Contractor accounting software has emerged as a vital tool for businesses operating in the construction and contracting sectors. The primary advantage of such software lies in its ability to streamline financial management processes, which can often be complex and time-consuming. For contractors, managing multiple projects simultaneously while keeping track of expenses, invoices, and payments can be overwhelming.

This is where specialized accounting software comes into play, offering tailored solutions that cater specifically to the unique needs of contractors. By automating routine tasks, contractor accounting software not only saves time but also reduces the likelihood of human error, which can lead to costly financial discrepancies. Moreover, contractor accounting software provides enhanced visibility into a company’s financial health.

With real-time data and analytics, contractors can make informed decisions based on accurate financial information. This capability is particularly crucial in an industry where cash flow management is paramount. By having access to up-to-date financial reports, contractors can better forecast their cash flow needs, ensuring they have the necessary funds to cover ongoing project expenses.

Additionally, many software solutions offer features that allow for tracking project profitability, enabling contractors to assess which projects are yielding the best returns and which may require reevaluation or adjustment.

Key Takeaways

- Contractor accounting software enhances financial accuracy and efficiency for construction businesses.

- Key features include invoicing, expense tracking, budgeting, and project management tools.

- Integration with other business systems ensures seamless data flow and operational consistency.

- Compliance features help businesses meet tax and regulatory requirements effortlessly.

- Selecting the right software involves assessing business needs, scalability, and user-friendliness.

Features to Look for in Contractor Accounting Software

When selecting contractor accounting software, it is essential to consider a range of features that will enhance operational efficiency. One of the most critical features is job costing, which allows contractors to track expenses associated with specific projects. This functionality enables businesses to analyze costs in real-time, ensuring that they remain within budget and can adjust their strategies as needed.

Job costing also aids in determining the profitability of individual projects, providing insights that can inform future bidding and project selection. Another important feature is invoicing capabilities. The ability to generate professional invoices quickly and accurately is crucial for maintaining cash flow.

Look for software that allows for customizable invoice templates and automated billing processes. This not only saves time but also ensures that invoices are sent out promptly, reducing the risk of delayed payments. Additionally, integration with payment processing systems can facilitate quicker transactions, allowing contractors to receive payments faster and improve their overall cash flow management.

Streamlining Invoicing and Payment Processes

Invoicing and payment processes are often a significant pain point for contractors, particularly when dealing with multiple clients and projects. Contractor accounting software can significantly streamline these processes by automating various tasks associated with billing. For instance, many software solutions allow users to create recurring invoices for ongoing projects or clients, eliminating the need to manually generate invoices each billing cycle.

This automation not only saves time but also ensures consistency in billing practices. Furthermore, contractor accounting software often includes features that enable electronic payment options. By integrating with payment gateways, contractors can offer clients the convenience of paying online, which can lead to faster payment turnaround times.

This is particularly beneficial in an industry where cash flow is critical; receiving payments promptly can make a substantial difference in a contractor’s ability to manage ongoing expenses and invest in new projects. Additionally, tracking payment statuses within the software provides contractors with a clear overview of outstanding invoices, allowing them to follow up on overdue payments efficiently.

Tracking Expenses and Managing Budgets

Effective expense tracking is essential for contractors who need to maintain tight control over their budgets. Contractor accounting software typically includes robust expense tracking features that allow users to categorize expenses by project or client. This level of detail enables contractors to identify where their money is going and make informed decisions about future spending.

For example, if a particular project consistently exceeds its budget due to unforeseen expenses, contractors can analyze the data to determine whether adjustments are necessary or if they need to revise their bidding strategies for similar projects in the future. In addition to tracking expenses, contractor accounting software often provides budgeting tools that help businesses set financial goals for their projects. By establishing budgets within the software, contractors can monitor their spending against these benchmarks in real-time.

This proactive approach allows for timely adjustments if expenses begin to exceed projections. Moreover, many software solutions offer reporting features that provide insights into budget performance over time, helping contractors refine their budgeting processes and improve overall financial management.

