QuickBooks, developed by Intuit, has established itself as a leading accounting software solution for small to medium-sized businesses. Launched in 1983, it has evolved significantly over the decades, adapting to the changing needs of businesses and the advancements in technology. The software offers a comprehensive suite of tools designed to simplify financial management, making it accessible even for those without extensive accounting knowledge.

With its user-friendly interface and robust features, QuickBooks enables business owners to manage their finances efficiently, ensuring they can focus on growth and customer satisfaction. The versatility of QuickBooks is one of its standout features. It caters to a wide range of industries, from retail and construction to professional services and non-profits.

Users can choose from various versions, including QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed, each tailored to meet specific business needs. This adaptability allows businesses to select the version that best aligns with their operational requirements, whether they need basic bookkeeping functions or advanced financial reporting capabilities. As a result, QuickBooks has become synonymous with effective financial management for countless entrepreneurs and organizations worldwide.

Key Takeaways

- QuickBooks is a popular accounting software used by businesses to manage their financial processes.

- Setting up QuickBooks for your business involves inputting company information, setting up accounts, and connecting bank accounts.

- QuickBooks can streamline financial processes by automating tasks such as invoicing, bill payments, and payroll.

- Invoicing and receiving payments can be easily managed through QuickBooks, allowing for efficient tracking and reconciliation.

- Tracking expenses and managing budgets is simplified with QuickBooks, providing insights into spending and helping to stay within budget.

Setting Up QuickBooks for Your Business

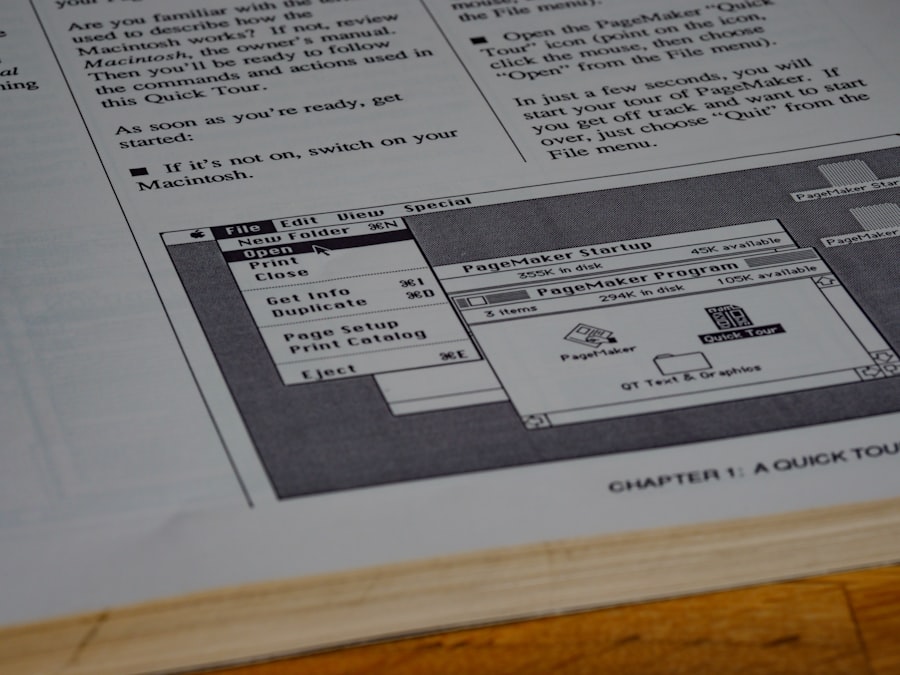

Setting up QuickBooks for your business is a crucial first step that lays the foundation for effective financial management. The process begins with selecting the appropriate version of QuickBooks that aligns with your business size and industry. For instance, QuickBooks Online is ideal for businesses that require remote access and collaboration, while QuickBooks Desktop may be more suitable for those who prefer a traditional software installation.

Once the version is chosen, users can create an account and begin the setup process. During the setup phase, users are prompted to input essential business information, such as the company name, address, and industry type. This information is vital as it helps QuickBooks tailor its features to your specific business needs.

Additionally, users can set up their chart of accounts, which serves as the backbone of their financial reporting structure. This involves categorizing income and expenses into relevant accounts, allowing for better tracking and analysis of financial performance. By taking the time to carefully configure these settings, businesses can ensure that their QuickBooks experience is optimized for their unique operational requirements.

Streamlining Financial Processes with QuickBooks

One of the primary advantages of using QuickBooks is its ability to streamline financial processes, significantly reducing the time and effort required for bookkeeping tasks. The software automates many routine functions, such as data entry and transaction categorization, which minimizes the risk of human error and frees up valuable time for business owners and their teams. For example, QuickBooks can automatically import bank transactions, allowing users to reconcile accounts with just a few clicks rather than manually entering each transaction.

