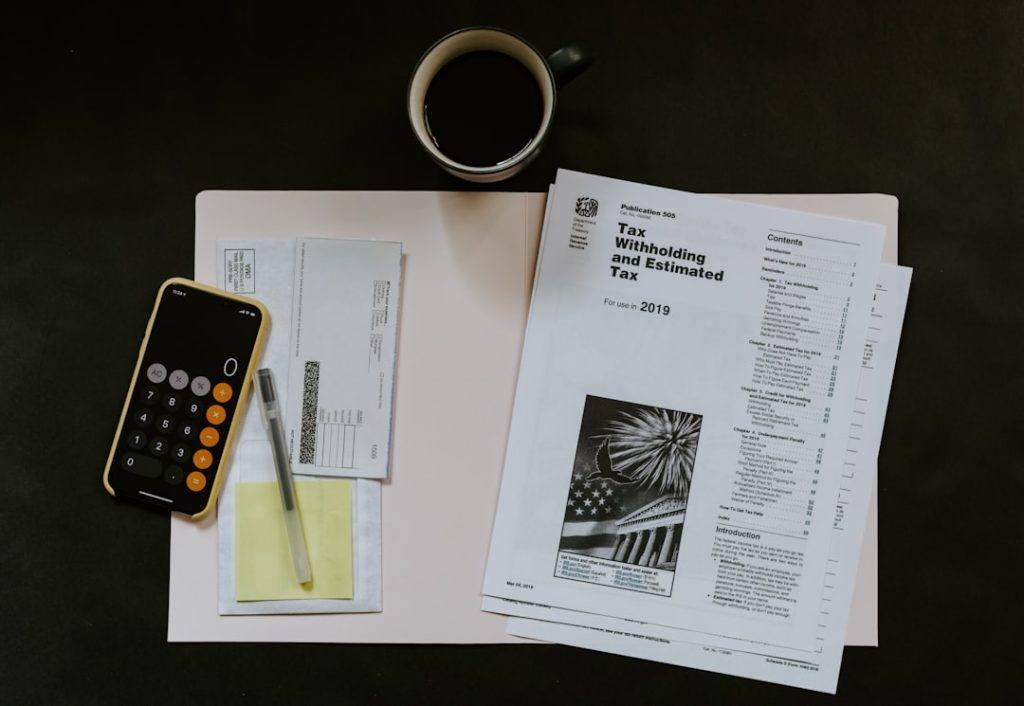

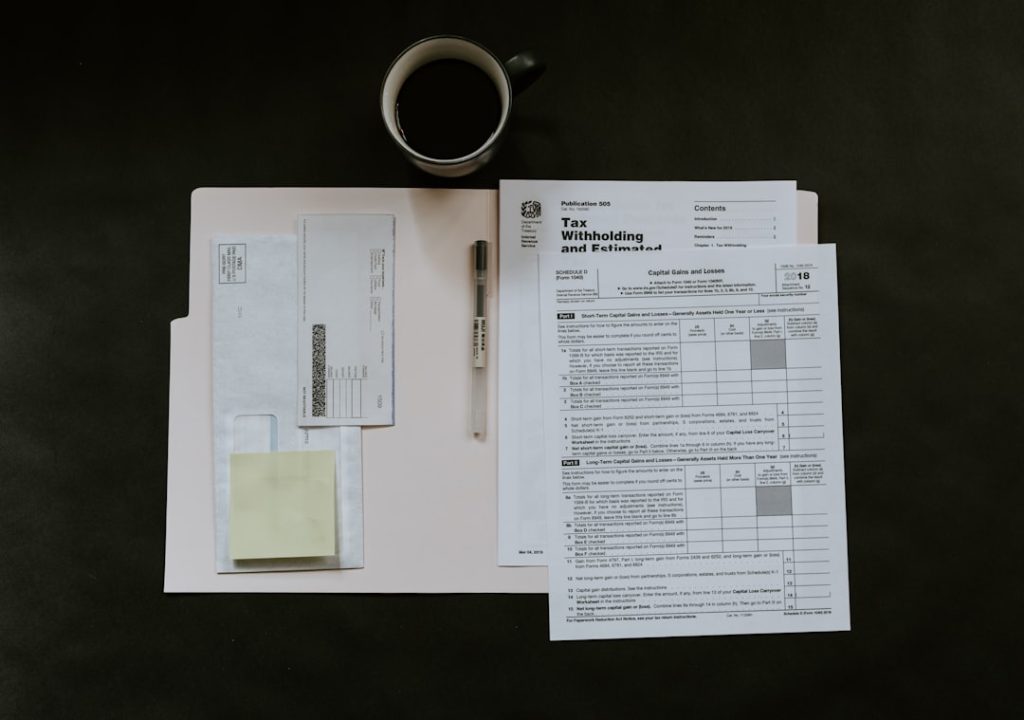

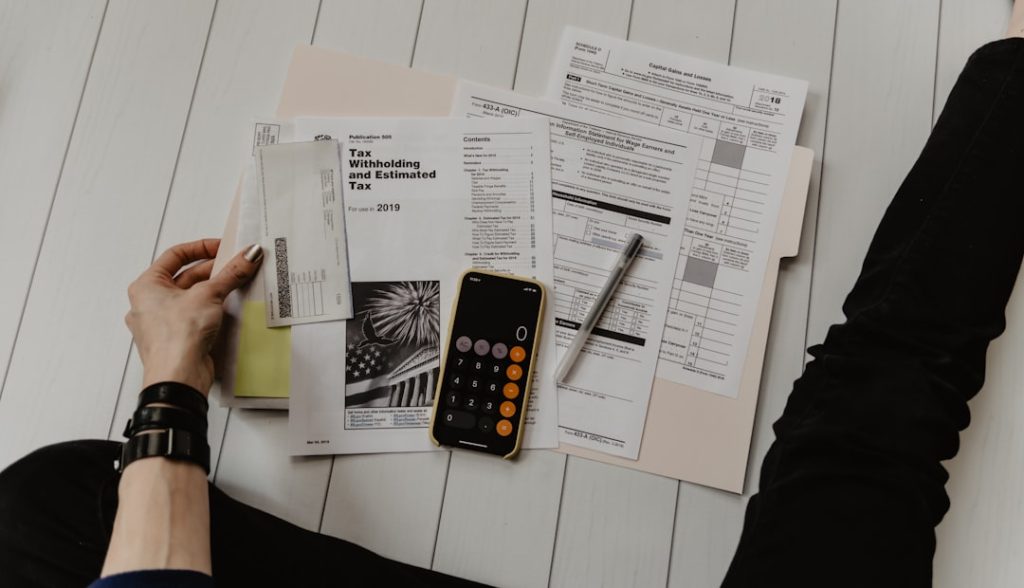

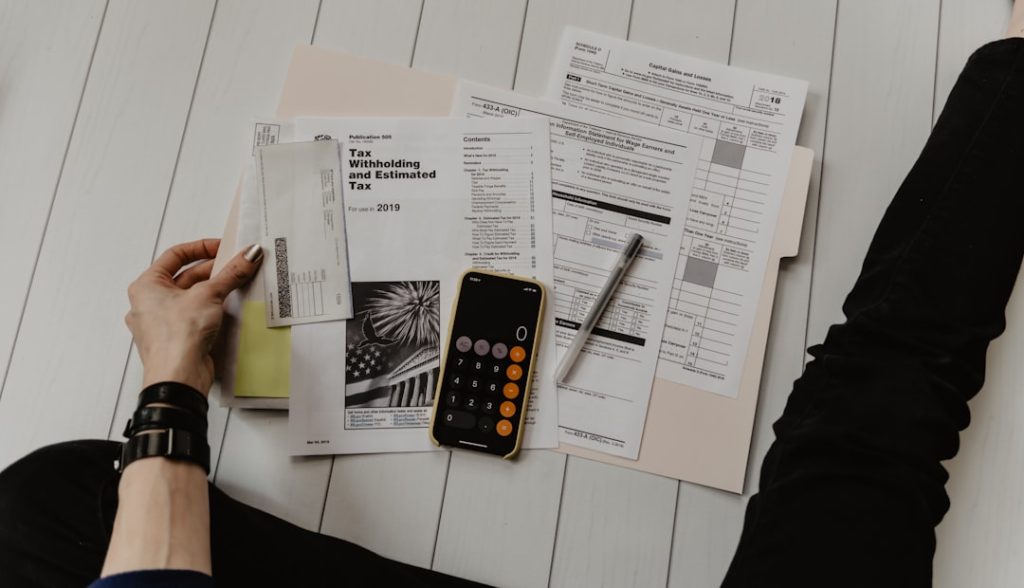

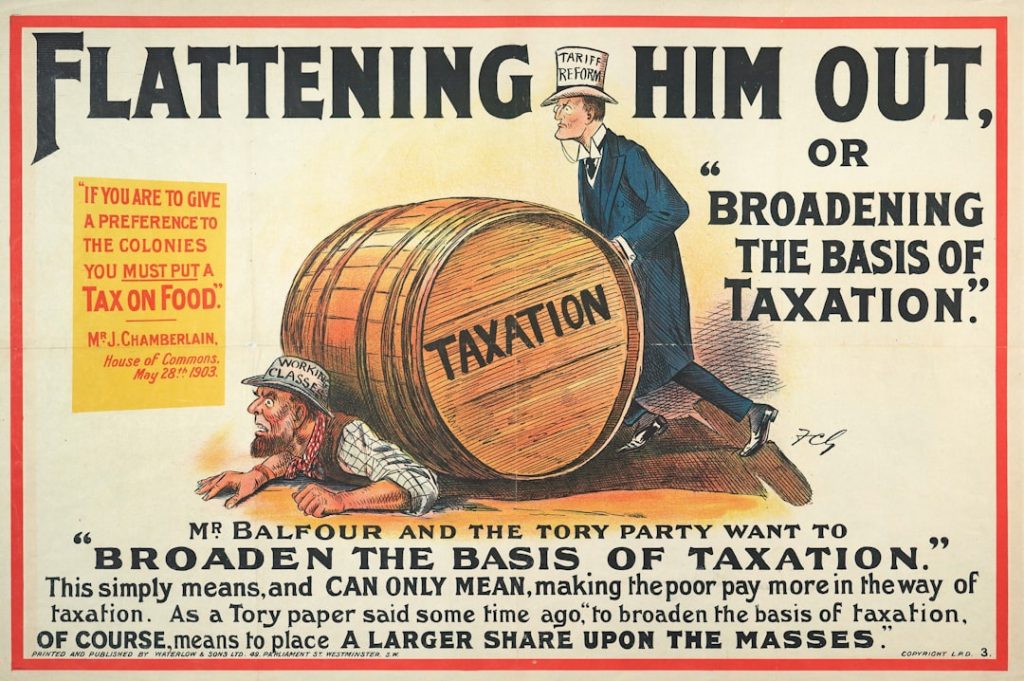

