Tax filing services encompass professional and technological solutions that help individuals and businesses prepare and submit tax returns to government agencies. These services span from automated online platforms that provide step-by-step guidance to full-service offerings from certified public accountants (CPAs) and licensed tax preparers who deliver customized consultation and support. The fundamental objective is to ensure adherence to tax regulations while identifying all eligible deductions and credits to optimize the client’s tax position.

The tax preparation industry has undergone substantial transformation, driven primarily by technological advancement. Digital solutions have largely replaced traditional paper-based methods and manual calculations. Contemporary tax filing services typically feature intuitive software that enables clients to enter financial data, performs automatic tax calculations, and facilitates electronic filing for expedited processing.

This technological evolution has improved operational efficiency and significantly reduced computational errors associated with manual data handling.

Key Takeaways

- Professional tax filing services simplify the complex tax preparation process.

- Hiring experts can maximize deductions and ensure accurate filings.

- Key factors in choosing a service include reputation, cost, and expertise.

- Local services can be found through online searches and personal recommendations.

- Asking the right questions helps ensure you select a trustworthy and competent tax filer.

The Benefits of Hiring a Professional Tax Filing Service

Engaging a professional tax filing service can yield numerous advantages, particularly for those with complex financial situations. One of the most significant benefits is the expertise that these professionals bring to the table. Tax laws are notoriously intricate and subject to frequent changes, making it challenging for individuals to stay informed about the latest regulations.

A qualified tax professional possesses a deep understanding of these laws and can navigate them effectively, ensuring that clients remain compliant while taking advantage of all available deductions and credits. Moreover, hiring a professional service can save clients considerable time and stress. The tax filing process can be daunting, especially for those who are unfamiliar with the necessary forms and documentation.

By outsourcing this task to a knowledgeable expert, individuals can focus on their personal or business responsibilities without the added burden of tax preparation. Additionally, many tax professionals offer year-round support, providing clients with guidance on tax planning strategies that can lead to more favorable outcomes in future tax years.

Factors to Consider When Choosing a Tax Filing Service

When selecting a tax filing service, several critical factors should be taken into account to ensure that clients receive the best possible support for their unique needs. First and foremost, it is essential to evaluate the qualifications and experience of the professionals involved. Clients should look for services staffed by certified public accountants or enrolled agents who have demonstrated expertise in tax preparation and planning.

This level of qualification often indicates a higher standard of service and a greater ability to handle complex tax situations. Another important consideration is the range of services offered by the provider. Some firms may specialize in specific areas, such as individual tax returns or business taxes, while others may provide a broader array of services, including bookkeeping, financial planning, and audit representation.

Clients should assess their own needs and choose a service that aligns with their requirements. Additionally, it is wise to inquire about the technology used by the firm; modern software solutions can enhance accuracy and efficiency in the tax preparation process.

How to Find Tax Filing Services Near You

Finding reputable tax filing services in your local area can be accomplished through various methods. One effective approach is to seek recommendations from friends, family members, or colleagues who have had positive experiences with tax professionals. Personal referrals often provide valuable insights into the quality of service and expertise offered by specific providers.

In addition to word-of-mouth recommendations, online resources can be instrumental in identifying local tax filing services. Websites such as Yelp or Google Reviews allow users to read reviews and ratings from previous clients, offering a glimpse into the experiences others have had with particular firms. Furthermore, professional organizations such as the American Institute of CPAs (AICPA) or the National Association of Enrolled Agents (NAEA) maintain directories of qualified professionals that can be filtered by location.

Comparing Different Tax Filing Services

| Service Provider | Location | Average Cost | Turnaround Time | Customer Rating (out of 5) | Services Offered |

|---|---|---|---|---|---|

| QuickTax Solutions | Downtown | 150 | 2 days | 4.5 | Individual, Business, E-filing |

| Reliable Tax Pros | Midtown | 120 | 3 days | 4.2 | Individual, Small Business, Audit Support |

| Express Tax Services | Uptown | 100 | 1 day | 4.0 | Individual, E-filing, Tax Consultation |

| TaxEase Professionals | Suburbs | 130 | 2-3 days | 4.3 | Individual, Business, Tax Planning |

| Budget Tax Help | Downtown | 80 | 4 days | 3.8 | Individual, Basic Filing |

Once potential tax filing services have been identified, it is crucial to compare them based on several key criteria. Pricing is often a primary consideration; however, it is essential to understand what is included in the quoted fees. Some firms may charge a flat rate for standard services, while others may bill hourly or charge additional fees for more complex situations.