Moreover, QuickBooks offers features like recurring billing and automated payment reminders that enhance cash flow management. Businesses can set up recurring invoices for regular clients, ensuring timely payments without the need for constant follow-up. This automation not only improves efficiency but also enhances customer relationships by providing a seamless billing experience.

By leveraging these capabilities, businesses can focus on strategic initiatives rather than getting bogged down in administrative tasks.

Utilizing QuickBooks for Invoicing and Payments

| Month | Number of Invoices Generated | Number of Payments Processed | Percentage of Invoices Paid on Time |

|---|---|---|---|

| January | 150 | 130 | 85% |

| February | 160 | 140 | 88% |

| March | 170 | 150 | 90% |

Invoicing is a critical component of any business’s financial operations, and QuickBooks excels in this area by providing a range of customizable invoicing options. Users can create professional-looking invoices that reflect their brand identity by incorporating logos and personalized messages. This level of customization not only enhances professionalism but also helps in building trust with clients.

Additionally, QuickBooks allows users to track invoice statuses in real-time, providing insights into which invoices have been paid and which are still outstanding. Payment processing is another area where QuickBooks shines. The software integrates with various payment gateways, enabling businesses to accept payments online seamlessly.

This feature is particularly beneficial in today’s digital economy, where customers expect convenience and flexibility in payment options. By offering online payment capabilities directly through invoices, businesses can expedite cash flow and reduce the time spent on collections. Furthermore, QuickBooks provides detailed reports on payment history, allowing users to analyze trends and make informed decisions regarding their billing practices.

Tracking Expenses and Managing Budgets with QuickBooks

Effective expense tracking is essential for maintaining a healthy financial position, and QuickBooks provides robust tools to help businesses manage their expenditures efficiently. Users can categorize expenses by type—such as travel, supplies, or utilities—allowing for better visibility into spending patterns. This categorization not only aids in budgeting but also simplifies tax preparation by ensuring that all deductible expenses are accurately recorded.

In addition to tracking expenses, QuickBooks offers budgeting features that enable businesses to set financial goals and monitor performance against those targets. Users can create budgets based on historical data or projected income, providing a framework for financial decision-making. The software generates variance reports that highlight discrepancies between actual spending and budgeted amounts, allowing businesses to identify areas where they may need to adjust their spending habits or reallocate resources.

By utilizing these tools effectively, businesses can maintain tighter control over their finances and make proactive adjustments as needed.

Generating Reports and Analyzing Financial Data

The ability to generate detailed financial reports is one of the most powerful features of QuickBooks. The software provides a wide array of reporting options that cater to various business needs, from profit and loss statements to balance sheets and cash flow statements. These reports offer valuable insights into a company’s financial health, enabling business owners to make informed decisions based on real-time data.

QuickBooks also allows users to customize reports according to specific criteria or timeframes, making it easier to analyze trends over time or assess the impact of particular business initiatives. For instance, a retail business might generate sales reports by product category to identify which items are performing well and which are underperforming. This level of analysis empowers businesses to refine their strategies and allocate resources more effectively.

Additionally, the ability to export reports to Excel or PDF formats facilitates sharing insights with stakeholders or preparing documentation for tax purposes.

Integrating QuickBooks with Other Business Tools

In today’s interconnected digital landscape, integration with other business tools is essential for maximizing efficiency and productivity. QuickBooks offers compatibility with a wide range of third-party applications that enhance its functionality across various aspects of business operations. For example, integrating customer relationship management (CRM) software with QuickBooks allows businesses to synchronize customer data seamlessly, ensuring that invoicing and payment processes are streamlined.

Moreover, e-commerce platforms like Shopify or WooCommerce can be integrated with QuickBooks to automate inventory management and sales tracking. This integration eliminates the need for manual data entry between systems, reducing errors and saving time. Additionally, payroll services can be linked with QuickBooks to ensure accurate employee compensation while maintaining compliance with tax regulations.

By leveraging these integrations, businesses can create a cohesive ecosystem that enhances overall operational efficiency.

Tips for Maximizing Efficiency and Productivity with QuickBooks

To fully harness the potential of QuickBooks, users should adopt best practices that promote efficiency and productivity within their financial management processes. One effective strategy is to take advantage of keyboard shortcuts available within the software. Familiarizing oneself with these shortcuts can significantly speed up navigation and data entry tasks, allowing users to accomplish more in less time.

Another tip is to regularly reconcile accounts within QuickBooks to ensure accuracy in financial reporting. By routinely comparing bank statements with recorded transactions in the software, users can identify discrepancies early on and address them promptly. Additionally, setting aside dedicated time each week or month for bookkeeping tasks can help maintain organization and prevent backlog during busier periods.

Furthermore, utilizing the mobile app version of QuickBooks can enhance productivity by allowing users to manage finances on-the-go. Whether capturing receipts through the app or sending invoices directly from a mobile device, this flexibility ensures that financial management remains seamless even outside the office environment. By implementing these strategies alongside the powerful features of QuickBooks, businesses can optimize their financial processes and drive greater success in their operations.