Expense management constitutes a fundamental element of accounting practices and directly impacts organizational financial performance. Systematic tracking, analysis, and control of expenses affects profitability and long-term viability. Organizations that implement comprehensive expense management systems can optimize resource allocation by directing funds toward high-return activities.

This approach improves operational efficiency and establishes clear financial accountability throughout the organization. Through detailed expense analysis, companies can identify inefficient spending patterns and make data-driven decisions that support strategic objectives. Effective expense management also ensures regulatory compliance and reduces financial risk.

Organizations must adhere to various financial reporting regulations that require accurate expense documentation. Inadequate expense controls can result in financial statement errors, potentially leading to regulatory violations and reputational damage. Rigorous expense management systems help organizations meet compliance requirements while providing stakeholders with accurate financial information.

This transparency strengthens relationships with investors, customers, and employees, contributing to overall organizational stability and credibility.

Key Takeaways

- Managing expenses is crucial for accurate accounting and financial health.

- Implementing strategic approaches helps control and reduce unnecessary costs.

- Utilizing modern tools and technologies enhances expense tracking and management.

- Budgeting plays a key role in planning and monitoring expenses effectively.

- Overcoming common challenges and adopting best practices improves overall financial performance.

Strategies for Managing Expenses in Accounting

Implementing effective strategies for managing expenses is vital for any organization aiming to enhance its financial performance. One of the most effective strategies is the establishment of a comprehensive expense policy that outlines acceptable spending practices and procedures for approval. This policy should be communicated clearly to all employees, ensuring that everyone understands the guidelines for incurring expenses.

By setting clear expectations, organizations can minimize unauthorized spending and promote a culture of fiscal responsibility. Another key strategy involves regular monitoring and analysis of expenses. This can be achieved through the use of financial reports that provide insights into spending patterns over time.

By analyzing these reports, organizations can identify trends and anomalies that may indicate areas of concern. For instance, if a particular department consistently exceeds its budget, it may warrant further investigation to understand the underlying causes. Regular reviews not only help in identifying potential issues but also facilitate proactive decision-making, allowing organizations to adjust their spending habits before problems escalate.

Tools and Technologies for Effective Expense Management

The advent of technology has revolutionized the way organizations manage their expenses. Numerous tools and software solutions are available that streamline the expense management process, making it easier for businesses to track and control spending. For example, cloud-based accounting software such as QuickBooks or Xero allows organizations to automate expense tracking, categorize transactions, and generate real-time financial reports.

These tools not only save time but also reduce the likelihood of human error, ensuring greater accuracy in financial reporting. In addition to traditional accounting software, mobile applications have emerged as powerful tools for managing expenses on-the-go. Applications like Expensify or Receipt Bank enable employees to capture receipts and log expenses directly from their smartphones.

This immediacy not only enhances compliance with expense policies but also simplifies the reimbursement process for employees. Furthermore, integrating these applications with existing accounting systems ensures that all data is synchronized, providing a holistic view of an organization’s financial health.

The Role of Budgeting in Expense Management

Budgeting plays a pivotal role in effective expense management by providing a framework for financial planning and control. A well-structured budget serves as a roadmap for an organization’s financial activities, outlining expected revenues and expenditures over a specific period. By establishing clear budgetary limits, organizations can prioritize spending and allocate resources more effectively.

This proactive approach helps prevent overspending and encourages departments to operate within their means. Moreover, budgeting facilitates performance evaluation by establishing benchmarks against which actual performance can be measured. Variance analysis—comparing budgeted figures to actual results—allows organizations to identify discrepancies and understand the reasons behind them.

For instance, if actual expenses exceed budgeted amounts in a particular category, it may indicate inefficiencies or unexpected costs that need to be addressed. This analytical process not only aids in corrective actions but also informs future budgeting decisions, creating a cycle of continuous improvement.

