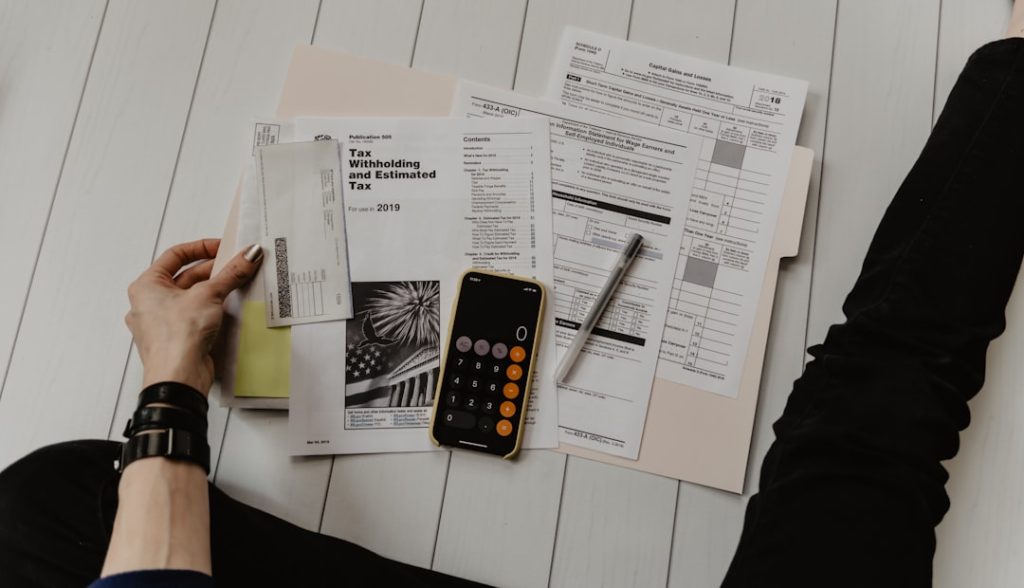

Local Tax Preparers: Your Trusted Tax Experts

In the intricate landscape of tax preparation, local tax preparers play a pivotal role in ensuring that individuals and businesses navigate their financial obligations with accuracy and compliance. Unlike large, impersonal tax preparation firms, local tax preparers offer a personalized touch that can significantly enhance the client experience. They possess an intimate understanding of the […]

Local Tax Preparers: Your Trusted Tax Experts Read More »