In the modern landscape of entrepreneurship, self-employment has become a viable and attractive option for many individuals seeking autonomy and flexibility in their work lives. However, with the freedom of being your own boss comes the responsibility of managing finances effectively. This is where accounting software plays a pivotal role.

Designed to simplify financial management, accounting software provides self-employed individuals with tools to track income, manage expenses, and prepare for tax obligations. The right software can transform the often daunting task of bookkeeping into a streamlined process, allowing entrepreneurs to focus on growing their businesses rather than getting bogged down in paperwork. The evolution of technology has led to a plethora of accounting software options tailored specifically for self-employed individuals.

These tools vary in features, pricing, and usability, catering to diverse needs and preferences. From basic expense tracking to comprehensive financial reporting, the capabilities of these software solutions can significantly enhance the efficiency of financial management. As self-employed individuals navigate the complexities of their finances, understanding the available options becomes crucial in selecting the right tool that aligns with their business goals.

Key Takeaways

- Accounting software helps self-employed individuals manage finances efficiently and accurately.

- QuickBooks Self-Employed offers a comprehensive set of tools tailored for freelancers and contractors.

- FreshBooks simplifies invoicing and expense tracking, making billing easier for small business owners.

- Wave provides a free, user-friendly option for basic accounting needs without compromising quality.

- Xero and Zoho Books offer advanced features and intuitive interfaces suitable for growing self-employed businesses.

Benefits of Using Accounting Software for Self Employed

Utilizing accounting software offers numerous advantages for self-employed individuals, significantly improving their financial management processes. One of the primary benefits is the automation of routine tasks. Manual bookkeeping can be time-consuming and prone to errors, especially when juggling multiple clients or projects.

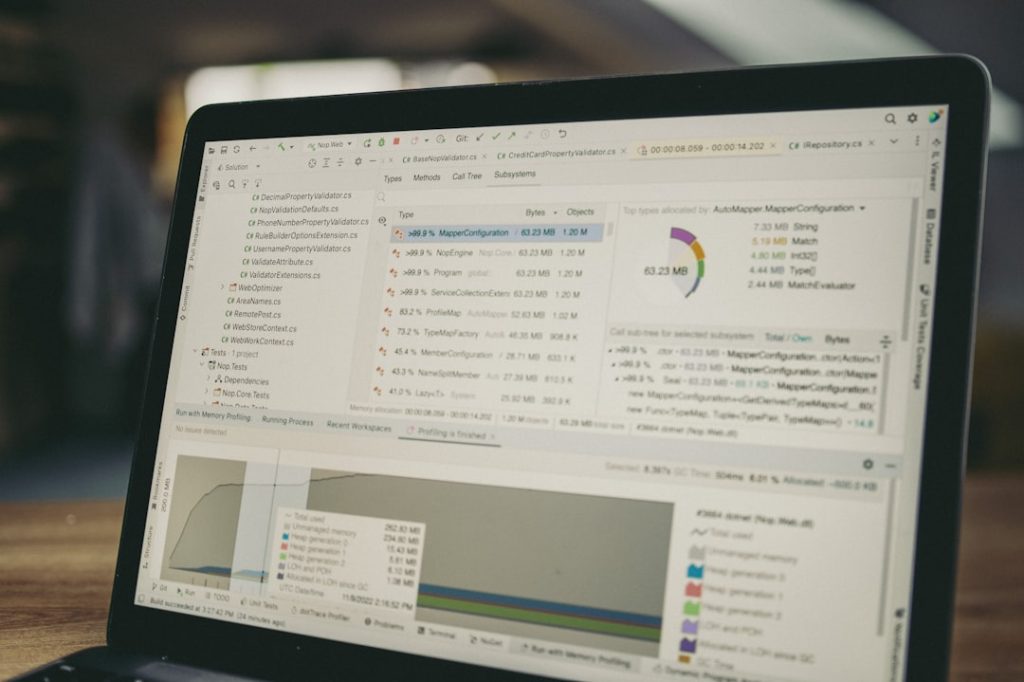

Accounting software automates invoicing, expense tracking, and financial reporting, allowing users to save valuable time and reduce the likelihood of mistakes. This automation not only enhances accuracy but also frees up time that can be redirected toward more strategic business activities. Another significant benefit is the ability to gain real-time insights into financial health.

Many accounting software solutions provide dashboards that display key financial metrics at a glance. This feature enables self-employed individuals to monitor cash flow, track outstanding invoices, and assess overall profitability without sifting through piles of paperwork. With access to up-to-date financial information, entrepreneurs can make informed decisions regarding budgeting, spending, and investment opportunities.

Furthermore, these insights can be invaluable during tax season, as they simplify the process of gathering necessary documentation and calculating tax liabilities.

QuickBooks Self-Employed: A Comprehensive Solution

QuickBooks Self-Employed stands out as a leading choice among accounting software options tailored for freelancers and independent contractors. This platform offers a comprehensive suite of features designed to meet the unique needs of self-employed individuals. One of its standout functionalities is the ability to separate personal and business expenses seamlessly.

Users can link their bank accounts and credit cards directly to the software, allowing for automatic categorization of transactions. This feature not only simplifies expense tracking but also ensures that users maintain accurate records for tax purposes. In addition to expense tracking, QuickBooks Self-Employed provides robust invoicing capabilities.

