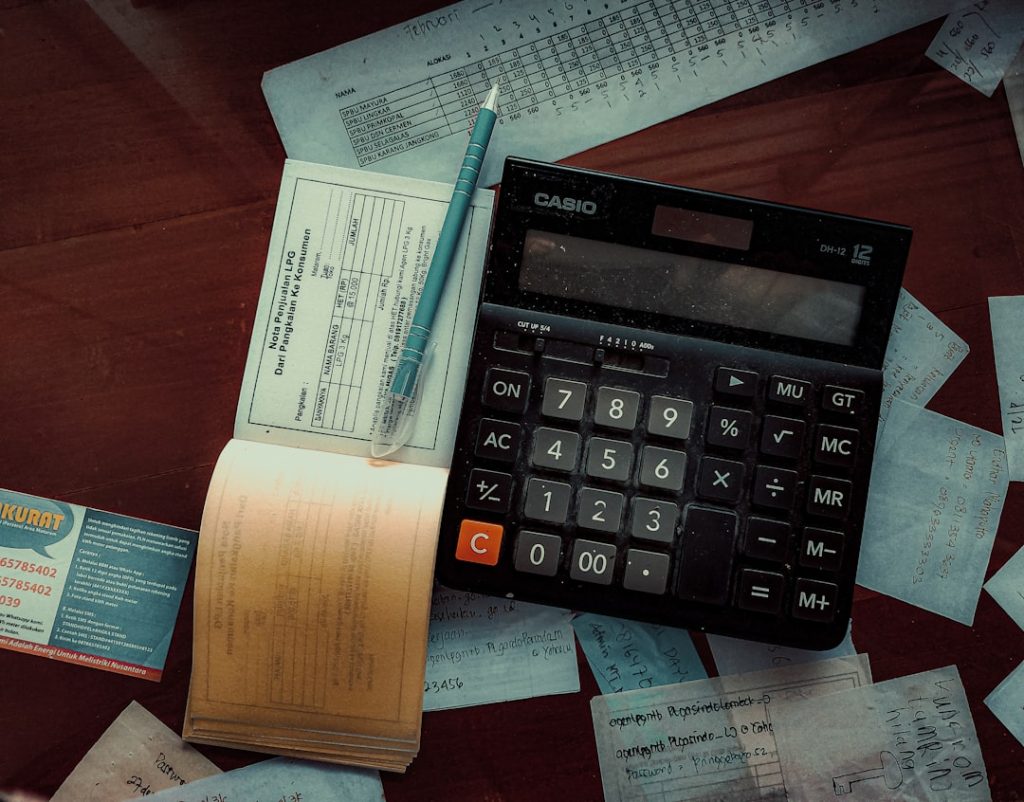

Maximize Your Savings with Section 179 Deduction

The Section 179 Deduction is a tax incentive that allows small businesses to deduct the full purchase price of qualifying equipment and software from their gross income in the year of purchase. Unlike standard depreciation methods that spread deductions across multiple years, this provision of the Internal Revenue Code enables immediate tax relief, improving cash […]

Maximize Your Savings with Section 179 Deduction Read More »