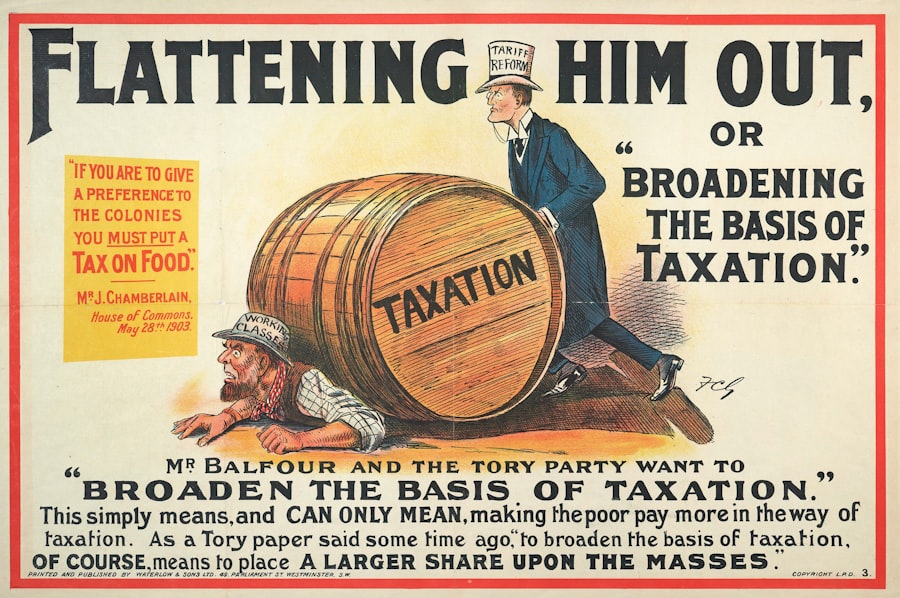

The tax-free threshold represents the maximum amount of income an individual can earn before becoming liable for income tax payments. This threshold amount differs across countries and is determined by various factors including age, residency status, and national tax legislation. In Australia, for example, residents can earn up to a specified dollar amount annually without paying income tax on that portion of their earnings.

The tax-free threshold functions as a policy tool designed to reduce the tax burden on lower-income earners. By exempting initial earnings from taxation, governments provide financial relief to individuals with limited income while encouraging workforce participation. This mechanism particularly benefits new workers, career changers, and those in economically vulnerable situations.

Knowledge of applicable tax-free thresholds enables individuals to accurately calculate their tax obligations and plan their finances accordingly.

Key Takeaways

- The tax-free threshold allows individuals to earn a certain amount without paying income tax.

- Claiming the tax-free threshold can reduce the amount of tax withheld from your pay.

- Eligibility typically depends on residency status and income level.

- Adjusting your tax-free threshold during the year can help manage your tax obligations effectively.

- Professional advice can optimize your use of the tax-free threshold and avoid common mistakes.

How to Claim the Tax-Free Threshold

Claiming the tax-free threshold typically involves a straightforward process, but it can vary depending on the jurisdiction in which one resides. In many cases, individuals must complete a specific form or declaration when they start a new job or when they submit their annual tax return. For example, in Australia, employees can claim the tax-free threshold by filling out a Tax File Number (TFN) declaration form provided by their employer.

This form allows individuals to indicate that they wish to claim the threshold, ensuring that their employer withholds the correct amount of tax from their paychecks. It is crucial for individuals to be aware of their eligibility and to ensure that they are claiming the tax-free threshold correctly. If an individual has multiple jobs, they can only claim the tax-free threshold from one employer at a time.

This means that careful consideration must be given to which job will benefit most from this claim. Additionally, if an individual’s income exceeds the threshold during the financial year, they may need to adjust their claims accordingly to avoid underpayment of taxes later on.

Benefits of Claiming the Tax-Free Threshold

Claiming the tax-free threshold can yield significant financial benefits for individuals, particularly those with lower incomes. One of the most immediate advantages is the increase in take-home pay. By reducing the amount of income subject to taxation, individuals can retain more of their earnings, which can be particularly beneficial for those who are managing tight budgets or living paycheck to paycheck.

This additional disposable income can be allocated towards essential expenses such as housing, food, and transportation, thereby improving overall financial stability. Moreover, claiming the tax-free threshold can also have long-term benefits for individuals’ financial health. By maximizing their take-home pay, individuals may find themselves in a better position to save for future goals, such as purchasing a home or investing in education.

Additionally, having more disposable income can allow individuals to contribute to retirement savings plans or emergency funds, which are crucial for long-term financial security. The cumulative effect of these benefits can lead to improved quality of life and reduced financial stress.