Users can create professional invoices with customizable templates and send them directly to clients via email. The software also includes features for tracking invoice status, enabling users to see which invoices have been paid and which are still outstanding. This level of organization is crucial for maintaining healthy cash flow, as it allows self-employed individuals to follow up on overdue payments promptly.

Moreover, QuickBooks Self-Employed offers tax estimation tools that help users set aside the appropriate amount for taxes throughout the year, reducing the stress associated with tax season.

FreshBooks: Streamlining Invoicing and Expense Tracking

FreshBooks is another popular accounting software solution that caters specifically to self-employed individuals and small business owners. Renowned for its user-friendly interface, FreshBooks excels in streamlining invoicing and expense tracking processes. The platform allows users to create and send invoices in just a few clicks, complete with customizable branding options that reflect their business identity.

This level of professionalism can enhance client relationships and improve payment turnaround times. Beyond invoicing, FreshBooks offers powerful expense tracking features that enable users to capture receipts effortlessly. With the mobile app, users can take photos of receipts and categorize expenses on the go, ensuring that no deductible expense goes unrecorded.

This capability is particularly beneficial for self-employed individuals who often incur various expenses while working remotely or traveling for business. Additionally, FreshBooks provides insightful reports that summarize income and expenses over specific periods, allowing users to analyze their financial performance and make data-driven decisions.

Wave: Free Accounting Software for Self Employed

| Software | Pricing (Monthly) | Key Features | Ease of Use | Best For | Customer Rating (out of 5) |

|---|---|---|---|---|---|

| QuickBooks Self-Employed | 15 | Expense tracking, invoicing, tax estimation, mileage tracking | High | Freelancers, independent contractors | 4.5 |

| FreshBooks | 15 | Invoicing, time tracking, expense management, project collaboration | High | Small business owners, freelancers | 4.6 |

| Wave Accounting | Free | Accounting, invoicing, receipt scanning, bank connections | Medium | Self-employed with basic accounting needs | 4.3 |

| Xero | 13 | Bank reconciliation, invoicing, inventory, payroll add-ons | Medium | Growing self-employed businesses | 4.4 |

| Zoho Books | 10 | Invoicing, expense tracking, project management, tax compliance | High | Self-employed professionals needing comprehensive features | 4.5 |

For self-employed individuals seeking a cost-effective solution, Wave offers a robust accounting software option at no charge. Wave’s free platform includes essential features such as invoicing, expense tracking, and financial reporting, making it an attractive choice for freelancers and small business owners operating on tight budgets. The user-friendly interface allows even those with minimal accounting knowledge to navigate the software with ease.

One of Wave’s standout features is its unlimited invoicing capability. Users can create and send invoices without any restrictions on the number of invoices generated or sent per month. This flexibility is particularly advantageous for self-employed individuals who may have fluctuating workloads or varying numbers of clients throughout the year.

Additionally, Wave integrates with various payment processors, enabling users to accept online payments directly through their invoices. This feature not only enhances convenience for clients but also accelerates cash flow by reducing the time it takes to receive payments.

Xero: Advanced Features for Managing Finances

Xero is a cloud-based accounting software solution that offers advanced features tailored for self-employed individuals and small businesses alike. Known for its comprehensive functionality, Xero provides tools for managing finances that go beyond basic bookkeeping tasks. One of its key strengths lies in its robust reporting capabilities.

Users can generate detailed financial reports that provide insights into profitability, cash flow, and overall business performance. Xero also excels in its bank reconciliation feature, which allows users to connect their bank accounts directly to the software. Transactions are automatically imported and matched against existing records, simplifying the reconciliation process significantly.

This feature not only saves time but also enhances accuracy by reducing manual data entry errors. Furthermore, Xero supports multi-currency transactions, making it an ideal choice for self-employed individuals who work with international clients or suppliers.

Zoho Books: A User-Friendly Accounting Software for Self Employed

Zoho Books is another noteworthy accounting software option designed with self-employed individuals in mind. Its user-friendly interface makes it accessible even for those who may not have extensive accounting experience. Zoho Books offers a range of features that cater specifically to the needs of freelancers and small business owners, including invoicing, expense tracking, and project management tools.

One of the standout features of Zoho Books is its project tracking capability. Users can create projects within the software and associate income and expenses directly with specific projects or clients. This functionality allows self-employed individuals to gain insights into project profitability and manage their time more effectively by understanding which projects are yielding the best returns.

Additionally, Zoho Books integrates seamlessly with other Zoho applications, providing users with a comprehensive suite of tools for managing various aspects of their business.

Choosing the Right Accounting Software for Your Self-Employed Business

Selecting the right accounting software is a critical decision for self-employed individuals looking to streamline their financial management processes. Each software solution discussed offers unique features tailored to different needs and preferences. QuickBooks Self-Employed provides comprehensive tools for expense tracking and invoicing; FreshBooks excels in user-friendly invoicing; Wave offers a free solution with essential features; Xero delivers advanced reporting capabilities; and Zoho Books combines ease of use with project management tools.

Ultimately, the choice will depend on individual business requirements, budget constraints, and personal preferences regarding usability and functionality. By carefully evaluating these factors and exploring available options, self-employed individuals can find an accounting software solution that not only simplifies their financial management but also supports their overall business growth and success.