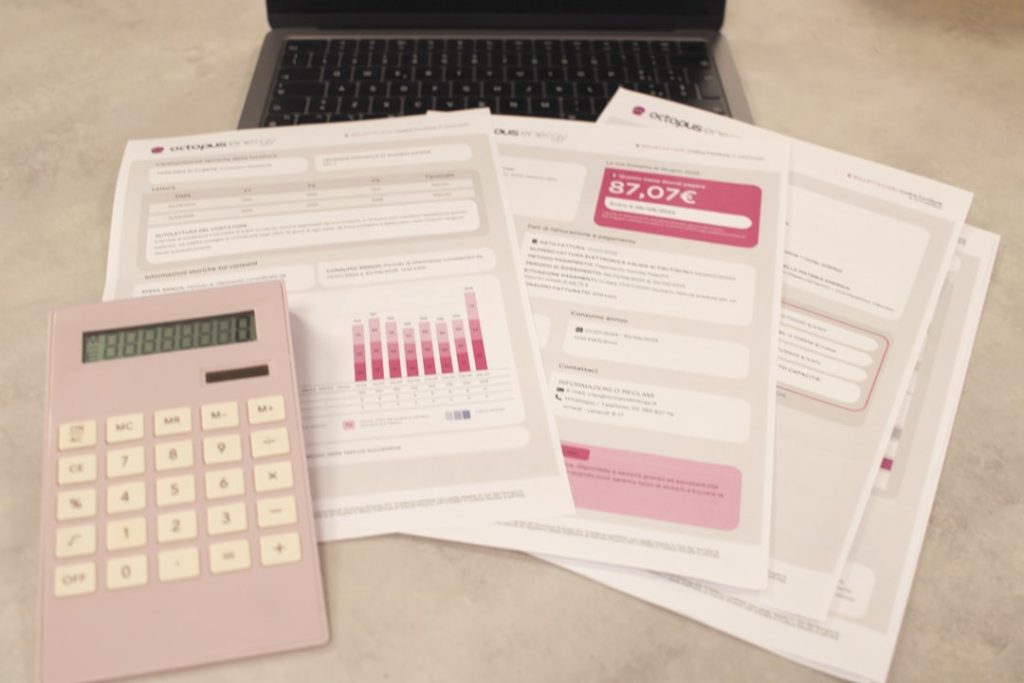

Open source accounting software has gained significant traction in recent years, primarily due to its flexibility, cost-effectiveness, and community-driven development. One of the most compelling benefits of open source solutions is the absence of licensing fees, which can be a substantial financial burden for small to medium-sized enterprises (SMEs). Unlike proprietary software, which often requires ongoing subscription fees or hefty one-time payments, open source software allows businesses to allocate their resources more efficiently.

This financial freedom enables companies to invest in other critical areas such as marketing, product development, or employee training. Moreover, open source accounting software offers unparalleled customization capabilities. Businesses can modify the software to suit their specific needs, whether that involves adding new features, integrating with existing systems, or tailoring the user interface.

This adaptability is particularly beneficial for companies with unique operational requirements that off-the-shelf solutions may not adequately address. The collaborative nature of open source projects also means that users can benefit from continuous improvements and updates driven by a community of developers and users who contribute their expertise and feedback. This results in a more robust and innovative product that evolves alongside the changing needs of businesses.

Key Takeaways

- Open source accounting software offers cost-effective, flexible solutions tailored to business needs.

- Selecting the right software involves evaluating features, scalability, and community support.

- Successful implementation requires careful planning and integration with existing business processes.

- Customization and integration with other systems enhance functionality and streamline operations.

- Ongoing training, support, and attention to security ensure compliance and maximize efficiency.

Choosing the Right Open Source Accounting Software for Your Business

Selecting the appropriate open source accounting software requires a thorough understanding of your business’s specific needs and objectives. The first step in this process is to conduct a comprehensive assessment of your current accounting practices and identify any pain points or inefficiencies. For instance, if your business struggles with tracking expenses or managing invoices, you may want to prioritize software that excels in these areas.

Additionally, consider the size of your organization and the complexity of your financial operations; some open source solutions are better suited for larger enterprises with intricate accounting needs, while others cater specifically to startups and small businesses. Another critical factor to consider is the level of community support and documentation available for the software. A vibrant community can provide valuable resources such as forums, tutorials, and user guides that can help you navigate any challenges you may encounter during implementation and use.

Popular open source accounting solutions like Odoo, GnuCash, and ERPNext have extensive communities that offer support and share best practices. Evaluating user reviews and case studies can also provide insights into how well a particular software solution has performed for businesses similar to yours, helping you make a more informed decision.

Implementing Open Source Accounting Software into Your Business Operations

The implementation phase is crucial for ensuring that your chosen open source accounting software integrates seamlessly into your existing business operations. This process typically begins with data migration, where historical financial data from your previous system is transferred to the new software. It is essential to ensure that this data is accurate and complete to avoid discrepancies in financial reporting.

