Smart Financial Planning: Tips for a Secure Future

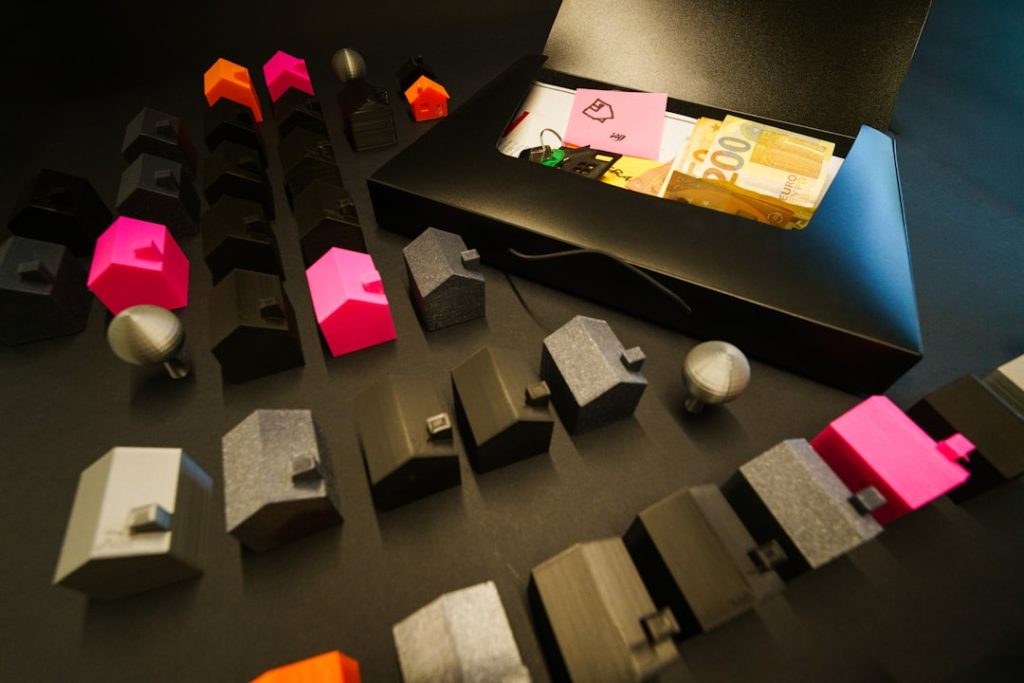

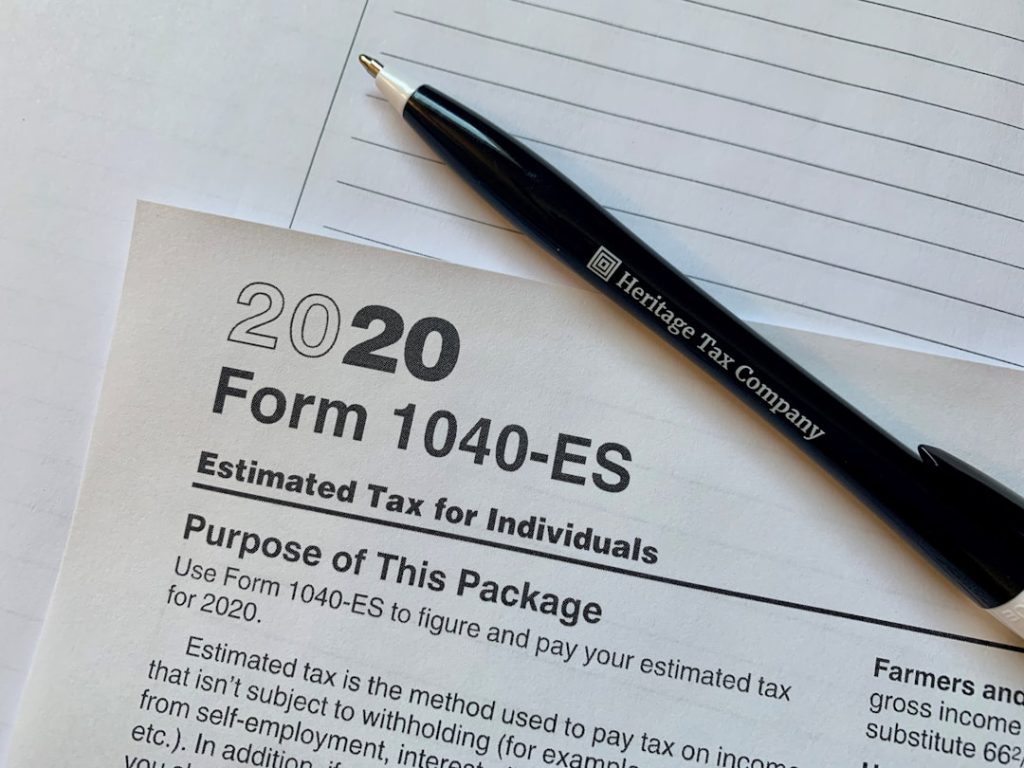

Establishing clear financial goals forms the foundation of successful personal finance management. These goals function as a roadmap, directing individuals toward their intended financial outcomes. To create meaningful objectives, one must first evaluate their current financial position, including income, expenses, debts, and existing savings. This evaluation establishes a baseline for identifying specific targets. For example, […]

Smart Financial Planning: Tips for a Secure Future Read More »