UBS Accounting Software is a financial management solution developed by UBS Corporation for businesses of various sizes, from small enterprises to large corporations. The software aims to streamline accounting processes and make financial management accessible to users with different levels of accounting expertise. The software features a user-friendly interface and provides comprehensive tools for managing financial data, maintaining regulatory compliance, and supporting business decision-making.

Key functionalities include automation of routine accounting tasks and enhanced accuracy in financial reporting. Modern businesses require accounting solutions that can adapt to evolving operational demands and regulatory requirements. UBS Accounting Software addresses these needs by offering integration capabilities with existing business workflows and systems.

The platform is designed to help organizations modernize their financial management processes while maintaining accuracy and compliance standards. The software serves as a digital solution for companies seeking to transition from manual accounting methods or upgrade their existing financial management systems. It provides standardized accounting procedures while offering customization options to meet specific business requirements.

Key Takeaways

- UBS Accounting Software offers comprehensive tools for efficient financial management.

- Key features include automation, real-time reporting, and seamless integration with other financial tools.

- The software helps businesses streamline finances, improve accuracy, and save time.

- Practical tips and case studies demonstrate successful implementation and benefits.

- UBS Accounting Software represents a forward-looking solution for modern financial management.

Features and Benefits of UBS Accounting Software

One of the standout features of UBS Accounting Software is its comprehensive suite of tools designed to handle various aspects of financial management. The software includes modules for general ledger management, accounts payable and receivable, payroll processing, and inventory control. This modular approach allows businesses to select the functionalities that best meet their needs while ensuring that all critical accounting processes are covered.

For instance, the general ledger module provides a centralized repository for all financial transactions, enabling users to generate accurate financial statements with ease. In addition to its extensive feature set, UBS Accounting Software offers significant benefits that enhance operational efficiency. One such benefit is the automation of repetitive tasks, such as invoice generation and payment reminders.

By reducing the manual workload associated with these tasks, businesses can allocate resources more effectively and focus on strategic initiatives rather than administrative duties. Furthermore, the software’s real-time reporting capabilities empower users to access up-to-date financial information at any time, facilitating timely decision-making and improving overall financial visibility.

How UBS Accounting Software Can Help You Manage Your Finances

Managing finances effectively is crucial for any business aiming for sustainability and growth. UBS Accounting Software plays a pivotal role in this regard by providing tools that streamline financial processes and enhance accuracy. For example, the software’s budgeting and forecasting features allow businesses to set financial goals and track their progress against these targets.

By analyzing historical data and trends, users can make informed predictions about future performance, enabling proactive adjustments to their financial strategies. Moreover, UBS Accounting Software supports compliance with regulatory requirements by automating tax calculations and generating necessary reports. This feature is particularly beneficial for businesses operating in jurisdictions with complex tax regulations.

By ensuring that all financial records are accurate and up-to-date, the software minimizes the risk of errors that could lead to costly penalties or audits. Additionally, the ability to generate customized reports tailored to specific business needs further enhances financial management capabilities, allowing stakeholders to gain insights into key performance indicators.

Streamlining Your Business Finances with UBS Accounting Software

The process of streamlining business finances is essential for improving efficiency and reducing operational costs. UBS Accounting Software facilitates this by integrating various financial functions into a single platform. This integration eliminates the need for disparate systems that can lead to data silos and inconsistencies in financial reporting.

For instance, when a sale is made, the software automatically updates inventory levels, records the transaction in the general ledger, and generates an invoice—all without requiring manual intervention. Additionally, UBS Accounting Software enhances collaboration among team members by providing a centralized platform for financial data. Multiple users can access the system simultaneously, allowing for real-time updates and communication regarding financial matters.

This collaborative environment fosters transparency and accountability within the organization, as team members can easily track changes and contributions related to financial activities. By streamlining these processes, businesses can achieve greater operational efficiency and reduce the time spent on financial management tasks.

Integrating UBS Accounting Software with Other Financial Tools

| Feature | Description | Supported Platforms | Key Metrics | Target Users |

|---|---|---|---|---|

| General Ledger | Core accounting module for managing financial transactions and balances | Windows, Web | Supports multi-currency, real-time posting | Small to Medium Businesses |

| Accounts Payable | Manages vendor invoices, payments, and due dates | Windows, Web | Automated payment scheduling, vendor management | SMBs, Enterprises |

| Accounts Receivable | Tracks customer invoices, payments, and aging reports | Windows, Web | Invoice automation, credit management | SMBs, Enterprises |

| Inventory Management | Monitors stock levels, orders, and warehouse management | Windows | Real-time inventory tracking, reorder alerts | Retail, Wholesale |

| Financial Reporting | Generates balance sheets, profit & loss, and cash flow statements | Windows, Web | Customizable reports, export options | Accountants, Business Owners |

| Tax Management | Calculates and files tax returns compliant with local regulations | Windows | Automated tax calculations, compliance updates | Businesses in regulated markets |