Depending on the complexity of your data, you may need to engage IT professionals or consultants who specialize in data migration to facilitate this process effectively. Once the data migration is complete, it is vital to configure the software according to your business’s specific requirements. This may involve setting up user roles and permissions, customizing workflows, and establishing reporting parameters.

During this stage, it is beneficial to involve key stakeholders from various departments to ensure that the software meets the diverse needs of your organization. Additionally, conducting thorough testing before going live can help identify any potential issues or bugs that need to be addressed. A well-planned implementation strategy not only minimizes disruptions but also sets the foundation for successful long-term use of the software.

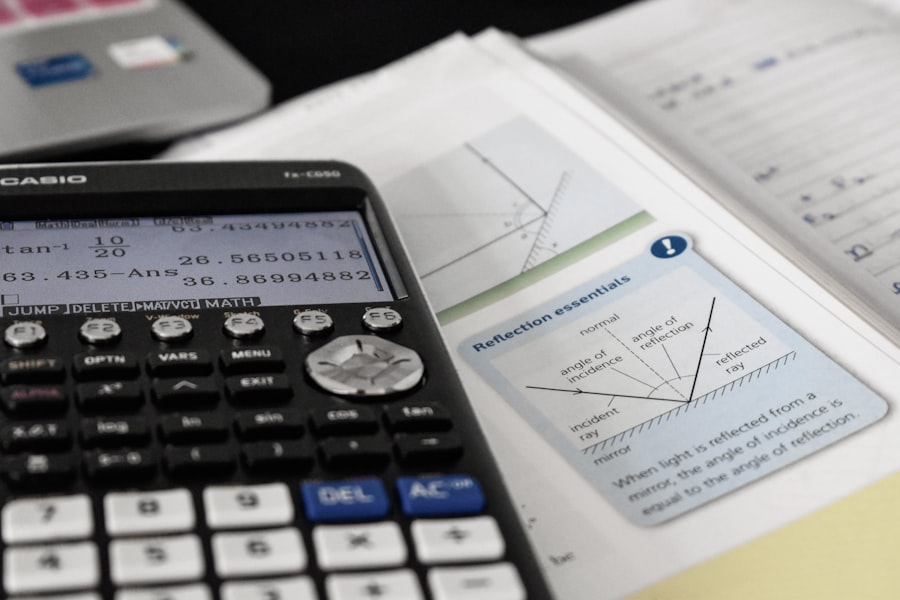

Customizing Open Source Accounting Software to Meet Your Business Needs

One of the standout features of open source accounting software is its ability to be customized extensively. This flexibility allows businesses to tailor the software to their unique operational requirements, enhancing usability and efficiency. Customization can take many forms, from modifying existing features to developing entirely new modules that address specific business processes.

For example, a manufacturing company might require specialized inventory management tools that are not available in standard accounting packages; through customization, they can create a solution that integrates seamlessly with their production workflow. Furthermore, businesses can also personalize the user interface to improve user experience and streamline operations. Custom dashboards can be designed to display key performance indicators (KPIs) relevant to different departments, allowing users to access critical information quickly.

Additionally, businesses can automate repetitive tasks such as invoicing or expense tracking through custom scripts or plugins, freeing up valuable time for employees to focus on more strategic initiatives. The ability to adapt the software not only enhances productivity but also fosters a sense of ownership among users who feel that the tool has been designed specifically for their needs.

Integrating Open Source Accounting Software with Other Business Systems

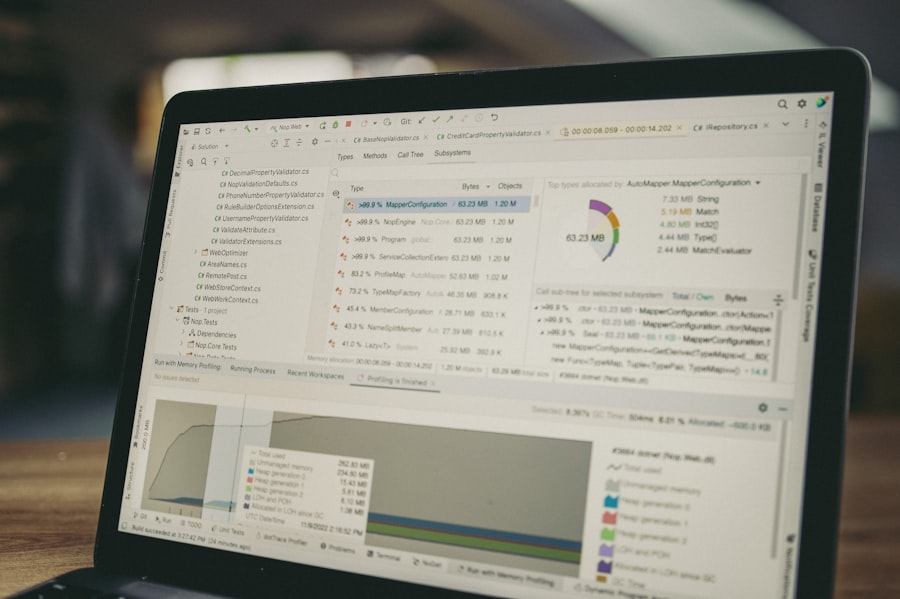

| Software | License | Key Features | Programming Language | Platform | Community Size | Last Update |

