The tax audit process is a systematic examination of an individual’s or organization’s financial records and tax returns by the Internal Revenue Service (IRS) or state tax authorities. The primary objective of an audit is to ensure that the taxpayer has accurately reported their income, deductions, and credits, and has complied with tax laws. Audits can be triggered by various factors, including discrepancies in reported income, unusual deductions, or random selection.

The IRS employs sophisticated algorithms and data analysis techniques to identify returns that may warrant further scrutiny. When a taxpayer is selected for an audit, they will receive a notice from the IRS detailing the specific issues under review. This notice will outline the type of audit being conducted, which can range from a correspondence audit—where the IRS requests additional information via mail—to a more comprehensive field audit that involves an in-person meeting.

Understanding the nature of the audit is crucial, as it dictates the level of preparation required. Taxpayers should be aware that audits can be time-consuming and may require significant documentation to substantiate claims made on their tax returns.

Key Takeaways

- Know the steps and purpose of the tax audit process to stay prepared.

- Keep thorough and organized financial records to support your tax filings.

- Collaborate with a qualified tax professional for expert guidance during an audit.

- Maintain clear and timely communication with the IRS to facilitate the audit.

- Understand your options for appealing decisions and improving future tax compliance.

Organizing Your Financial Records

Effective organization of financial records is paramount when preparing for a tax audit. Taxpayers should maintain meticulous records of all income sources, expenses, and deductions claimed on their tax returns. This includes not only W-2s and 1099s but also receipts for business expenses, bank statements, and any other documentation that supports the figures reported to the IRS.

A well-organized filing system can significantly reduce stress during an audit, as it allows for quick access to necessary documents. In addition to physical records, digital organization has become increasingly important in today’s technology-driven world. Utilizing accounting software can streamline the process of tracking income and expenses, making it easier to generate reports that are useful during an audit.

Furthermore, taxpayers should consider maintaining electronic copies of important documents in a secure cloud storage system. This not only provides a backup in case of loss or damage but also facilitates easy sharing of information with tax professionals or auditors when required.

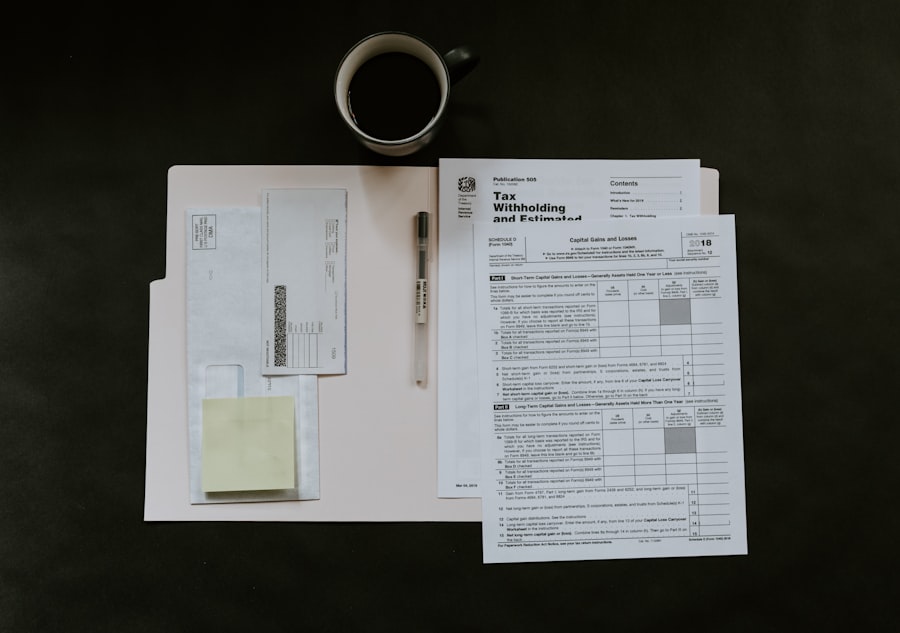

Working with a Tax Professional

Engaging a tax professional can be invaluable during the audit process. Certified Public Accountants (CPAs), enrolled agents, and tax attorneys possess specialized knowledge and experience that can help navigate the complexities of tax law and IRS procedures. A tax professional can provide guidance on how to respond to audit notices, assist in gathering necessary documentation, and represent the taxpayer during meetings with IRS agents.

Their expertise can help ensure that taxpayers do not inadvertently provide information that could lead to further scrutiny. Moreover, a tax professional can offer insights into potential areas of concern based on their understanding of current tax regulations and common audit triggers. They can help taxpayers identify any discrepancies in their records before the audit begins, allowing for proactive measures to be taken.

