage repeat visits. A restaurant might introduce limited-time offerings based on local ingredients or seasonal themes, enticing customers to try new dishes before they disappear from the menu. Additionally, analyzing sales data can help identify which items are underperforming and should be removed or revamped.

By continuously evolving the menu based on customer preferences and market trends, businesses can maintain relevance in a competitive landscape.

Monitoring and Adjusting Budget as Needed

Finally, monitoring and adjusting the budget as needed is crucial for maintaining financial health over time. Regularly reviewing financial performance against budgeted goals allows businesses to identify discrepancies early on and make necessary adjustments. For instance, if a restaurant notices that food costs are consistently exceeding budgeted amounts due to rising ingredient prices, it may need to reevaluate its sourcing strategies or adjust menu pricing accordingly.

Additionally, establishing key performance indicators (KPIs) can provide valuable insights into various aspects of the business’s financial performance. Metrics such as average check size, table turnover rate, and labor cost percentage can help identify areas that require attention or adjustment. By fostering a culture of continuous improvement and being willing to adapt strategies based on real-time data, businesses can navigate challenges effectively while positioning themselves for long-term success in an ever-evolving market landscape.