Xero Accounting has emerged as a leading cloud-based accounting software solution, particularly favored by small to medium-sized enterprises (SMEs) and freelancers. Founded in 2006 in New Zealand, Xero has grown exponentially, boasting over three million subscribers worldwide. Its user-friendly interface, robust features, and seamless integration capabilities make it an attractive option for businesses looking to simplify their financial management.

Unlike traditional accounting software that requires installation and maintenance, Xero operates entirely online, allowing users to access their financial data from anywhere with an internet connection. This flexibility is particularly beneficial for businesses with remote teams or those that require real-time financial insights. One of the standout features of Xero is its commitment to providing a comprehensive suite of tools that cater to various accounting needs.

From invoicing and expense tracking to payroll management and tax compliance, Xero offers a holistic approach to financial management. The platform is designed to streamline processes, reduce manual data entry, and enhance collaboration between business owners and their financial advisors. As businesses increasingly recognize the importance of accurate financial reporting and analysis, Xero positions itself as a vital partner in achieving these goals, enabling users to focus on growth and strategic decision-making rather than getting bogged down in administrative tasks.

Key Takeaways

- Xero Accounting offers a comprehensive platform for managing business finances efficiently.

- Setting up your Xero account correctly is crucial for accurate financial tracking.

- Xero simplifies invoicing, expense management, and integrates seamlessly with other financial tools.

- The software provides robust reporting and analytics to help monitor business performance.

- Automation and collaboration features in Xero enhance productivity and streamline accounting processes.

Setting Up Your Xero Account

Setting up a Xero account is a straightforward process that can be completed in just a few steps. To begin, users need to visit the Xero website and select a pricing plan that best suits their business needs. Xero offers several tiers of subscription, each with varying features and capabilities.

Once a plan is chosen, users can create an account by providing essential information such as their business name, email address, and password. After confirming their email address, users are guided through an intuitive setup wizard that helps them configure their account settings. During the setup process, users are prompted to enter key financial information, including their business type, fiscal year-end date, and currency preferences.

This initial configuration is crucial as it lays the foundation for accurate financial reporting. Additionally, Xero allows users to customize their dashboard by adding widgets that display relevant financial metrics at a glance. This personalized dashboard not only enhances user experience but also ensures that critical information is readily accessible.

Once the account is set up, users can begin importing existing financial data from other accounting systems or spreadsheets, making the transition to Xero seamless.

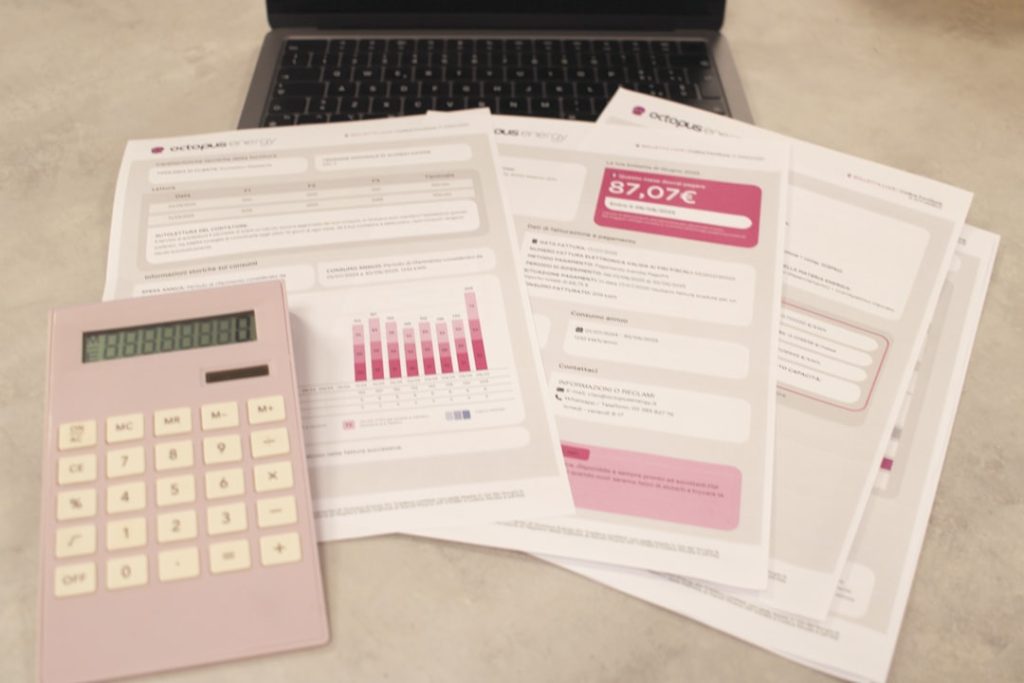

Managing Invoices and Expenses with Xero

Xero simplifies the invoicing process by allowing users to create professional-looking invoices in just a few clicks. Users can customize invoice templates with their branding elements, such as logos and color schemes, ensuring that all communications reflect their business identity. The platform supports various payment options, including credit cards and bank transfers, which can be integrated directly into invoices.

This feature not only enhances customer convenience but also accelerates cash flow by enabling clients to pay invoices online quickly. Expense management is equally streamlined within Xero. Users can easily record expenses by uploading receipts directly through the mobile app or web interface.

