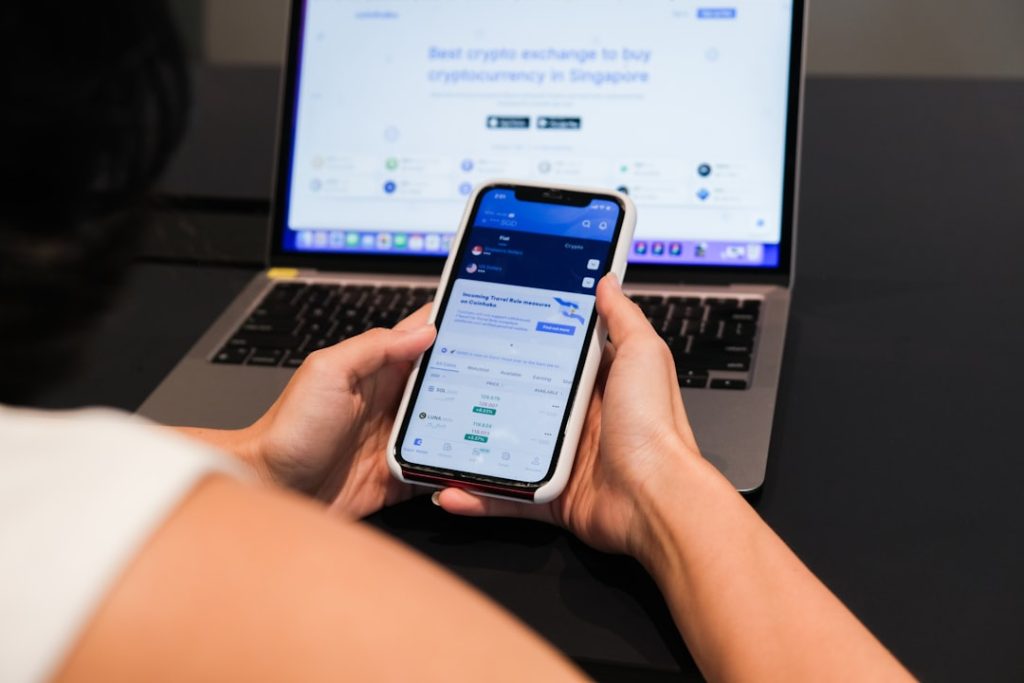

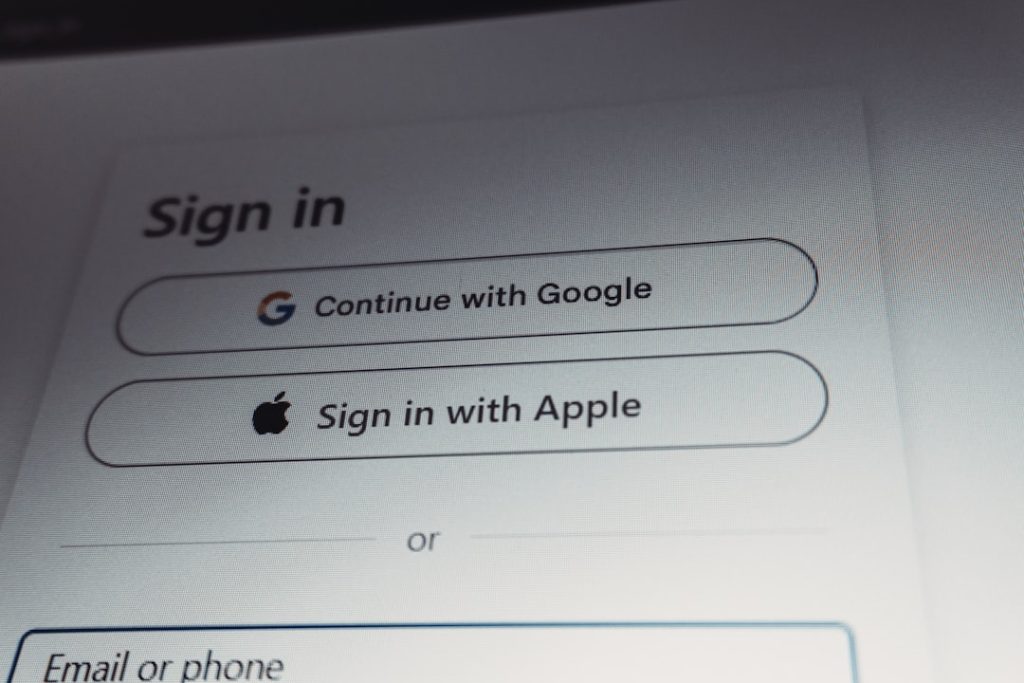

The Big Four: Amazon, Apple, Facebook, Google

In the contemporary landscape of global business, the term “Big Four” typically refers to four colossal entities that have fundamentally reshaped their respective industries and, by extension, the world economy. These companies—Amazon, Apple, Facebook (now Meta Platforms, Inc.), and Google (part of Alphabet Inc.)—have not only achieved remarkable financial success but have also become integral […]

The Big Four: Amazon, Apple, Facebook, Google Read More »