|---|---|---|---|---|---|---|

| GnuCash | GPLv2 | Double-entry accounting, Scheduled transactions, Reports & graphs | C, Scheme | Windows, macOS, Linux | Large | 2024 |

| Odoo Accounting | AGPLv3 | Invoicing, Bank synchronization, Multi-currency, Tax management | Python | Web-based | Very Large | 2024 |

| LedgerSMB | GPLv2 | Double-entry, Multi-user, Multi-currency, Audit trail | Perl | Web-based | Medium | 2023 |

| FrontAccounting | GPLv2 | Multi-currency, Multi-user, Inventory management, Financial reports | PHP | Web-based | Medium | 2023 |

| ERPNext | GPLv3 | Accounting, CRM, Inventory, Payroll, Project management | Python, JavaScript | Web-based | Large | 2024 |

Integration is a vital aspect of maximizing the effectiveness of open source accounting software within an organization. Many businesses rely on various systems for different functions—such as customer relationship management (CRM), inventory management, and e-commerce platforms—making it essential for these systems to communicate effectively with one another. Open source accounting solutions often come equipped with APIs (Application Programming Interfaces) that facilitate integration with other software applications.

This capability allows for seamless data exchange between systems, reducing manual data entry and minimizing errors. For instance, integrating an open source accounting system with a CRM platform can streamline sales processes by automatically updating customer records and financial transactions in real-time. Similarly, linking inventory management systems can provide accurate insights into stock levels and sales trends, enabling better decision-making regarding purchasing and production.

By creating a cohesive ecosystem where all systems work together harmoniously, businesses can enhance operational efficiency and gain a comprehensive view of their financial health.

Training and Support for Open Source Accounting Software Users

Effective training and support are critical components in ensuring that users can leverage open source accounting software to its fullest potential. Unlike proprietary solutions that often come with dedicated customer support teams, open source software relies heavily on community-driven support mechanisms. Therefore, it is essential for organizations to invest time in training their employees on how to use the software effectively.

This training can take various forms, including workshops, online tutorials, and hands-on sessions led by experienced users or consultants. Additionally, creating a knowledge base or internal documentation can be beneficial for ongoing reference as employees navigate the software. Encouraging users to participate in community forums or user groups can also foster a culture of collaboration and knowledge sharing within the organization.

By providing comprehensive training and support resources, businesses can empower their employees to utilize the software efficiently, ultimately leading to improved productivity and better financial management.

Security and Compliance Considerations for Open Source Accounting Software

While open source accounting software offers numerous advantages, it also presents unique security challenges that organizations must address proactively. One common misconception is that open source solutions are inherently less secure than proprietary alternatives; however, this is not necessarily true. The transparency of open source code allows for greater scrutiny by developers and security experts who can identify vulnerabilities more readily than in closed-source systems.

Nevertheless, businesses must take responsibility for implementing robust security measures to protect sensitive financial data. To enhance security, organizations should regularly update their open source accounting software to incorporate the latest patches and improvements released by the community. Additionally, implementing strong access controls—such as multi-factor authentication—can help safeguard against unauthorized access.

Compliance with industry regulations such as GDPR or PCI DSS is also crucial; businesses must ensure that their chosen software adheres to these standards by implementing necessary data protection measures and maintaining accurate records of financial transactions.

Maximizing Efficiency and Cost Savings with Open Source Accounting Software

The ultimate goal of adopting open source accounting software is to maximize efficiency while achieving significant cost savings. By eliminating licensing fees associated with proprietary solutions, businesses can redirect those funds toward enhancing other operational areas or investing in growth initiatives. Furthermore, the ability to customize and integrate open source solutions allows organizations to streamline their accounting processes significantly.

For example, automating routine tasks such as invoicing or payroll processing reduces manual labor and minimizes errors, leading to faster turnaround times and improved accuracy. Additionally, real-time reporting capabilities inherent in many open source accounting systems enable businesses to make informed decisions based on up-to-date financial data. This agility allows organizations to respond quickly to market changes or internal challenges, ultimately enhancing their competitive edge.

By leveraging the full potential of open source accounting software—through customization, integration, training, and robust security measures—businesses can achieve not only cost savings but also improved operational efficiency that drives long-term success.