Navigating the labyrinth of tax preparation can be a daunting task for many individuals and businesses alike. The complexity of tax laws, coupled with the ever-changing regulations, makes it imperative to seek expert assistance. Expert tax preparation not only ensures compliance with the law but also optimizes financial outcomes.

A proficient tax preparer possesses the knowledge and experience to identify potential pitfalls and opportunities that may not be immediately apparent to the average taxpayer. This expertise can lead to significant savings, making the investment in professional services worthwhile. Moreover, expert tax preparation can alleviate the stress associated with tax season.

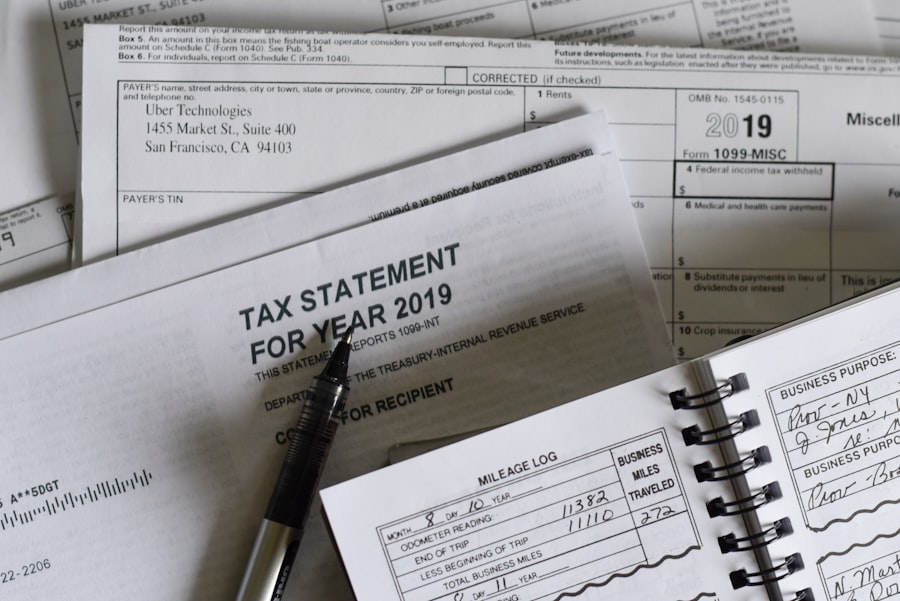

For many, the mere thought of gathering documents, calculating figures, and understanding tax implications can be overwhelming. A qualified tax professional can streamline this process, allowing clients to focus on their personal or business priorities. By delegating this responsibility to an expert, taxpayers can rest assured that their returns are being handled with precision and care, reducing the likelihood of errors that could lead to audits or penalties.

Key Takeaways

- Expert tax preparation ensures accurate filing and compliance with complex tax laws.

- Understanding deductions and credits can significantly reduce your tax liability.

- Avoiding common mistakes prevents costly penalties and delays in processing.

- Strategic planning helps maximize your tax refund and financial benefits.

- Hiring a professional and choosing the right service enhances efficiency and peace of mind.

Understanding Tax Laws and Regulations

Tax laws are intricate and often subject to frequent changes, which can create confusion for those attempting to navigate them without professional guidance. The Internal Revenue Code (IRC) is a comprehensive set of laws that govern federal taxation in the United States, and it is supplemented by various regulations, rulings, and court decisions. Each year, new legislation can alter existing laws or introduce new provisions, making it essential for taxpayers to stay informed about these developments.

An expert tax preparer is well-versed in these complexities and can provide clarity on how they apply to individual circumstances. Additionally, understanding state and local tax regulations is equally important. Each jurisdiction may have its own set of rules regarding income tax, sales tax, property tax, and more.

For instance, some states offer unique deductions or credits that can significantly impact a taxpayer’s liability. A knowledgeable tax professional can navigate these local nuances, ensuring that clients take full advantage of available benefits while remaining compliant with all applicable laws. This comprehensive understanding of both federal and state regulations is crucial for effective tax planning and preparation.

Utilizing Deductions and Credits

Deductions and credits are powerful tools that can substantially reduce a taxpayer’s overall liability. Deductions lower taxable income, while credits directly reduce the amount of tax owed. However, many taxpayers are unaware of the full range of deductions and credits available to them.

An expert tax preparer can identify eligible deductions such as mortgage interest, student loan interest, medical expenses, and charitable contributions. For instance, a taxpayer who itemizes deductions may find that their total deductions exceed the standard deduction threshold, resulting in a lower taxable income. Credits can be even more beneficial since they provide a dollar-for-dollar reduction in tax liability.

Common credits include the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and education-related credits like the American Opportunity Credit. Each of these credits has specific eligibility requirements that can be complex to navigate without professional assistance. A skilled tax preparer will not only ensure that clients claim all eligible deductions and credits but will also strategize their use to maximize overall tax benefits.

