Federal income tax withholding is a critical component of the U.S. tax system, designed to ensure that individuals pay their income taxes gradually throughout the year rather than in a lump sum at tax time. When you receive a paycheck, your employer deducts a portion of your earnings to cover your estimated federal tax liability.

This withholding is based on the information you provide on your W-4 form, which includes details such as your filing status, number of dependents, and any additional amounts you wish to withhold. The purpose of this system is to help taxpayers avoid underpayment penalties and to facilitate the government’s cash flow. The amount withheld from your paycheck is not arbitrary; it is calculated using IRS guidelines that take into account various factors, including your income level and the number of allowances you claim.

The IRS updates these guidelines periodically to reflect changes in tax law and economic conditions. Understanding how this withholding works is essential for effective financial planning, as it directly impacts your take-home pay and your overall tax liability at the end of the year. If too much is withheld, you may receive a refund when you file your tax return; conversely, if too little is withheld, you may owe money when you file.

Key Takeaways

- Federal income tax withholding determines the amount of tax deducted from your paycheck based on various personal factors.

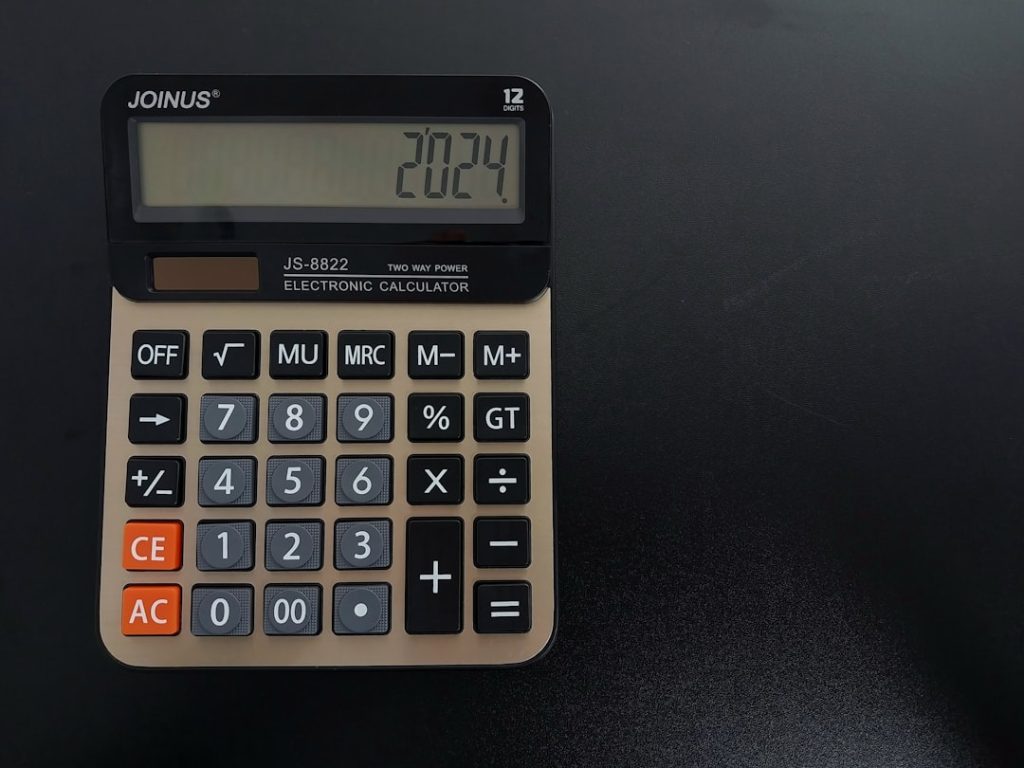

- The Federal Income Tax Withholding Calculator helps estimate the correct withholding to avoid owing taxes or overpaying.

- Life changes like marriage, having children, or a new job can significantly impact your withholding needs.

- Avoid common errors such as incorrect filing status or ignoring additional income when using the calculator.

- Utilize available resources and FAQs to stay informed and make accurate adjustments to your tax withholding.

How to Use the Federal Income Tax Withholding Calculator

The Federal Income Tax Withholding Calculator is an invaluable tool provided by the IRS to help taxpayers determine the appropriate amount of federal income tax to withhold from their paychecks. To use this calculator effectively, you will need to gather some essential information, including your most recent pay stub, your filing status, and any additional income or deductions you anticipate for the year. The calculator guides you through a series of questions that help assess your financial situation and provide a tailored withholding recommendation.

Once you input your data into the calculator, it will analyze your information and suggest an optimal withholding amount based on current tax rates and regulations. This process can help you avoid common pitfalls associated with over- or under-withholding. For instance, if you find that you are withholding too much, the calculator may suggest adjusting your W-4 form to increase your take-home pay.

Conversely, if it indicates that you are under-withholding, it may recommend increasing your deductions to prevent a tax bill at the end of the year. Utilizing this tool can lead to more informed financial decisions and greater peace of mind regarding your tax obligations.

Factors Affecting Your Withholding Amount

Several factors can influence the amount of federal income tax withheld from your paycheck. One of the most significant is your filing status, which can be single, married filing jointly, married filing separately, or head of household. Each status has different tax brackets and standard deductions that affect how much tax you owe.

