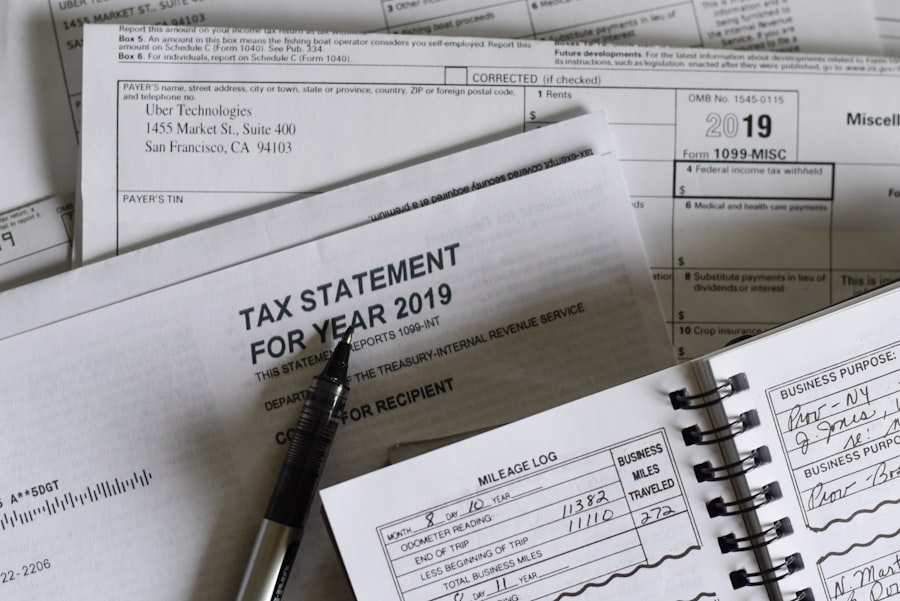

The tax filing process can often seem daunting, especially for those who are new to it or have recently experienced significant life changes such as marriage, home ownership, or the birth of a child. At its core, the process involves reporting your income to the Internal Revenue Service (IRS) and determining how much tax you owe or how much of a refund you can expect. The first step in this journey is gathering all necessary documentation, which includes W-2 forms from employers, 1099 forms for freelance work, and any other income statements.

Additionally, taxpayers must keep track of various financial records that may impact their tax situation, such as receipts for deductible expenses and records of any investments. Once all relevant documents are collected, the next step is to choose a method for filing. Taxpayers can opt to file their taxes manually using paper forms, utilize tax preparation software, or seek assistance from professional tax preparers.

Each method has its own advantages and disadvantages. For instance, while filing manually may save on costs, it can be time-consuming and prone to errors. Conversely, professional services can provide expertise and ensure compliance with tax laws but may come with a higher price tag.

Understanding these options is crucial for making an informed decision that aligns with one’s financial situation and comfort level with tax matters.

Key Takeaways

- Understand the steps involved in filing your taxes to ensure accuracy and compliance.

- Identify all eligible deductions and credits to maximize your tax benefits.

- Use Jackson Hewitt’s professional tax preparation services for expert assistance.

- Organize your financial documents carefully to streamline the filing process.

- Plan ahead for next year’s tax season to optimize your refund and avoid errors.

Identifying eligible deductions and credits

Deductions and credits play a pivotal role in reducing taxable income and ultimately lowering the amount owed to the IRS. Deductions reduce the amount of income that is subject to taxation, while credits directly reduce the tax liability dollar-for-dollar. Identifying eligible deductions begins with understanding the difference between standard and itemized deductions.

For the tax year 2023, the standard deduction for single filers is $13,850, while married couples filing jointly can claim $27,700. Taxpayers should evaluate whether their total itemized deductions exceed the standard deduction to determine which option is more beneficial. Common deductions include those for mortgage interest, state and local taxes, medical expenses exceeding a certain percentage of adjusted gross income (AGI), and charitable contributions.

For example, if a taxpayer donates $1,000 to a qualified charity and their AGI is $50,000, they may be able to deduct that amount from their taxable income if they choose to itemize. On the other hand, tax credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit can significantly impact a taxpayer’s refund or balance due. The EITC is designed to benefit low- to moderate-income working individuals and families, providing a credit that can be worth thousands of dollars depending on income level and number of qualifying children.

Utilizing Jackson Hewitt’s tax preparation services

Jackson Hewitt offers a range of tax preparation services designed to simplify the filing process for individuals and families alike. With a network of thousands of locations across the United States, Jackson Hewitt provides in-person assistance from trained tax professionals who can guide clients through every step of the filing process. This personalized service is particularly beneficial for those who may feel overwhelmed by the complexities of tax laws or who have unique financial situations that require expert advice.