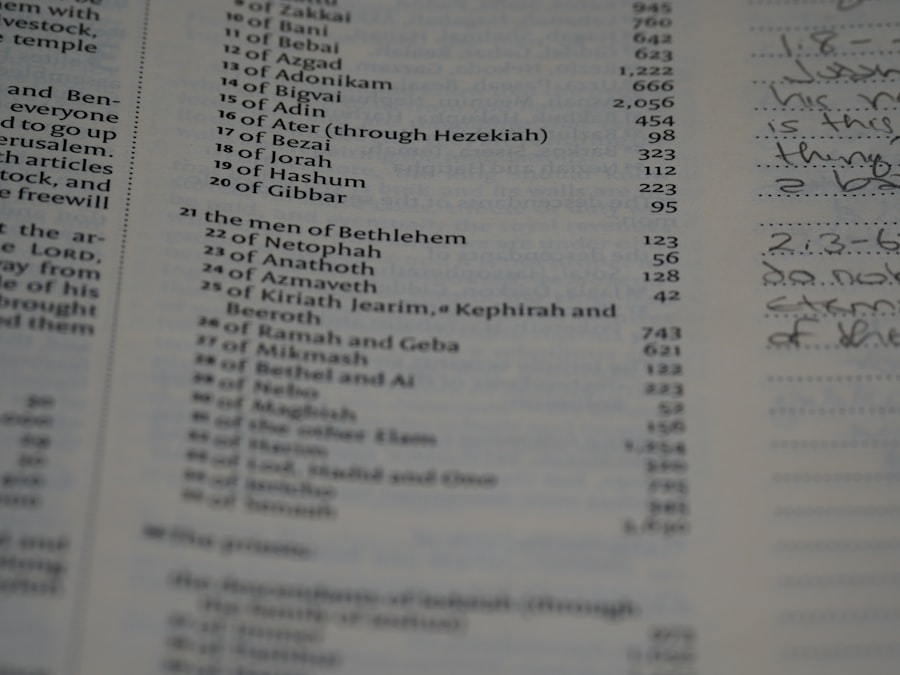

Best Practices for Controlling and Monitoring Expenses

| Expense Category | Monthly Amount | Annual Amount | Percentage of Total Expenses |

|---|---|---|---|

| Rent | 2,000 | 24,000 | 30% |

| Utilities | 300 | 3,600 | 4.5% |

| Salaries | 4,500 | 54,000 | 67.5% |

| Office Supplies | 150 | 1,800 | 2.25% |

| Travel | 400 | 4,800 | 6% |

To effectively control and monitor expenses, organizations should adopt several best practices that promote accountability and transparency. One such practice is the implementation of a centralized expense management system that consolidates all financial data in one place. This system should allow for real-time tracking of expenses across various departments, enabling managers to monitor spending patterns closely.

By having access to up-to-date information, decision-makers can quickly identify areas where costs can be reduced or optimized. Another best practice involves fostering a culture of cost awareness among employees. Training sessions focused on financial literacy can empower staff to understand the impact of their spending decisions on the organization’s overall financial health.

Encouraging employees to take ownership of their budgets fosters a sense of responsibility and can lead to more prudent spending habits. Additionally, recognizing and rewarding departments or individuals who consistently adhere to budgetary constraints can further reinforce this culture of accountability.

The Impact of Effective Expense Management on Financial Performance

Effective expense management has a profound impact on an organization’s overall financial performance. By controlling costs and optimizing resource allocation, businesses can enhance their profitability margins significantly. For instance, companies that implement rigorous expense management practices often find themselves better positioned to invest in growth opportunities or weather economic downturns.

This financial resilience is crucial in today’s competitive landscape, where agility and adaptability are key drivers of success. Furthermore, effective expense management contributes to improved cash flow management. By keeping expenses in check, organizations can ensure that they have sufficient liquidity to meet their obligations while also investing in strategic initiatives.

Positive cash flow is essential for maintaining operational stability and supporting long-term growth objectives. In contrast, poor expense management can lead to cash flow challenges that hinder an organization’s ability to function effectively, potentially resulting in missed opportunities or even insolvency.

Common Challenges in Expense Management and How to Overcome Them

Despite the importance of managing expenses effectively, organizations often face several challenges that can hinder their efforts. One common issue is the lack of visibility into spending patterns across different departments or business units. When expenses are not tracked consistently or transparently, it becomes difficult for management to identify areas where costs can be reduced.

To overcome this challenge, organizations should invest in integrated expense management systems that provide comprehensive visibility into all financial transactions. Another significant challenge is employee compliance with expense policies. Employees may inadvertently violate spending guidelines due to a lack of understanding or awareness of the policies in place.

To address this issue, organizations should prioritize training and communication regarding expense policies. Regular workshops or informational sessions can help ensure that employees are well-informed about acceptable spending practices and the importance of adhering to these guidelines. Additionally, simplifying the expense reporting process can encourage compliance by making it easier for employees to submit their expenses accurately.

The Future of Expense Management in Accounting: Trends and Innovations

As technology continues to evolve, the future of expense management in accounting is poised for significant transformation. One notable trend is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies in expense management systems. These technologies can analyze vast amounts of data to identify spending patterns and anomalies automatically, providing organizations with actionable insights that were previously difficult to obtain.

For example, AI-driven tools can flag unusual transactions for review or suggest cost-saving measures based on historical data. Additionally, the rise of remote work has prompted organizations to rethink their expense management strategies. With employees working from various locations, traditional methods of tracking expenses may no longer be sufficient.

As a result, companies are increasingly turning to cloud-based solutions that facilitate real-time collaboration and streamline the expense reporting process regardless of where employees are located. This shift not only enhances efficiency but also supports a more flexible work environment that aligns with modern workforce expectations. In conclusion, managing expenses effectively is crucial for maintaining an organization’s financial health and achieving long-term success.

By implementing robust strategies, leveraging technology, and fostering a culture of accountability, businesses can navigate the complexities of expense management while positioning themselves for future growth and innovation.