Who is Eligible to Claim the Tax-Free Threshold

Eligibility for claiming the tax-free threshold generally depends on several factors, including residency status, age, and income level. In many jurisdictions, residents who earn below a certain income level are eligible to claim this threshold. For instance, in Australia, residents who earn less than the specified annual limit can claim the tax-free threshold on their income.

However, non-residents typically do not qualify for this benefit and may be subject to different tax rates from the outset. Additionally, specific age-related criteria may apply in some regions. For example, minors or students may have different thresholds or exemptions available to them based on their unique circumstances.

It is also important for individuals who have multiple sources of income or who work part-time or casually to understand how these factors might affect their eligibility. Being well-informed about these criteria ensures that individuals can take full advantage of available tax benefits while remaining compliant with local laws.

Tips for Maximizing Your Income by Claiming the Tax-Free Threshold

| Metric | Description | Value | Notes |

|---|---|---|---|

| Tax Free Threshold Amount | The amount of income you can earn before paying tax | 18,200 | Applies to Australian residents for tax purposes |

| Eligibility | Criteria to claim the tax free threshold | Australian resident for tax purposes | Must not claim the threshold from another employer |

| Effect on PAYG Withholding | How claiming affects tax withheld from salary | Reduces amount withheld | Helps increase take-home pay |

| Multiple Employers | Claiming threshold from more than one employer | Not allowed | Can result in tax debt at year-end |

| Non-Residents | Tax free threshold eligibility for non-residents | Not eligible | Tax withheld at higher rates |

| Impact on Tax Return | How claiming threshold affects annual tax return | May reduce tax payable or increase refund | Depends on total income and deductions |

To maximize income through claiming the tax-free threshold, individuals should first ensure that they are accurately reporting their income and understanding their financial situation comprehensively. Keeping detailed records of all sources of income is essential for determining whether one qualifies for the tax-free threshold and how much of it can be claimed. This includes wages from employment, freelance work, and any other forms of income that may contribute to total earnings.

Another effective strategy is to regularly review one’s employment situation and adjust claims as necessary. For instance, if an individual takes on additional work or experiences a change in income level, it may be prudent to reassess whether they should continue claiming the tax-free threshold from their primary employer or adjust their claims accordingly. Additionally, utilizing budgeting tools and financial planning resources can help individuals make informed decisions about how best to allocate their increased take-home pay for maximum benefit.

Potential Pitfalls to Avoid When Claiming the Tax-Free Threshold

While claiming the tax-free threshold offers numerous benefits, there are potential pitfalls that individuals should be aware of to avoid complications with their taxes. One common mistake is failing to update claims when there are changes in employment status or income levels. If an individual continues to claim the tax-free threshold after their income has exceeded the limit, they may face unexpected tax liabilities at the end of the financial year.

This could result in owing money to tax authorities and incurring penalties or interest charges. Another pitfall involves misunderstanding residency status and its implications for claiming the tax-free threshold. Non-residents often have different tax obligations and may not be eligible for certain benefits available to residents.

Individuals should ensure they understand their residency status and how it affects their ability to claim the threshold accurately. Consulting with a tax professional can help clarify these issues and prevent costly mistakes.

How to Adjust Your Tax-Free Threshold Throughout the Year

Adjusting your tax-free threshold throughout the year is an important aspect of effective tax management. As life circumstances change—such as starting a new job, receiving a promotion, or experiencing fluctuations in income—individuals may need to revisit their claims to ensure they remain compliant with tax regulations. In many jurisdictions, individuals can submit updated declarations or forms to their employers whenever there is a significant change in their financial situation.

For example, if an individual takes on additional part-time work that pushes their total income above the tax-free threshold, they should inform their primary employer so that appropriate adjustments can be made to withholding taxes. This proactive approach helps prevent underpayment issues at year-end and ensures that individuals are not caught off guard by unexpected tax bills.

Seeking Professional Advice for Maximizing Your Income through the Tax-Free Threshold

Navigating the complexities of taxation can be daunting, especially when it comes to understanding how best to utilize the tax-free threshold for maximum benefit. Seeking professional advice from a qualified tax advisor or accountant can provide invaluable insights tailored to an individual’s unique financial situation. These professionals possess extensive knowledge of current tax laws and regulations and can help clients identify opportunities for optimizing their income while remaining compliant with legal requirements.

Additionally, a tax professional can assist with strategic planning throughout the year, ensuring that individuals are making informed decisions about their claims and adjusting them as necessary based on changes in income or employment status. By leveraging expert advice, individuals can enhance their understanding of taxation and make proactive choices that contribute positively to their overall financial health.