In addition to in-person services, Jackson Hewitt also offers online tax preparation options that allow users to file their taxes from the comfort of their own homes. Their user-friendly platform is equipped with tools that help identify potential deductions and credits while ensuring compliance with current tax regulations. Furthermore, Jackson Hewitt’s professionals are available year-round, meaning clients can seek advice not only during tax season but also when planning for future financial decisions that may impact their taxes.

Exploring options for maximizing your refund

Maximizing your tax refund involves strategic planning and an understanding of available opportunities within the tax code. One effective way to enhance your refund is by ensuring that you take full advantage of all eligible deductions and credits. This includes not only common deductions but also lesser-known opportunities such as education credits for tuition payments or deductions for student loan interest.

For instance, the American Opportunity Tax Credit allows eligible students to claim up to $2,500 per year for qualified education expenses during their first four years of higher education. Another strategy for maximizing your refund is to contribute to retirement accounts such as a Traditional IRA or a Health Savings Account (HSA). Contributions to these accounts can reduce your taxable income for the year in which they are made, potentially increasing your refund.

Additionally, taxpayers should consider adjusting their withholding allowances on their W-4 forms throughout the year to ensure they are not overpaying taxes. By doing so, individuals can keep more money in their paychecks while still ensuring they meet their tax obligations.

Tips for organizing your financial documents

| Metric | Value | Notes |

|---|---|---|

| Number of Locations | 6,000+ | Across the United States |

| Year Founded | 1982 | Established as a tax preparation service |

| Average Refund Time | Less than 10 days | Varies based on filing method |

| Customer Satisfaction Rate | 85% | Based on recent surveys |

| Services Offered | Tax Preparation, Refund Advances, Audit Assistance | Includes both in-person and online services |

| Average Cost of Tax Preparation | 100 – 200 | Depends on complexity of return |

| Mobile App Rating | 4.2 / 5 | Based on app store reviews |

Effective organization of financial documents is essential for a smooth tax filing experience. One practical approach is to create a dedicated folder or digital file system where all relevant documents can be stored throughout the year. This includes W-2s, 1099s, receipts for deductible expenses, bank statements, and any correspondence from the IRS.

By keeping these documents in one place, taxpayers can easily access them when it comes time to file their taxes. Additionally, maintaining a calendar with important tax-related dates can help ensure that nothing is overlooked. Marking deadlines for filing taxes, making estimated payments, or submitting documentation for deductions can prevent last-minute scrambles and potential penalties.

It’s also wise to regularly review financial documents throughout the year rather than waiting until tax season. This proactive approach allows individuals to identify any missing information early on and make necessary adjustments before filing.

Avoiding common tax filing mistakes

Tax filing mistakes can lead to delays in processing returns or even audits by the IRS. One common error is incorrect personal information on tax forms, such as misspelled names or incorrect Social Security numbers. These mistakes can cause significant issues and may require additional time to resolve.

Taxpayers should double-check all personal information before submitting their returns to avoid these pitfalls. Another frequent mistake involves overlooking potential deductions or credits due to lack of awareness or misunderstanding of eligibility requirements. For example, many taxpayers fail to claim the Earned Income Tax Credit simply because they do not realize they qualify based on their income level or family situation.

Utilizing professional services like those offered by Jackson Hewitt can help mitigate these risks by ensuring that all eligible deductions and credits are identified and claimed accurately.

Taking advantage of Jackson Hewitt’s refund advance options

Jackson Hewitt provides unique refund advance options that allow taxpayers to access a portion of their anticipated refund before their return is fully processed by the IRS. This service can be particularly beneficial for individuals who may need immediate cash flow relief during tax season. The refund advance program typically offers loans ranging from $200 up to $4,000 depending on eligibility criteria and expected refund amounts.

To take advantage of this option, clients must file their taxes through Jackson Hewitt and apply for the advance during the filing process. The application is straightforward and often completed at the same time as filing taxes. Once approved, clients can receive funds quickly—sometimes within hours—allowing them to address pressing financial needs without waiting for the IRS processing timeline.

Planning for next year’s tax season

Planning ahead for next year’s tax season is crucial for minimizing stress and maximizing potential refunds. One effective strategy is to regularly review financial goals and changes throughout the year that may impact taxes. For instance, if an individual anticipates a significant change in income due to a new job or promotion, it’s wise to adjust withholding allowances accordingly to avoid underpayment penalties or overpaying taxes.

Additionally, keeping abreast of changes in tax laws is essential as these can affect deductions and credits available in future filings. Taxpayers should consider setting aside time each quarter to review their financial situation and make necessary adjustments to their withholding or contributions to retirement accounts. By adopting a proactive approach throughout the year rather than waiting until tax season arrives, individuals can ensure they are well-prepared and positioned for success when it comes time to file their taxes again.