Avoiding Costly Mistakes

| Metric | Description | Typical Value | Impact on Cost |

|---|---|---|---|

| Error Rate | Percentage of errors made during project execution | 2-5% | High – Errors often lead to rework and delays |

| Rework Time | Additional time spent correcting mistakes | 10-20% of total project time | Medium to High – Increases labor costs and extends deadlines |

| Training Hours | Hours spent training staff to avoid mistakes | 20-40 hours per employee annually | Low to Medium – Prevents costly errors through skill development |

| Inspection Frequency | Number of quality checks per project phase | 3-5 inspections | Medium – Early detection reduces costly fixes later |

| Cost of Mistakes | Average additional cost incurred due to errors | 5-15% of project budget | High – Directly increases overall project expenses |

Mistakes in tax preparation can lead to significant financial repercussions, including penalties, interest charges, and even audits by the IRS. Common errors include miscalculating income, failing to report all sources of income, or incorrectly claiming deductions and credits. These mistakes can arise from simple oversight or a lack of understanding of the tax code.

Engaging an expert tax preparer minimizes the risk of such errors, as they are trained to meticulously review all information before submission. Furthermore, the consequences of mistakes extend beyond immediate financial penalties; they can also impact future tax filings. For example, if a taxpayer is audited due to discrepancies in their return, it may trigger a more extensive examination of previous years’ filings.

This not only adds stress but can also lead to additional liabilities if past mistakes are uncovered. By relying on a professional who understands the intricacies of tax preparation, individuals can avoid these costly pitfalls and maintain peace of mind throughout the filing process.

Maximizing Your Refund with Strategic Planning

Strategic planning is essential for maximizing tax refunds and minimizing liabilities. This involves not only understanding current tax laws but also anticipating future changes that could affect a taxpayer’s financial situation. An expert tax preparer can help clients develop a proactive approach to their taxes by analyzing their financial landscape and identifying opportunities for savings.

For instance, contributing to retirement accounts such as IRAs or 401(k)s not only provides immediate tax benefits but also sets up long-term financial security. Additionally, timing plays a crucial role in tax planning. Certain financial decisions made throughout the year—such as selling investments or making large purchases—can have significant implications for tax liability.

A knowledgeable preparer will advise clients on the best timing for these transactions to optimize their refund potential. By taking a holistic view of a taxpayer’s financial situation and employing strategic planning techniques, an expert can help clients achieve their financial goals while ensuring compliance with tax regulations.

The Benefits of Hiring a Professional Tax Preparer

Hiring a professional tax preparer offers numerous advantages that extend beyond mere compliance with tax laws. One of the most significant benefits is access to specialized knowledge and experience. Tax professionals are often required to complete continuing education courses to stay current with changes in tax legislation and best practices.

This ongoing education equips them with the tools necessary to navigate complex situations that may arise during the preparation process. In addition to expertise, professional preparers often utilize advanced software and technology that enhance accuracy and efficiency in filing returns. These tools can help identify potential deductions and credits that may be overlooked by individuals preparing their own taxes.

Furthermore, many professional preparers offer audit support services, providing peace of mind in the event of an IRS inquiry. This level of support is invaluable for taxpayers who may feel overwhelmed by the prospect of an audit or who lack confidence in their ability to defend their return.

Tips for Choosing the Right Tax Preparation Service

Selecting the right tax preparation service is crucial for ensuring a smooth filing process and maximizing potential benefits. One key factor to consider is the qualifications and credentials of the preparer. Look for professionals who hold certifications such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Accredited Tax Advisor (ATA).

These designations indicate a higher level of expertise and commitment to ethical standards in tax preparation. Another important consideration is the preparer’s experience with specific situations relevant to your financial circumstances. For example, if you are self-employed or have complex investment portfolios, seek out professionals who specialize in those areas.

Additionally, reading reviews and seeking recommendations from trusted sources can provide valuable insights into a preparer’s reputation and reliability. Finally, ensure that you understand the fee structure before engaging a service; transparency regarding costs will help avoid surprises when it comes time to pay for services rendered.

Planning for Future Tax Seasons

Effective tax preparation is not just about filing returns; it also involves planning for future seasons to optimize financial outcomes year after year. This proactive approach includes keeping meticulous records throughout the year, which simplifies the preparation process when tax season arrives. Maintaining organized documentation of income sources, expenses, receipts for deductions, and any relevant correspondence with tax authorities will streamline filing and reduce stress.

Moreover, regular consultations with a tax professional throughout the year can help identify changes in personal or business circumstances that may impact future filings. For instance, life events such as marriage, divorce, or having children can significantly alter one’s tax situation. By staying engaged with a tax preparer year-round, individuals can make informed decisions that align with their long-term financial goals while ensuring compliance with evolving tax laws.

This ongoing relationship fosters a deeper understanding of one’s financial landscape and empowers taxpayers to take control of their fiscal responsibilities effectively.