For example, married couples filing jointly typically benefit from lower tax rates compared to single filers, which can lead to a different withholding amount. Another critical factor is the number of allowances you claim on your W-4 form. Each allowance reduces the amount of income subject to withholding, meaning that claiming more allowances can result in a higher take-home pay but may also increase the risk of under-withholding.

Additionally, other sources of income—such as bonuses, freelance work, or investment income—can also affect your overall tax liability and should be considered when determining your withholding amount. Changes in life circumstances, such as marriage, divorce, or having children, can also necessitate a reevaluation of your withholding strategy.

Tips for Maximizing Your Paycheck

Maximizing your paycheck involves strategic planning around your federal income tax withholding and other deductions. One effective approach is to review and adjust your W-4 form regularly, especially after significant life events or changes in financial circumstances. By accurately reflecting your current situation on this form, you can ensure that you are not over-withholding and thus leaving money on the table that could be used for immediate expenses or investments.

Another strategy is to consider contributing to tax-advantaged accounts such as a 401(k) or Health Savings Account (HSA). Contributions to these accounts can reduce your taxable income, which may lower the amount withheld from your paycheck while simultaneously helping you save for retirement or medical expenses. Additionally, taking advantage of employer-sponsored benefits can also enhance your overall compensation package without increasing your taxable income.

By being proactive about these financial decisions, you can effectively increase your take-home pay while still meeting your tax obligations.

Common Mistakes to Avoid When Using the Calculator

| Filing Status | Number of Allowances | Weekly Income Range | Withholding Amount |

|---|---|---|---|

| Single | 0 | 0 – 200 | 0 |

| Single | 0 | 201 – 500 | 15 |

| Single | 1 | 0 – 300 | 0 |

| Married | 0 | 0 – 400 | 0 |

| Married | 0 | 401 – 800 | 20 |

| Married | 2 | 0 – 600 | 0 |

While the Federal Income Tax Withholding Calculator is a powerful tool, there are common mistakes that users should be aware of to ensure accurate results. One frequent error is failing to input all sources of income accurately. Many individuals only consider their primary job when using the calculator but neglect additional income streams such as side jobs or investment earnings.

This oversight can lead to an inaccurate withholding recommendation that does not reflect their true tax liability. Another mistake is not updating the W-4 form after significant life changes. For instance, if someone gets married or has a child but does not adjust their withholding accordingly, they may end up with too little tax withheld throughout the year.

This could result in a substantial tax bill when they file their return. Additionally, some users may overlook the importance of reviewing their withholding periodically; what worked last year may not be suitable for the current year due to changes in income or tax laws. Being mindful of these pitfalls can help taxpayers make more informed decisions regarding their withholding amounts.

Adjusting Your Withholding for Life Changes

Life changes can significantly impact your financial situation and should prompt a reevaluation of your federal income tax withholding. Major events such as marriage, divorce, having children, or even changing jobs can alter your tax liability and necessitate adjustments to your W-4 form. For example, getting married often allows couples to file jointly, which may result in lower overall taxes due to different tax brackets and deductions available for married couples.

Similarly, having children can provide additional tax benefits such as child tax credits and increased allowances on your W-4 form. Conversely, if you experience a divorce or lose a dependent, it may be necessary to decrease the number of allowances claimed or adjust your filing status accordingly. Keeping track of these life changes and understanding their implications on your taxes is crucial for maintaining an appropriate withholding amount throughout the year.

Resources for Additional Tax Withholding Information

For those seeking further information on federal income tax withholding, several resources are available through both government and private channels. The IRS website offers comprehensive guidance on withholding rules and regulations, including detailed instructions for completing Form W-4 and links to various calculators and tools designed to assist taxpayers in managing their withholding effectively. The IRS also provides publications that explain various aspects of taxation in layman’s terms.

In addition to IRS resources, many financial advisory services offer tools and consultations aimed at helping individuals understand their tax obligations better. Tax preparation software often includes features that allow users to simulate different withholding scenarios based on their unique financial situations. Furthermore, local community organizations sometimes provide free workshops or seminars focused on financial literacy and tax education, making it easier for individuals to access valuable information about managing their taxes.

Frequently Asked Questions about Federal Income Tax Withholding

Many taxpayers have questions regarding federal income tax withholding that can help clarify common concerns. One frequently asked question is whether it’s possible to change withholding mid-year. The answer is yes; taxpayers can submit a new W-4 form at any time during the year if they believe their withholding needs adjustment due to changes in income or personal circumstances.

Another common inquiry revolves around how much should be withheld from each paycheck. While there is no one-size-fits-all answer due to varying personal situations, using tools like the IRS Withholding Calculator can provide tailored recommendations based on individual circumstances. Additionally, some taxpayers wonder about the implications of receiving a large refund versus owing money at tax time; while receiving a refund may seem beneficial, it often indicates over-withholding throughout the year, which could have been better utilized for investments or savings during that time.

Understanding federal income tax withholding is essential for effective financial management in today’s complex economic landscape. By utilizing available resources and tools while remaining aware of personal circumstances that affect withholding amounts, individuals can navigate their tax obligations more effectively and make informed decisions about their finances throughout the year.