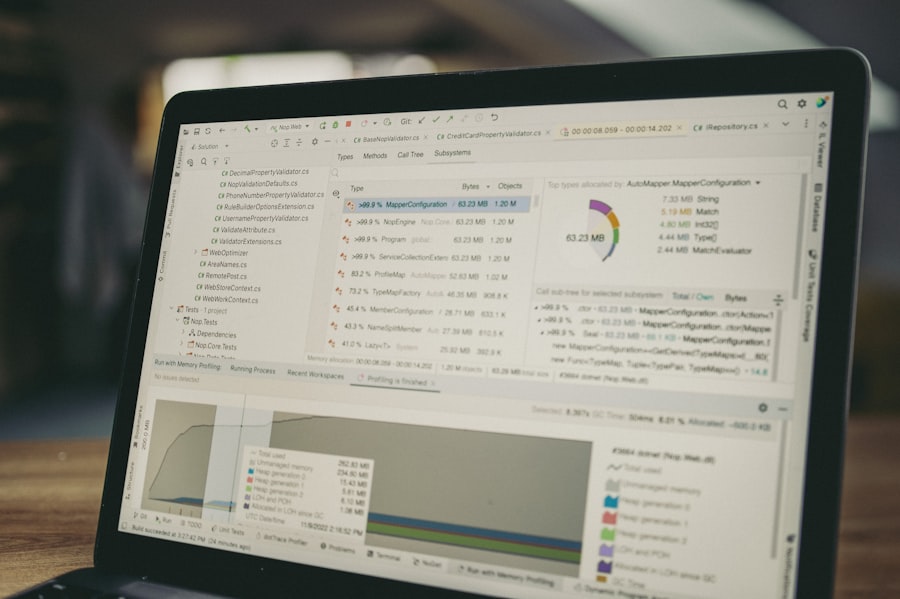

In today’s interconnected digital landscape, the ability to integrate accounting software with other financial tools is paramount for maximizing efficiency. UBS Accounting Software offers compatibility with various third-party applications, enabling businesses to create a cohesive financial ecosystem. For example, integration with customer relationship management (CRM) systems allows for seamless data transfer between sales and accounting functions.

This ensures that customer transactions are accurately reflected in financial records without requiring duplicate data entry. Furthermore, UBS Accounting Software can be integrated with banking platforms to facilitate direct bank reconciliation. This feature simplifies the process of matching transactions recorded in the software with those appearing on bank statements, significantly reducing the time spent on reconciliation tasks.

By leveraging these integrations, businesses can enhance their overall financial management capabilities while minimizing errors associated with manual data entry.

Tips for Getting the Most Out of UBS Accounting Software

To fully leverage the capabilities of UBS Accounting Software, users should consider several best practices that can enhance their experience and improve outcomes. First and foremost, investing time in training is essential. While the software is designed to be user-friendly, understanding its full range of features requires familiarity with its functionalities.

Organizations should provide comprehensive training sessions for employees to ensure they are equipped to utilize the software effectively. Another important tip is to regularly review and update financial processes within the software. As businesses evolve, their financial needs may change; therefore, it is crucial to adapt the software settings accordingly.

This may involve customizing reports or adjusting workflows to align with new business objectives. Additionally, taking advantage of customer support resources offered by UBS can help users troubleshoot issues quickly and gain insights into best practices from experienced professionals.

Case Studies: How Businesses Have Successfully Streamlined Their Finances with UBS Accounting Software

Numerous businesses have successfully implemented UBS Accounting Software to streamline their financial operations and achieve significant improvements in efficiency. For instance, a mid-sized manufacturing company faced challenges in managing its inventory and tracking expenses across multiple departments. After adopting UBS Accounting Software, the company was able to integrate its inventory management with accounting functions seamlessly.

This integration allowed for real-time tracking of inventory levels and automated updates to financial records whenever stock was sold or replenished. Another case study involves a small retail business that struggled with manual bookkeeping processes that were prone to errors and time-consuming reconciliations. By transitioning to UBS Accounting Software, the retailer automated invoicing and payment processing, which not only reduced administrative burdens but also improved cash flow management.

The ability to generate detailed sales reports enabled the business owner to make informed decisions about inventory purchases and marketing strategies based on actual sales performance.

The Future of Financial Management with UBS Accounting Software

As businesses continue to navigate an increasingly complex financial landscape, tools like UBS Accounting Software will play a crucial role in shaping the future of financial management. The ongoing advancements in technology promise even greater integration capabilities, enhanced automation features, and improved user experiences. As organizations seek to optimize their operations and drive growth, embracing innovative solutions like UBS will be essential for staying competitive in a rapidly evolving marketplace.

The future of financial management will likely see an increased emphasis on data analytics and real-time reporting capabilities within accounting software. As businesses strive for greater transparency and accountability in their financial practices, tools that provide actionable insights will become indispensable. With its commitment to continuous improvement and adaptation to market needs, UBS Accounting Software is well-positioned to lead the way in transforming how organizations manage their finances effectively in the years to come.