Simplifying Project Management and Reporting

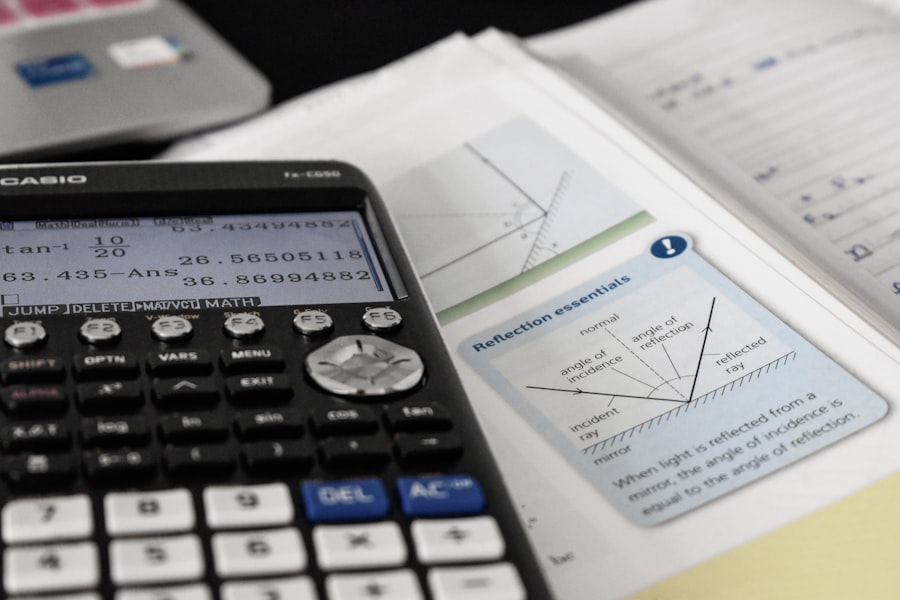

| Feature | Description | Importance for Contractors | Common Metrics | Example Software |

|---|---|---|---|---|

| Job Costing | Tracks expenses and revenues for individual projects | High – essential for profitability analysis | Cost variance, Profit margin per job | QuickBooks Contractor Edition, Sage 100 Contractor |

| Invoicing & Billing | Generates and manages client invoices and payments | High – ensures timely cash flow | Invoice turnaround time, Payment collection rate | FreshBooks, Xero |

| Payroll Management | Manages employee wages, taxes, and compliance | Medium – important for labor cost control | Payroll accuracy, Tax filing compliance rate | Gusto, ADP |

| Change Order Management | Tracks and manages contract changes and approvals | Medium – helps avoid disputes and cost overruns | Number of change orders, Approval time | Procore, Buildertrend |

| Financial Reporting | Generates reports on financial health and project status | High – supports decision making | Cash flow reports, Profit & loss statements | Zoho Books, QuickBooks |

| Integration with Estimating | Links cost estimates with accounting data | Medium – improves accuracy and forecasting | Estimate accuracy, Budget adherence | Buildertrend, CoConstruct |

Project management is a critical aspect of contracting work, and effective accounting software can simplify this process significantly. Many contractor accounting solutions come equipped with project management features that allow users to track project timelines, milestones, and deliverables alongside financial data. This integration ensures that contractors have a comprehensive view of each project’s status, enabling them to make informed decisions about resource allocation and scheduling.

Reporting capabilities are another essential feature of contractor accounting software. The ability to generate detailed reports on project performance, financial health, and overall business metrics is invaluable for contractors looking to assess their operations critically. These reports can provide insights into profitability trends, cash flow patterns, and expense management effectiveness.

By leveraging this data, contractors can identify areas for improvement and develop strategies to enhance their overall business performance.

Integrating with Other Business Systems

In today’s digital landscape, integration with other business systems is crucial for maximizing efficiency and minimizing data silos. Contractor accounting software should seamlessly integrate with other tools used by the business, such as project management software, customer relationship management (CRM) systems, and payroll solutions. This integration allows for a more cohesive workflow where data flows freely between systems without the need for manual entry or reconciliation.

For instance, integrating accounting software with project management tools enables contractors to synchronize project budgets with actual expenses automatically. This real-time data exchange ensures that all team members have access to the most current information regarding project finances, reducing the risk of miscommunication or errors. Additionally, integration with CRM systems can enhance client relationship management by providing insights into billing history and payment statuses, allowing contractors to engage more effectively with their clients.

Ensuring Compliance with Tax and Regulatory Requirements

Navigating tax regulations and compliance requirements can be particularly challenging for contractors due to the complexity of tax laws that vary by region and project type. Contractor accounting software plays a vital role in ensuring compliance by automating tax calculations and generating necessary documentation for reporting purposes. Many software solutions are designed to stay updated with the latest tax regulations, reducing the risk of errors that could lead to penalties or audits.

Moreover, contractor accounting software often includes features that facilitate the generation of tax forms required for various jurisdictions. For example, it may automatically prepare 1099 forms for subcontractors or generate sales tax reports based on project locations. By simplifying these processes, contractors can focus more on their core business activities rather than getting bogged down by administrative tasks related to compliance.

Choosing the Right Contractor Accounting Software for Your Business

Selecting the right contractor accounting software requires careful consideration of several factors tailored to your specific business needs. First and foremost, assess the size and complexity of your operations. Smaller contracting firms may benefit from simpler solutions with essential features like invoicing and expense tracking, while larger organizations may require more comprehensive systems that include advanced project management capabilities and robust reporting tools.

Additionally, consider the scalability of the software you choose. As your business grows or takes on more complex projects, your accounting needs may evolve as well. Opting for a solution that can scale with your business ensures that you won’t need to switch systems frequently as your requirements change.

Furthermore, take advantage of free trials or demos offered by many software providers; this hands-on experience can provide valuable insights into how well a particular solution aligns with your workflow and operational needs. In conclusion, contractor accounting software offers numerous benefits that can significantly enhance financial management within contracting businesses. By understanding its advantages and carefully evaluating features tailored to your specific needs, you can select a solution that streamlines your operations and supports your growth objectives effectively.