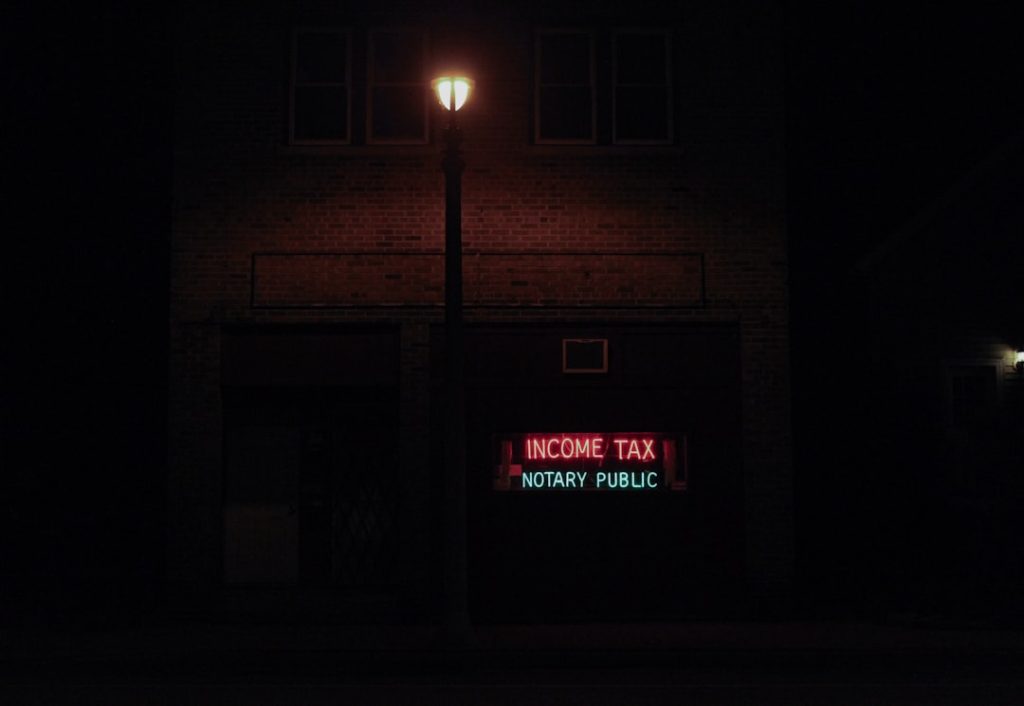

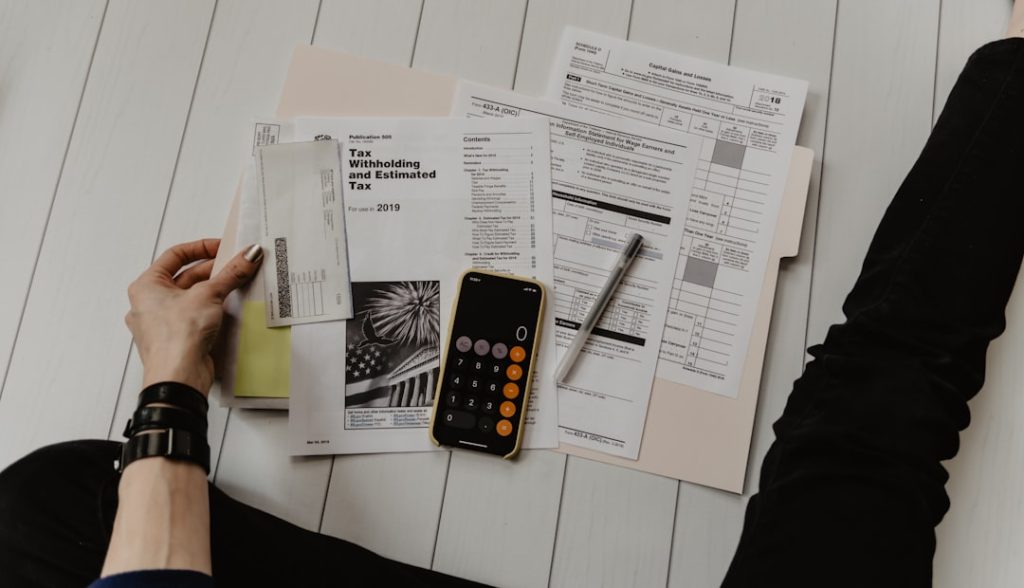

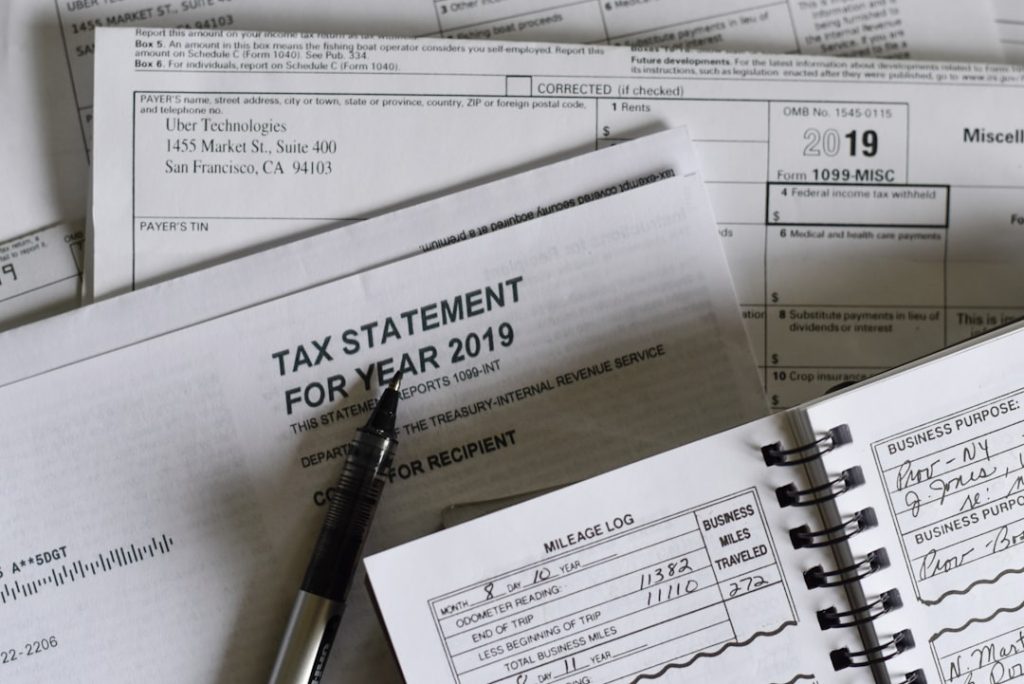

Maximizing Medical Tax Deductions: A Guide for Taxpayers

Medical tax deductions allow taxpayers to reduce their taxable income by deducting qualifying medical expenses that exceed 7.5% of their adjusted gross income (AGI) for the 2023 tax year. Only the amount exceeding this threshold can be deducted from taxable income. The Internal Revenue Service defines deductible medical expenses as costs primarily paid for the […]

Maximizing Medical Tax Deductions: A Guide for Taxpayers Read More »