This collaboration not only enhances the taxpayer’s confidence but also increases the likelihood of a favorable outcome during the audit process.

Communicating with the IRS

Effective communication with the IRS is essential throughout the audit process. Taxpayers should respond promptly to any correspondence from the IRS, as delays can lead to complications or even penalties. When communicating with the IRS, it is important to be clear and concise while providing all requested information.

Keeping a record of all communications, including dates, times, and names of IRS representatives spoken to, can be beneficial for future reference. In some cases, taxpayers may find it necessary to request additional time to gather documentation or prepare for an audit meeting. The IRS typically allows for extensions if a valid reason is provided.

However, it is crucial to make such requests in writing and to do so as early as possible in the process. Maintaining a professional tone in all communications can foster a more cooperative relationship with IRS agents, which may lead to a smoother audit experience.

Providing Documentation and Evidence

| Metric | Description | Typical Value / Range | Notes |

|---|---|---|---|

| Audit Selection Rate | Percentage of tax returns selected for audit | 0.5% – 1.5% | Varies by jurisdiction and taxpayer type |

| Audit Completion Time | Average duration to complete a tax audit | 3 – 12 months | Depends on complexity and taxpayer cooperation |

| Discrepancy Rate | Percentage of audits resulting in adjustments | 30% – 50% | Indicates frequency of errors or omissions |

| Average Additional Tax Assessed | Mean amount of additional tax identified per audit | Varies widely | Depends on audit scope and taxpayer profile |

| Penalty Rate | Percentage of audits resulting in penalties | 20% – 40% | Reflects severity of non-compliance |

| Taxpayer Response Time | Average time taxpayers take to respond to audit notices | 15 – 45 days | Impacts audit duration |

| Audit Cost per Case | Average cost incurred by tax authority per audit | Varies by country and audit type | Includes labor and administrative expenses |

During an audit, providing thorough documentation and evidence is critical to substantiating claims made on tax returns. Taxpayers should prepare to present not only primary documents such as receipts and invoices but also secondary evidence that supports their financial activities. For instance, if claiming business expenses, it may be beneficial to provide additional context through bank statements showing transactions related to those expenses or contracts that outline services rendered.

It is also important to ensure that all documentation is organized and easily accessible during the audit process. Creating a checklist of required documents based on the IRS notice can help ensure that nothing is overlooked. Additionally, taxpayers should be prepared to explain any discrepancies or unusual items in their records clearly and logically.

This level of preparedness demonstrates diligence and can positively influence the auditor’s perception of the taxpayer’s compliance.

Understanding Potential Outcomes

The outcomes of a tax audit can vary widely depending on the findings of the IRS review. If everything checks out and no discrepancies are found, the taxpayer may receive a letter confirming that no changes are necessary. However, if the auditor identifies issues such as unreported income or disallowed deductions, the taxpayer may face additional taxes owed along with potential penalties and interest charges.

In some cases, taxpayers may have the opportunity to negotiate with the IRS regarding penalties or payment plans if they owe additional taxes. Understanding these potential outcomes ahead of time can help taxpayers prepare mentally and financially for what lies ahead. It is also essential for taxpayers to know their rights during an audit process; they have the right to appeal any findings they disagree with and seek resolution through established channels.

Appealing an Audit Decision

If a taxpayer disagrees with the findings of an audit, they have the right to appeal the decision through a formal process known as an “appeal.” The first step typically involves filing a written protest with the IRS Office of Appeals within 30 days of receiving the audit report. This protest should clearly outline the reasons for disagreement and include any supporting documentation that reinforces the taxpayer’s position. The appeals process provides an opportunity for taxpayers to present their case before an independent reviewer who was not involved in the original audit decision.

This impartiality can lead to more favorable outcomes for taxpayers who have legitimate grounds for contesting findings. It is advisable for taxpayers to work closely with their tax professionals during this stage to ensure that their appeal is well-structured and supported by adequate evidence.

Implementing Changes for Future Tax Compliance

Regardless of the outcome of an audit, it is crucial for taxpayers to take proactive steps toward improving their tax compliance moving forward. This may involve reassessing their record-keeping practices, seeking ongoing advice from tax professionals, or investing in accounting software that simplifies tracking income and expenses. By implementing these changes, taxpayers can reduce their risk of future audits and ensure they remain compliant with evolving tax laws.

Additionally, staying informed about changes in tax legislation is vital for maintaining compliance. Tax laws are subject to frequent updates, and being aware of these changes can help taxpayers avoid unintentional errors on their returns. Regularly reviewing financial practices and seeking professional guidance when necessary can foster a culture of compliance that minimizes stress during tax season and reduces the likelihood of future audits.