The software employs optical character recognition (OCR) technology to extract relevant data from receipts automatically, reducing the need for manual entry. Additionally, Xero allows users to categorize expenses according to different accounts or projects, providing greater visibility into spending patterns. This level of detail is invaluable for businesses looking to control costs and optimize their budgets.

Integrating Xero with Other Financial Tools

One of the significant advantages of using Xero is its ability to integrate seamlessly with a wide range of third-party applications and financial tools. This interoperability enhances the functionality of Xero by allowing businesses to tailor their accounting ecosystem according to their specific needs. For instance, Xero can be integrated with payment processors like Stripe or PayPal, enabling businesses to manage transactions more efficiently.

These integrations facilitate automatic reconciliation of payments against invoices, significantly reducing the time spent on manual bookkeeping tasks. Moreover, Xero supports integrations with various inventory management systems, CRM platforms, and e-commerce solutions. For example, businesses using Shopify can connect their store with Xero to automatically sync sales data and inventory levels.

This integration not only streamlines operations but also ensures that financial records are always up-to-date. By leveraging these integrations, businesses can create a cohesive workflow that minimizes errors and enhances overall productivity.

Reporting and Analytics in Xero

| Feature | Description | Metric / Data |

|---|---|---|

| Monthly Pricing | Cost of the standard plan per month | Starts at 12 |

| Number of Users | Users included in the standard plan | 1 user (additional users available) |

| Invoices | Number of invoices that can be sent per month | Unlimited |

| Bank Connections | Number of bank accounts that can be connected | Unlimited |

| Payroll | Payroll feature availability | Available in select countries |

| Mobile App | Availability of mobile application | iOS and Android |

| Supported Currencies | Number of currencies supported for transactions | Over 160 |

| Customer Support | Type of customer support offered | Email and live chat support |

| Integration | Number of third-party app integrations | Over 800 |

Xero provides robust reporting and analytics capabilities that empower businesses to gain deeper insights into their financial performance. The platform offers a variety of pre-built reports, including profit and loss statements, balance sheets, and cash flow forecasts. These reports can be customized based on specific date ranges or account categories, allowing users to analyze trends over time or drill down into particular areas of interest.

The ability to generate real-time reports means that business owners can make informed decisions based on current data rather than relying on outdated information. In addition to standard reports, Xero also features advanced analytics tools that enable users to visualize their financial data through charts and graphs. This visual representation makes it easier for stakeholders to understand complex financial information at a glance.

Furthermore, Xero’s dashboard can be configured to display key performance indicators (KPIs) relevant to the business’s goals. By monitoring these KPIs regularly, businesses can identify areas for improvement and adjust their strategies accordingly.

Automating and Streamlining Processes with Xero

Automation is a core principle of Xero’s design philosophy, aimed at reducing manual tasks and enhancing efficiency. One of the most notable automation features is the recurring billing option for invoices. Businesses can set up recurring invoices for clients who require regular billing cycles, such as subscription services or retainer agreements.

This feature eliminates the need for manual invoice creation each month while ensuring that cash flow remains consistent. Additionally, Xero’s bank reconciliation feature automates the process of matching transactions recorded in the accounting system with those in the bank statement. By connecting bank accounts directly to Xero, users can import bank transactions automatically and reconcile them with ease.

The software uses machine learning algorithms to suggest matches based on historical data, further speeding up the reconciliation process. This level of automation not only saves time but also minimizes the risk of human error in financial reporting.

Collaborating with Your Accountant or Bookkeeper in Xero

Collaboration is made easy with Xero’s multi-user access feature, which allows business owners to invite accountants or bookkeepers to access their accounts securely. Users can assign different permission levels based on roles within the organization, ensuring that sensitive information is protected while still allowing necessary access for financial professionals. This collaborative approach fosters transparency and enables accountants to provide timely advice based on real-time data.

Moreover, Xero’s communication tools facilitate seamless interaction between business owners and their financial advisors. Users can leave comments on specific transactions or reports within the platform, creating a centralized space for discussions related to financial matters. This feature enhances accountability and ensures that all parties are aligned on financial strategies and objectives.

Tips for Maximizing Efficiency with Xero Accounting

To fully leverage the capabilities of Xero Accounting, businesses should consider implementing best practices that enhance efficiency and productivity. One effective strategy is to take advantage of keyboard shortcuts available within the platform. Familiarizing oneself with these shortcuts can significantly speed up navigation and data entry processes.

Another tip is to regularly review and update account settings as the business evolves. As companies grow or change direction, ensuring that financial settings align with current operations is crucial for maintaining accurate records. Additionally, utilizing Xero’s mobile app allows users to manage finances on-the-go—whether it’s sending invoices from a client meeting or capturing receipts while traveling.

Finally, engaging in continuous learning about new features and updates released by Xero can provide businesses with additional tools for efficiency. Participating in webinars or accessing online resources offered by Xero can help users stay informed about best practices and innovative ways to utilize the software effectively. By adopting these strategies and fully embracing the capabilities of Xero Accounting, businesses can streamline their financial processes, enhance collaboration with advisors, and ultimately drive growth through informed decision-making based on accurate financial insights.