Clients should request detailed estimates that outline all potential costs associated with their tax preparation. Another factor to consider is the level of customer service provided by each firm. A responsive and communicative service can make a significant difference in the overall experience.

Prospective clients should assess how accessible the firm is for questions or concerns during the preparation process. Additionally, it may be beneficial to inquire about the firm’s policy on audit support; some providers offer assistance in case of an audit, which can provide peace of mind for clients.

Questions to Ask When Hiring a Tax Filing Service

Before committing to a particular tax filing service, clients should prepare a list of questions to ensure they are making an informed decision. One critical question pertains to the professional’s qualifications: “What credentials do you hold?” Understanding whether the preparer is a CPA, enrolled agent, or simply a tax preparer can provide insight into their level of expertise. Clients should also inquire about the firm’s experience with similar tax situations.

For instance, if an individual has multiple income sources or owns a business, it is essential to confirm that the chosen service has experience handling such complexities. Additionally, asking about the firm’s approach to maximizing deductions and credits can reveal their commitment to providing comprehensive support.

Tips for a Smooth Tax Filing Process

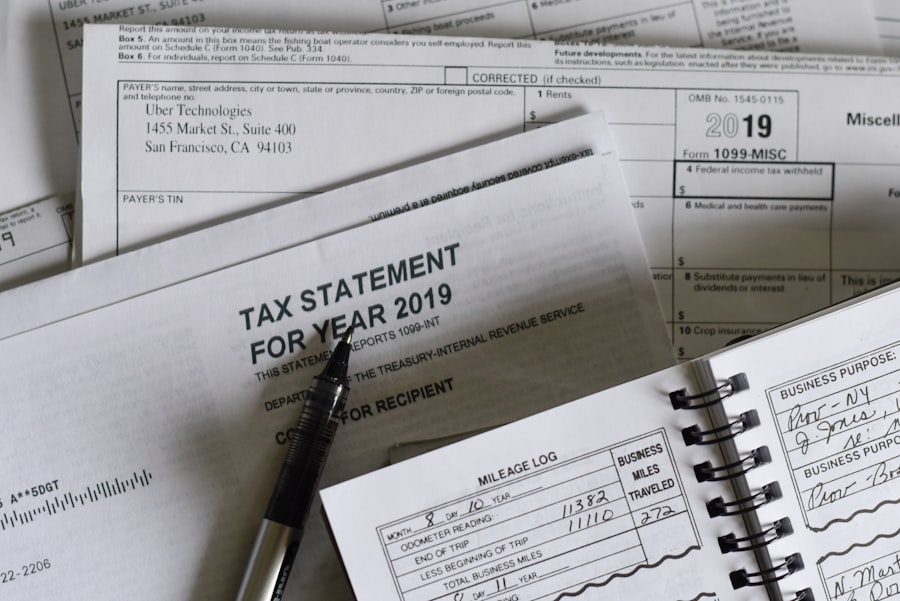

To facilitate a seamless tax filing experience, clients can take several proactive steps before engaging with a tax filing service. First and foremost, gathering all necessary documentation ahead of time is crucial. This includes W-2 forms, 1099s, receipts for deductible expenses, and any other relevant financial records.

Having these documents organized will not only expedite the preparation process but also reduce the likelihood of errors. Communication is another vital aspect of ensuring a smooth process. Clients should feel comfortable discussing their financial situation openly with their tax preparer, as this transparency allows for more accurate assessments and recommendations.

Additionally, staying informed about deadlines and requirements can help clients avoid last-minute scrambles as tax season approaches.

The Importance of Hiring a Reputable Tax Filing Service

The significance of hiring a reputable tax filing service cannot be overstated. A trustworthy provider not only ensures compliance with tax laws but also safeguards clients against potential audits or penalties resulting from errors or omissions on their returns. Moreover, reputable firms often have established relationships with local tax authorities, which can facilitate smoother interactions should any issues arise.

Furthermore, engaging a reputable service can lead to long-term benefits beyond just filing taxes for one year. Many clients develop ongoing relationships with their tax professionals, allowing for continuous support in financial planning and strategy development. This relationship can prove invaluable as clients navigate changes in their financial circumstances or as new tax laws come into effect.

Ultimately, investing in a reputable tax filing service is an investment in peace of mind and financial well-being.